Higher bills, confusing and conflicting services and pricing, and badly trained customer service representatives are just a few of the problems afflicting customers transitioning from Bright House Networks and Time Warner Cable to service plans being gradually introduced around the country by Charter Communications/Spectrum. Stop the Cap! has collected more than 50 reports from customers experiencing problems, bill shock, lost access to Wi-Fi hotspots, and “bait and switch” promotions promised by one representative only to be reneged on later when the first bill arrives.

Higher bills, confusing and conflicting services and pricing, and badly trained customer service representatives are just a few of the problems afflicting customers transitioning from Bright House Networks and Time Warner Cable to service plans being gradually introduced around the country by Charter Communications/Spectrum. Stop the Cap! has collected more than 50 reports from customers experiencing problems, bill shock, lost access to Wi-Fi hotspots, and “bait and switch” promotions promised by one representative only to be reneged on later when the first bill arrives.

The $58/Month Charter Spectrum Rate Hike

Park La Brea resident Lydia Plona is one of dozens of customers in California that have complained to the Los Angeles Times about their soaring cable bills after Charter/Spectrum replaced Time Warner Cable in Southern California. It was among the first regions in the country to say goodbye to Time Warner Cable and hello to Charter and their Spectrum-branded service plans. Unfortunately, Charter has already worn out its welcome with customers like Plona. When Charter was done with her, the $96 Time Warner Cable bill she used to pay was replaced with a new $154 bill from Spectrum — a $58 rate hike per month, which amounts to almost $700 more a year.

Much of the Midwest just completed its transition away from Time Warner Cable and Bright House to Spectrum and confusing pricing and plans and expensive upgrade fees are troubling customers from Wisconsin to Ohio.

Want More than 60Mbps? Pay $199 Upgrade Fee

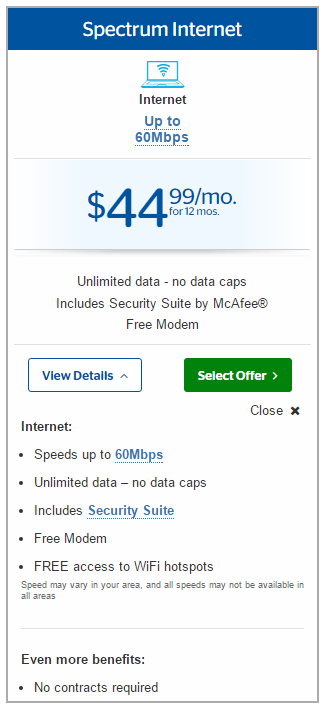

Micah Lane, a former Time Warner Cable customer in Columbus, Ohio faced a major dilemma — should he switch from his current Time Warner Cable broadband plan to Spectrum? He originally assumed the answer would be yes, believing he could upgrade from a 50/5Mbps Time Warner Cable plan to a 100Mbps Spectrum plan for around $30 more than he had paid Time Warner. He discovered an upgrade was ready and waiting, but would cost him a one-time $199 upgrade fee.

“I was told repeatedly when a Time Warner Cable customer moves to Spectrum, they are automatically assigned a base plan of 60Mbps,” Lane told us. “Any speed above that in a non-Time Warner Cable Maxx market is considered an upgrade subject to the $200 upgrade fee. My parents would not be happy with that on their bill.”

Stop the Cap! has communicated with a dozen Spectrum converts, and heard from at least 40 others about problems experienced with their plan transitions. The most common complaints reference a hard-to-avoid $200 broadband upgrade fee, charged even when moving from a 100Mbps Time Warner Cable plan to a 100Mbps Spectrum plan, and promised bundled package offers that ended up costing much more when the first bill arrived.

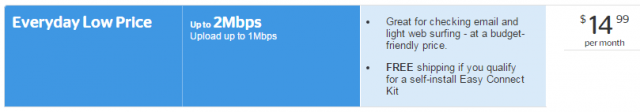

Charter’s standard broadband plan offers 60Mbps service.

“You better be ready for the fight of your life because I had to threaten to escalate my complaint to the Better Business Bureau and the FCC to get that $200 fee off my bill,” said Stop the Cap! reader Roger. “Nobody ever told me about the fee but it was applied to my online statement hours after I changed plans and of course there is no way to go back to Time Warner’s plans once you make the change.”

