The new 4G LTE-equipped Apple iPad you picked up late last week may be burning a hole in your wallet more than you think. Across the country, consumers are reporting shock and surprise when they discover the new, faster mobile broadband-equipped tablet is capable of blowing through AT&T and Verizon Wireless’ monthly usage caps in a matter of hours.

The new 4G LTE-equipped Apple iPad you picked up late last week may be burning a hole in your wallet more than you think. Across the country, consumers are reporting shock and surprise when they discover the new, faster mobile broadband-equipped tablet is capable of blowing through AT&T and Verizon Wireless’ monthly usage caps in a matter of hours.

The culprits: online video and giant-sized app downloads.

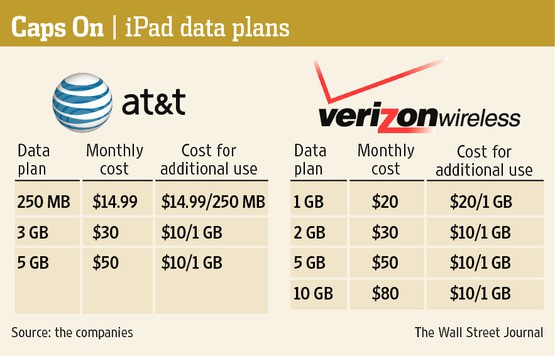

Online video on a usage-limited mobile broadband plan simply does not last long on Apple’s newest sensation. A Wall Street Journal article found one new iPad owner discouraged after a two hour basketball game completely obliterated his 3GB usage allowance provided by AT&T. With $10/GB overlimit fees just around the corner, AT&T is set to earn enormous data fees from customers who use their iPads to stream video.

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/WSJ New Apple iPad Eats Up Monthly Data Plans 3-21-12.flv[/flv]

The Wall Street Journal reports the newest iPad has been out for less than a week and buyers are already burning through their monthly data allowances on usage capped 4G mobile plans. (3 minutes)

USA Today tech columnist Edward Baig also blew through his allowance in less than one day:

Less than 24 hours after purchasing the Verizon Wireless version of the iPad + 4G — and choosing a $30, 2GB monthly data plan from Verizon — I was shocked by the notification on my iPad’s screen: “There is no data remaining on your current plan.”

My remaining options for the month included changing to a $50 5GB data plan or an $80 10GB plan. (AT&T offers a 250MB plan for $14.99; 3GB for $30; and 5GB for $50.)

[…] In my case, I wasn’t watching video. What nailed me, I think, is that I was wirelessly downloading a number of the apps that I had already purchased for my older iPad onto the latest model. Those apps were made available through Apple’s iCloud.

To help avoid just this situation, the new iPad has a 50MB per app download limit on 4G. Anything over that, and you’re directed to Wi-Fi. (The over-the-air download limit on 3G-capable iPads was 20MB.) But that’s a per-app limit, and all those smaller-sized apps I was moving to the new iPad collectively added up.

Storing anything on Apple’s iCloud service or other backup storage sites like Dropbox can prove costly when relying on 4G service from AT&T and Verizon. That’s on top of Apple’s premium price for 4G-equipped iPads, which start at $629 (comparable Wi-Fi only models are priced at $499 and above). As a result, consumers are shutting off the wireless mobile feature they paid $130 extra to receive.

Storing anything on Apple’s iCloud service or other backup storage sites like Dropbox can prove costly when relying on 4G service from AT&T and Verizon. That’s on top of Apple’s premium price for 4G-equipped iPads, which start at $629 (comparable Wi-Fi only models are priced at $499 and above). As a result, consumers are shutting off the wireless mobile feature they paid $130 extra to receive.

“All the advantages of the iPad device are completely neutralized by [AT&T’s] two gigabyte data limit,” Steve Wells told the Journal.

Some customers are upgrading their mobile data plans to 5GB for $50 a month, offered by both AT&T and Verizon. Others are learning to stick to Wi-Fi. According to a study conducted by the consulting firm Chetan Sharma, nearly 90% of tablets bought in the United States are Wi-Fi only models. The added cost for mobile-equipped tablets and the expensive data plans that accompany them are largely responsible.

Consumer Advice:

- You can still leverage 4G mobile broadband speeds on a cheaper Wi-Fi-only equipped iPad if your smartphone supports the “mobile hotspot” feature. When activated, your phone becomes a Wi-Fi hotspot your iPad can connect to for wireless data. If you have an unlimited mobile hotspot plan from Verizon Wireless (now difficult to obtain unless you are grandfathered on an unlimited data plan), you are not subject to Verizon’s usage limits for mobile devices.

- Rely as much as possible on Wi-Fi, especially for file downloads or streamed content. Since the iPad can seamlessly switch between Wi-Fi and expensive mobile data service, protect yourself by shutting off Cellular Data within the settings menu when you don’t absolutely need to use it.

- Turn off LTE service when not needed. 4G consumes battery life faster and its speeds encourage the kind of increased usage that can exhaust your allowance.

- Monitor how much data you’ve used from the settings menu. Web browsing and e-mail will not consume a lot. Online video and giant app downloads will.

[Thanks to our regular readers Scott and Earl for sending in several stories reporting on this.]

Apple iPad in the News:

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg Brown Says He Wouldnt Ditch iPad 2 for New Version 3-16-12.mp4[/flv]

Joe Brown, editor-in-chief at Gizmodo.com, talks about Apple Inc.’s new iPad, the outlook for Amazon.com Inc.’s Kindle Fire and the tablet market. Brown speaks with Jon Erlichman on Bloomberg Television’s “Bloomberg West.” (6 minutes)

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/WNYW New York Record Breaking Sales for iPad 3-19-12.mp4[/flv]

Shelly Palmer talks about the record-breaking sales numbers of the new Apple iPad. He discusses what is great and not so great about the new tablet on New York’s WNYW-TV. (4 minutes)

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg Reynolds Sees No Danger Despite New IPad’s Higher Heat 3-20-12.mp4[/flv]

Paul Reynolds, electronics editor for Consumer Reports, talks about the magazine’s temperature test of Apple Inc.’s new iPad. The newest iPad runs “significantly hotter” than the earlier model when conducting processor-intensive tasks such as playing graphics-heavy games, Consumer Reports said on its website. (9 minutes)

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/WFXT Boston New Ipad Is it Worth it 3-22-12.flv[/flv]

It’s the hottest item in the tech world – literally. WFXT in Boston also takes a look at how other tablet manufacturers are doing in competition with Apple. (4 minutes)

Subscribe

Subscribe