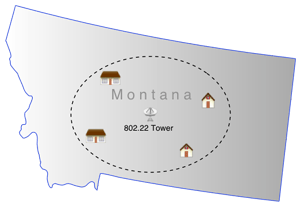

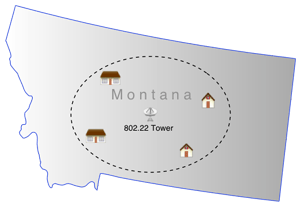

An example of an 801.22 Wireless Regional Area Network

The mainstream media and technology blogs have been running away with coverage about the IEEE’s recent approval of the so-called “white space” 802.22 wireless standard with stories of up to 100 kilometers of wireless coverage for home Wi-Fi over unused UHF television channels. The thought of installing a router that can deliver reception of your personal broadband connection for up to 62 square miles sounds very exciting, but don’t get as carried away as some media outlets have.

The truth is, 802.22 benefits wireless providers, not consumers (unless you happen to receive your Internet service from a commercial provider over this technology.)

The new standard was designed to benefit Wireless Regional Area Networks (WRANs). In general terms, this means Wireless Internet Service Provider (WISPs), who are most likely to adopt the new technology to enhance wireless service over long distances in rural areas not covered by DSL, cable broadband, or other wired networks. To achieve the maximum amount of coverage noted in the popular press, providers will need to utilize specialized transmitters using antennas considerably higher than what one would find in a home environment.

Unlike today’s Wi-Fi networks, 802.22 uses much lower frequencies which tend to propagate over longer distances. Using frequencies in the Megahertz range instead of the Gigahertz range makes it much more likely ground-based wireless signals will penetrate buildings and reach across the rural landscape.

To accommodate “white space” wireless, the Federal Communications Commission last year approved the use of unused broadcast channels for these data transmissions. But providers will not simply be able to fire up their white space Wi-Fi network just anywhere. The standard includes a provision that will automatically register the exact location of each transmission site with a central coordinating body. Providers must agree to vacate channels if harmful interference to licensed broadcasters is “sensed” by the technology, and even though multiple operators may be able to operate concurrently in an area at the same time, there are important limitations on how many available “white space” channels will exist in different television markets.

Realistically, the most sensible implementation of 802.22 will come in very rural areas with few, if any, local broadcast signals to contend with. If the FCC has its way, a considerable amount of the so-called “white space” will be sold off to America’s largest cell phone companies, leaving even fewer channels open for this kind of wireless broadband. In large urban markets, it’s doubtful many channels will be available for 802.22 use, if any at all. Currently, the FCC dictates these networks cannot operate on an occupied broadcast channel, or the adjacent channels on either side. That means if your city has a station on channel 31, these networks cannot use channels 30, 31, or 32.

Realistically, the most sensible implementation of 802.22 will come in very rural areas with few, if any, local broadcast signals to contend with. If the FCC has its way, a considerable amount of the so-called “white space” will be sold off to America’s largest cell phone companies, leaving even fewer channels open for this kind of wireless broadband. In large urban markets, it’s doubtful many channels will be available for 802.22 use, if any at all. Currently, the FCC dictates these networks cannot operate on an occupied broadcast channel, or the adjacent channels on either side. That means if your city has a station on channel 31, these networks cannot use channels 30, 31, or 32.

Another problem is the available bandwidth for individual users. Each “channel” has 6MHz of bandwidth, which can realistically provide 12Mbps service to a single user. The IEEE specifies a maximum speed of 22Mbps, but that is more theoretical than actual when taking into account the longer distances average customers will be from the transmitter. Providers will almost certainly pack each channel with multiple users. A dozen customers concurrently using the service would probably get around 1.5Mbps on average (384kbps upstream), assuming nobody saturates the channel at maximum speeds. That is equivalent to some rural DSL providers. Should providers “oversubscribe” the network, and dozens of customers try and use the service at the same time, speeds could drop precipitously. The further users are from the transmitter, the lower the speeds they will receive regardless of how many users are on the network at that time.

To handle demand, one solution is to run multiple transmitters to handle the traffic, but how many transmitters can operate will depend on how much “white space” is available. That is why this technology is best suited for rural areas where UHF television signals, and customers, are few and far between.

Home Wi-Fi users will need to wait for the development of a different standard — 802.11af — to take any advantage of “white-space” Wi-Fi, sometimes called White-Fi or “Super Wi-Fi.”

Home Wi-Fi users will need to wait for the development of a different standard — 802.11af — to take any advantage of “white-space” Wi-Fi, sometimes called White-Fi or “Super Wi-Fi.”

Since the much used 2.4 GHz band for Wi-Fi is congested in urban areas, IEEE 802.11af can provide additional open frequencies for home users. But most 802.11af home equipment will operate at considerably lower power and range, and will suffer some of the same bandwidth limitations created by narrow channel spacing. An even bigger problem will be available channel space. The same urban areas experiencing over-congested Wi-Fi will also likely have the largest number of operating television signals, limiting the use of this technology.

Some theorize White-Fi wireless will not be of much use to home broadband users at all, instead opening up connectivity for devices we might not normally associate with wireless connectivity. A home security system could plausibly work well with limited bandwidth. So could home electronic devices that want to communicate their status. A washer and dryer could use the technology to communicate with each other to synchronize completion time and signal the homeowner that their laundry is ready. Home weather stations could deliver data over longer distances, refrigerators could signal owners they need to be restocked, and so on.

If you are waiting for wireless broadband nirvana, unfortunately there is not much to see here with these developments. Increasing usage demands continue to make wireless among the least suitable technologies to deliver the substantial-sized data pipeline broadband consumers increasingly require.

Subscribe

Subscribe