AT&T seems to have suddenly discovered it has millions of rural customers who are making due with the company’s poorly-rated, slow speed DSL service AT&T pondered selling off to somebody else.

AT&T seems to have suddenly discovered it has millions of rural customers who are making due with the company’s poorly-rated, slow speed DSL service AT&T pondered selling off to somebody else.

In a sudden turnaround, CEO Randall Stephenson has decided it might be better to upgrade the company’s service instead of ditching it altogether.

Stephenson’s apparent decision not to jettison rural AT&T landlines on the open market may have more to do with the current regulatory climate than what’s best for shareholders in the short term. AT&T may also find few buyers for the millions of rural landlines the company has no plans to upgrade to its U-verse fiber to the neighborhood platform. The most likely would-be buyers are preoccupied with their current operations:

- Frontier Communications, which purchased rural assets from Verizon Communications, is facing an enormous debt payment in 2013 and a declining stock price;

- FairPoint Communications, which owns former Verizon landlines in northern New England, is still trying to make its business plan work after an earlier bankruptcy filing;

- CenturyLink is still attempting to absorb former-Baby Bell Qwest into its network;

- Windstream may be too small to buy the millions of customers in multiple states AT&T seemed to no longer want until recently.

Stephenson told investors at a Sanford C. Bernstein conference that the company is now considering keeping its rural customers and upgrading DSL technology to better serve them.

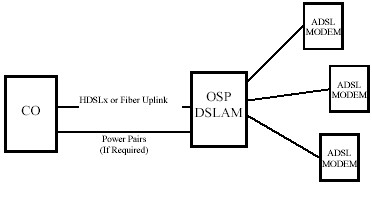

A DSLAM reduces the amount of speed-slowing traditional copper phone wiring between the telephone company's "central office" (CO) and your home's DSL modem.

With 15 million AT&T customers having no prospect of getting AT&T’s U-verse service, and 5 million without any AT&T broadband options at all, Stephenson says investment in Internet Protocol Digital Subscriber Line Access Multiplexers, better-known as IP DSLAMs, could extend service and also improve speeds for existing DSL customers, and not cost the company a fortune.

Stephenson noted the cost of the equipment needed to extend service has dropped considerably, in part because demand for DSL has been in decline as customers seek faster broadband, often from cable operators. The two largest phone companies in the country — AT&T and Verizon — had also shown little interest in further expanding their DSL networks.

For a reasonable investment on service upgrades, AT&T could bring speeds of 10Mbps or more to certain customers who now live with 6Mbps or less.

The challenge AT&T faces is reducing the amount of legacy copper telephone wiring between the phone company’s switching office and the customer. Customers who live more than 10,000 feet from a central office make due with very slow DSL speeds. Replacing some of that copper wiring with fiber optics can dramatically increase speeds.

AT&T U-verse works on a similar concept, except AT&T’s most advanced service needs as little copper phone wiring as possible. AT&T’s newest proposal for its rural customers would represent a middle ground — extending fiber to a handful of DSLAMs at distant points from the central exchange, with copper phone wiring carrying the signal the rest of the way to the subscriber’s home. This would open the door to DSL for customers who could not purchase the service before. It would also boost speeds for existing customers.

The decision marks a departure from AT&T’s interest in “solving” the rural broadband problem with heavily usage-limited wireless Internet access over its 4G network. Verizon Wireless is currently testing its own wireless broadband service designed for home users, but it costs $60 and only provides 10GB per month of usage.

While Stephenson has not backed away completely from selling off rural customers outside of U-verse service areas, he told investors he now has a more optimistic view of AT&T’s rural folk in light of marketplace changes.

“We are giving this a hard look,” Stephenson told investors on a recent JPMorgan conference call. Already-available DSLAM technology “brings broadband capability in a more cost-effective manner, with a better revenue profile than perhaps we would have thought two years ago.”

Subscribe

Subscribe