![]() An Indiana company will spend between $70 and $100 million building a fiber-to-the-home network delivering gigabit broadband speed in Lexington, Ky., partly in response to months of consumer dissatisfaction with Charter Communications’ Spectrum service.

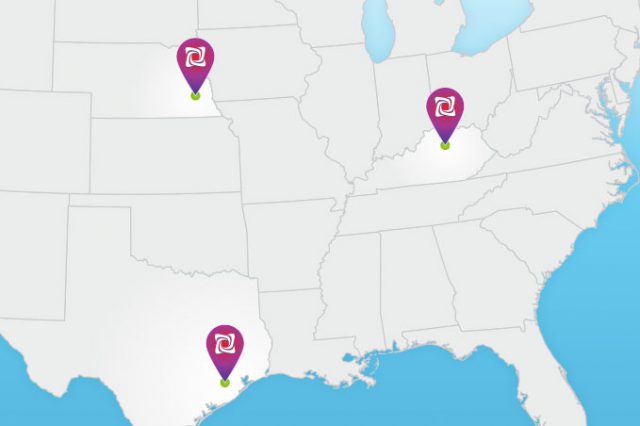

An Indiana company will spend between $70 and $100 million building a fiber-to-the-home network delivering gigabit broadband speed in Lexington, Ky., partly in response to months of consumer dissatisfaction with Charter Communications’ Spectrum service.

MetroNet could make Lexington the largest gigabit city in the country, according to the city’s mayor Jim Gray.

“Santa Claus is coming to town,” Gray said.

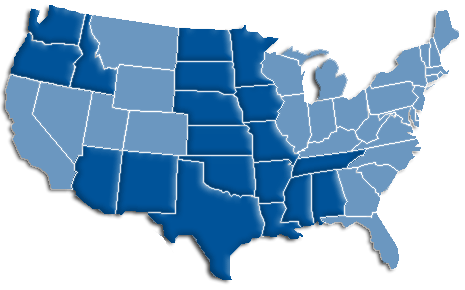

Headquartered in Evansville, Ind., MetroNet provides internet, phone and television service across a 100% fiber optic network in 35 communities in the midwest — mostly in Indiana and the western suburbs of Chicago. The company started operations in 2005, wiring the community of Greencastle, Ind. Since then, it has grown with the financial support of billionaire investors including Microsoft founder Bill Gates and Nike’s Phil Knight. Oak Hill Equity Partners, a private equity firm, has a financial interest in MetroNet, along with investments in WOW!, Atlantic Broadband, Wave Broadband, and Cincinnati Bell.

Headquartered in Evansville, Ind., MetroNet provides internet, phone and television service across a 100% fiber optic network in 35 communities in the midwest — mostly in Indiana and the western suburbs of Chicago. The company started operations in 2005, wiring the community of Greencastle, Ind. Since then, it has grown with the financial support of billionaire investors including Microsoft founder Bill Gates and Nike’s Phil Knight. Oak Hill Equity Partners, a private equity firm, has a financial interest in MetroNet, along with investments in WOW!, Atlantic Broadband, Wave Broadband, and Cincinnati Bell.

MetroNet may have selected Lexington because it has a poorly received cable operator — Spectrum, and Windstream, a competitively inadequate phone company. Windstream does not provide the kind of service AT&T’s U-verse and AT&T Fiber offers in other Kentucky cities.

All of Lexington’s residents could get service from MetroNet is as little as three or four years, because the company has agreed to wire the entire urban service area, a departure from the “fiberhood” concept introduced by Google, wiring individual neighborhoods only after a sufficient number of customers pre-register for service and pay a deposit. The project is likely to win a quick approval from the Lexington-Fayette Urban County Council, allowing construction to begin in January. Because MetroNet sells television service, it will have to apply for and receive a franchise from the city.

Prices and packaging:

- 100/25Mbps $49.95

- 200/75Mbps $59.95

- 500/100Mbps $69.95

- 1,000/250Mbps $89.95

- Television packages range from $18-79 a month

- Digital Phone service is $9.95 a month

- Discounts of $10-20 a month are available for customers selecting a two year “price lock” agreement

- a $9.95/mo “technology fee” also applies.

Although most welcome the competition, some noticed MetroNet does not intend to sell service at fire sale prices.

“I checked their rates in Lafayette, Ind. and they weren’t that cheap,” commented James Wood. “100Mbps internet + Standard tier TV+ phone was $146/mo for two years.”

MetroNet uniquely charges exactly the prices it pays for cable television networks, with no mark-up. (1:39)

Subscribe

Subscribe Despite claims from some industry-backed researchers and former members of Congress that Net Neutrality

Despite claims from some industry-backed researchers and former members of Congress that Net Neutrality

Windstream will bring its fiber to the neighborhood service Kinetic TV to around 50,000 homes in 13 suburban and exurban communities surrounding Charlotte, N.C., to stay competitive with Time Warner Cable/Charter and a publicly owned cable system serving Mooresville.

Windstream will bring its fiber to the neighborhood service Kinetic TV to around 50,000 homes in 13 suburban and exurban communities surrounding Charlotte, N.C., to stay competitive with Time Warner Cable/Charter and a publicly owned cable system serving Mooresville.

Newly independent Cable One will reduce its emphasis on cable television and turn its time, attention, and capital towards improving broadband service for its 690,000 largely rural customers in 19 states.

Newly independent Cable One will reduce its emphasis on cable television and turn its time, attention, and capital towards improving broadband service for its 690,000 largely rural customers in 19 states.