Charter/Spectrum has become increasingly intransigent about that $200 fee, which the company claims is necessary to verify your home connection is suitable for faster internet speeds. But some representatives have also blamed the fee on the need to recoup expenses from network upgrades, even when many of those upgrades were performed by Time Warner Cable before the company was sold.

“There is really massive confusion at Charter and the information you get is totally inconsistent from one operator to the next,” said Paul Friedrich in Cincinnati. He rents an apartment with a roommate and after being told the $200 upgrade fee was non-negotiable, he told Charter to stuff it. “We can get the same or better service without the upgrade fee from Cincinnati Bell so bye bye Spectrum. When we threatened them with canceled service, however, the fee magically disappeared!”

The “savings” Charter promised to bring Time Warner Cable customers have not exactly materialized in Ohio, either.

“I just called TWC/Spectrum to see if I could get upgraded internet,” wrote DSL Reports reader cmiz87 in Grove City. “I’m currently on the old 50/5Mbps plan. To upgrade to the 100/10Mbps plan would cost $104.99/month PLUS a $199.99 “activation” fee, even though I have my own modem. That is just for internet only.”

Especially aggravating to many Time Warner Cable customers in non-Maxx service areas is the special treatment Maxx customers received when their areas were converted to Charter Spectrum. Customers with at least 200Mbps service were initially transitioned from their Time Warner Cable Maxx service plans to Charter Spectrum’s 300Mbps plan without any upgrade fee. For those areas where the clock ran out waiting for Maxx upgrades when Charter completed its deal to acquire Time Warner Cable, it’s ‘pay $200 or no upgrade for you.’

“Customers in northern Kentucky [were already getting] 300Mbps service as a free upgrade for the last six months,” noted DSL Reports reader dougm0. “Last year Time Warner Cable was going door-to-door in my neighborhood in Cincinnati [telling us] you will get 300Mbps service free in a couple of months. Just two weeks ago I chatted with a rep that said I would still get a 300Mbps upgrade automatically when launched.”

Now Charter/Spectrum is charging what he calls “this bogus $200 fee.”

“My wife and I are planning our exit from Charter and going back to Cincy Bell,” he reports. “Free install and same speed for less.”

Business Class for 300Mbps

In Reno and other cities, some Charter customers are moving to Business Class service to get 300Mbps service, which is not yet available in most former Time Warner Cable areas. But it will not be cheap. New customers can sign up with a promotion for as little as $159/month, but after two years that price jumps to $279.

Residential Pricing Confusion

Charter’s residential pricing seemed simple enough when it was announced. But in practice, readers report it is all over the map. In Wisconsin, one customer in Franklin signed up for 300Mbps service for $110 per month and agreed to pay the $200 upgrade fee. But in Green Bay, Spectrum is charging $110 a month for 100Mbps — half the speed — along with the $200 upgrade fee. That was a dealbreaker. In Kenosha, one customer moving from a Time Warner Cable internet plan to Charter Spectrum’s basic 60Mbps plan found two unpleasant surprises on his bill:

01/19/2017 Change Of Service Fee $52.74

01/19/2017 Spectrum WiFi Activation $10.54

Adding even more confusion were prices quoted to another customer in West Wauwatosa:

- Ultra: 300/20Mbps, $105/mo, $199.99 upgrade fee

- Regular: 60/5Mbps, $68.63/mo, no upgrade fee

Confusion for Some Legacy Time Warner Cable Customers As Well

A surprise last upgrade for Time Warner Cable customers in Rochester, N.Y.

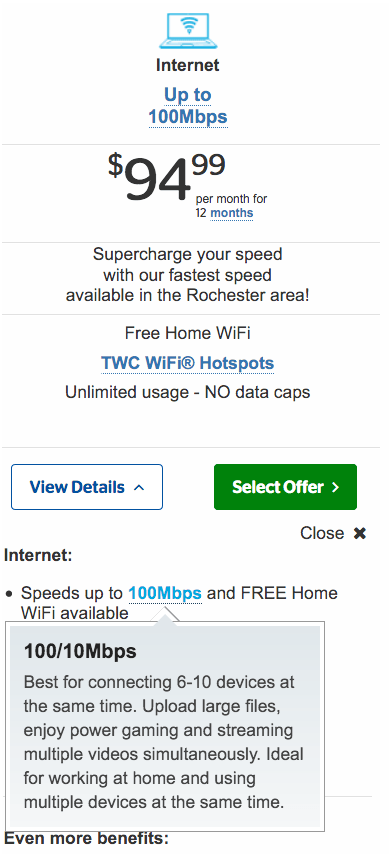

In markets that still have not transitioned to Charter Spectrum, there is confusion to be found there as well. Upstate New York will see an introduction to Spectrum service plans in February-March, but a few Time Warner Cable upgrades have been quietly introduced in the meantime. Rochester, N.Y., which never made it officially to the Maxx city upgrade list, now has 100Mbps broadband as an option, but representatives denied it for at least a week when customers called to upgrade.

The new speed option was supposed to only be offered to customers qualified to get it, as upgrades were gradually completed around the area, but a website issue marketed the upgrade to everyone, including to some customers as far away as Buffalo.

For those successfully signing up with what is likely to be their last Time Warner Cable plan, many are hoping the investment will help them avoid the $200 upgrade fee when Spectrum’s 100Mbps plan becomes available in the next month or two. But some former Time Warner Cable customers in other cities already transitioned and two Charter representatives we queried about this scenario say they will be out of luck.

Customers start with a 60Mbps standard internet plan from Charter in non-Maxx areas. If a customer chooses a higher speed plan, even if they had 100Mbps from Time Warner Cable before, the $200 upgrade fee still applies. Both representatives claimed the fee was mandatory.

But some of our readers report success in getting that fee off their bills or it was never charged. Speaking to a supervisor or making a service change with an executive level customer service representative can make a big difference avoiding that fee. Customers who establish contact with a Charter representative as a result of a Better Business Bureau or FCC complaint were able to get the fee consistently waived. Results were more mixed when talking to Charter Spectrum’s regular sales department, even when asking for a supervisor to intervene. It may be a case of finding a representative with the authority to waive the fee.

“Even the representative agreed with us it was unfair to charge us $200 for moving from 100Mbps with Time Warner Cable to 100Mbps with Charter Spectrum,” another Stop the Cap! reader in Texas told us. “But they couldn’t do anything about it. When we threatened to cancel, a retention representative finally intervened and got the fee off the bill, only to have it return a month later. We filed a complaint with the Better Business Bureau and that finally worked to get the fee removed. But my neighbor couldn’t get anyone to budge on that fee.”

Wi-Fi Woes in Florida

Bright House Networks customers are also experiencing transition troubles. Residential customers reportedly lost any static IP addresses they signed up for when they converted to a Charter Spectrum residential plan. Static IP addresses are still available for Spectrum commercial plans. More troubling for many is the loss of access to Bright House Network’s secure Wi-Fi network.

Bright House Networks customers are also experiencing transition troubles. Residential customers reportedly lost any static IP addresses they signed up for when they converted to a Charter Spectrum residential plan. Static IP addresses are still available for Spectrum commercial plans. More troubling for many is the loss of access to Bright House Network’s secure Wi-Fi network.

Customers in central Florida who switched from a Bright House plan to a Charter Spectrum plan lost access to “BHN Secure,” “Bright House Networks,” and secured “CableWiFi” hotspots formerly administered by Bright House. Customers used to access those secure networks using their My Services Bright House username and password. But after transitioning to a Charter Spectrum plan, those credentials no longer work. Customers can still use their Bright House Road Runner e-mail address and password to get access to the very insecure open “CableWiFi” hotspot option, but those doing so should exercise extreme caution using it for any confidential communications, banking, or other sensitive online activities.

Charter’s Bad Advice: Change Your Wi-Fi Password to Your Favorite Sports Team!

Techcrunch noticed some very bad advice coming from Charter’s social media team on Twitter, recommending their 31,700 Twitter followers change their Wi-Fi passwords in support of their favorite sports teams.

Change your WiFi password and show guests where your loyalty lies! #ThatsMyTeampic.twitter.com/7kg04D7GN9

— Spectrum (@GetSpectrum) January 23, 2017

The original tweet has been deleted, no doubt after someone realized the dangerous security lapse it introduced to Wi-Fi hackers who could probably guess the favorite teams of the locals.

The FrankenBundle: Fewer Options, Less Confusion, Higher Prices Later

In Indianapolis, former Bright House Networks customers are being told having fewer options is a good thing.

In Indianapolis, former Bright House Networks customers are being told having fewer options is a good thing.

WRTV-TV talked with Charter spokesman Mike Pedalty, who called his former employer’s packages a “Frankenbundle:”

“We kept adding things and confusing customers, where they didn’t understand what we were adding on and how it was packaged,” Pedalty told the TV station. Now he says most customers will choose from three basic TV packages and ‘best of all you won’t have to fight for a promo rate every year, when your current package expires.’

That’s because Charter has no intention of negotiating a better deal for you as prices gradually increase.

Back in Los Angeles, Plona understands what merger benefits she is really getting from the deregulatory atmosphere that permitted Charter to buy Time Warner Cable.

“When you let these companies do as they please, all they do is raise our rates,” Plona said. “It seems like prices go up every time you deregulate.”

Subscribe

Subscribe Comcast has confirmed new Altice USA and Charter Communications customers that used to subscribe to Cablevision, Time Warner Cable, and Bright House Networks will be able to continue accessing the free nationwide Cable WiFi roaming service, even though Altice and Charter are not members of the consortium that runs it.

Comcast has confirmed new Altice USA and Charter Communications customers that used to subscribe to Cablevision, Time Warner Cable, and Bright House Networks will be able to continue accessing the free nationwide Cable WiFi roaming service, even though Altice and Charter are not members of the consortium that runs it.

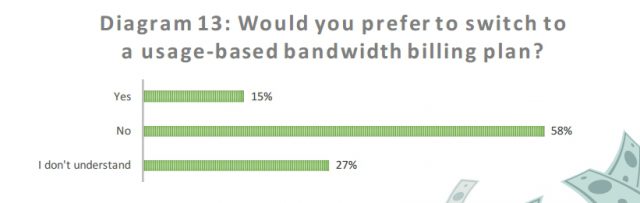

Incognito’s findings show broadband providers are reducing initiatives to acquire new customers as broadband penetration in the United States approaches 90%. Instead, they want current subscribers to pay more to satisfy demands for higher average revenue per customer. Customers already believe their current ISP is charging too much for too slow service.

Incognito’s findings show broadband providers are reducing initiatives to acquire new customers as broadband penetration in the United States approaches 90%. Instead, they want current subscribers to pay more to satisfy demands for higher average revenue per customer. Customers already believe their current ISP is charging too much for too slow service.

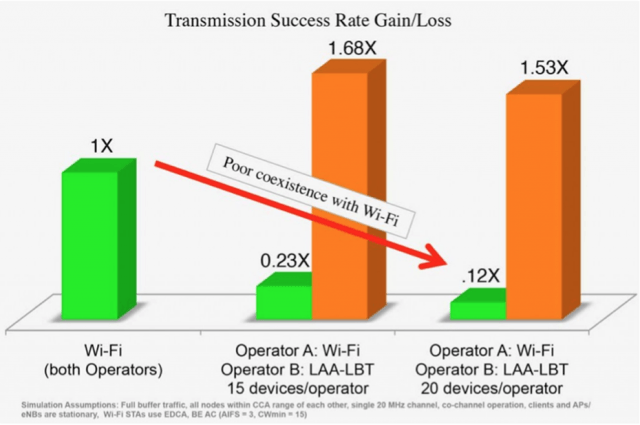

Critics contend the wireless industry’s proposed service is not as likely to use “Listen Before Talk” effectively, a standard that checks for existing traffic before powering up on an unlicensed frequency. Consumer groups fear mobile carriers will have both the ability and a strong incentive to use LTE-U and LAA to charge consumers for the use of unlicensed spectrum and give themselves an unfair advantage by escaping the interference its own technology can cause other users.

Critics contend the wireless industry’s proposed service is not as likely to use “Listen Before Talk” effectively, a standard that checks for existing traffic before powering up on an unlicensed frequency. Consumer groups fear mobile carriers will have both the ability and a strong incentive to use LTE-U and LAA to charge consumers for the use of unlicensed spectrum and give themselves an unfair advantage by escaping the interference its own technology can cause other users. Staffers at the New York State Department of Public Service have recommended the Public Service Commission

Staffers at the New York State Department of Public Service have recommended the Public Service Commission  The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used:

The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used: New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent.

New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent. New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.