As cleanup efforts continue across New York, New Jersey, and Connecticut, some of America’s largest telecommunications companies are coming under increased scrutiny for being caught flat-footed after Hurricane Sandy roared across the tri-state region, causing damage Verizon’s chief technology officer now admits is worse than 9/11.

As cleanup efforts continue across New York, New Jersey, and Connecticut, some of America’s largest telecommunications companies are coming under increased scrutiny for being caught flat-footed after Hurricane Sandy roared across the tri-state region, causing damage Verizon’s chief technology officer now admits is worse than 9/11.

As of this morning, Verizon Wireless’ network is reportedly straining, particularly in Manhattan and Brooklyn, where cell service that worked immediately after the storm is now increasingly failing.

Verizon said 94% of its cell sites were operational after the storm, but some local officials in the area believe 94% of Verizon’s wireless network has now failed them when they need it the most.

Many telecom companies, particularly AT&T, are being criticized for excessive secrecy about the ongoing state of their networks post-Sandy. AT&T, which left its customers in the dark about service restoration as late as last night while asking customers to contribute $10 to the American Red Cross, finally mass e-mailed customers a statement devoid of much detail signed by Steve Hodges, president of AT&T’s northeast region.

“Restoring our wireless network is our top priority,” Hodges writes. “The vast majority of our cell sites in the Northeast are online and working. We are working issues in areas that were especially hard-hit, where flooding, power loss, transportation and debris all pose challenges. Our crews are working around the clock to restore network service to areas that were impacted by the storm. We will not stop until we repair all of the damage to our network and restore service back to its full capacity.”

The Federal Communications Commission correctly predicted the situation with mobile phones could get worse before it gets better, as backup power wears down and flooding persists. At a press conference held yesterday, FCC chairman Julius Genachowski revealed at least a quarter of all cell sites in areas damaged by Sandy were not operational. Those numbers were less optimistic that those provided by carriers.

The FCC this week activated the Disaster Information Reporting System, a central reporting point for telecommunications companies to update the agency regarding outages and other service disruptions. The FCC also alerted providers that in emergency circumstances, they can assist companies getting fuel for generators and help locate portable cell tower equipment for companies caught unaware.

Some may need the help.

New York State Assemblyman Alec Brook-Krasny and Brooklyn Borough President Marty Markowitz both reported Verizon Wireless’ outages are worsening in Brooklyn and midtown Manhattan.

The Federal Emergency Management Agency (FEMA) today told Sen. Chuck Schumer the federal agency will reimburse New York for 100 percent of the costs incurred restoring power across the storm areas. But that may not expedite how quickly power returns.

Power restoration is expected to bring most cell towers back online. Worsening service is being attributed to battery backup or generator equipment exhausting on-hand fuel supplies, which usually keeps service up and running for up to three days. That means cell towers without power and unreachable by workers will have begun failing late Wednesday into today.

Damage assessments are further behind in New Jersey, the state that took the worst impact from Hurricane Sandy.

Stop the Cap! obtained some new figures from cell phone companies regarding the state of their networks:

- Verizon: Still holding to 94% operational in storm areas;

- AT&T: Declined to comment except to say “the vast majority” of their network is operational;

- T-Mobile: 80% operational in NYC, 90% operational in Washington, D.C.

- Sprint: 75% operational

[flv width=”384″ height=”228″]http://www.phillipdampier.com/video/WSJ Verizon Offices Damaged 11-1-12.mp4[/flv]

Verizon’s critical network takes another hit. “We’ve been here before,” says one Verizon executive, referring to the destruction from the 9/11 terrorist attacks which severely damaged the same facility on West Street now flooded out. (3 minutes)

Our readers report that cell service becomes spotty to non-existent in coastal New Jersey and Connecticut. In Manhattan anywhere south of 29th Street, readers report almost no signals at all.

Residents are trading tips about “magic spots” where cell service does suddenly pop up, and Gizmodo notes the only place in Alphabet City (the east side in southern Manhattan) to get service is on literally one street corner, where crowds congregate to make and receive calls.

The other salve for telecom withdrawal is the nearest pay phone.

Amusing stories of 20-somethings waiting in long lines only to be confounded by unfamiliar pay phones are appearing in the New York media. One radio station even aired basic instructions for members of the Millennial Generation that have never heard of inserting coins into telephones.

The biggest challenge for the city’s pay phone vendors is clearing them of coin overloads, something unheard of before the storm.

The often maligned pay phone has exposed the limits of the “more advanced” and expensive networks that were supposed to replace them. Despite claims of superiority for wireless service, northeast residents have once again discovered it has its limits:

- They don’t work during major weather events that knock out power and limit access to maintain backup generators;

- Cell networks are less capable of handling large call volumes, a problem made worse when cell phone refugees in other areas seek out remaining cell signals, further congesting the network;

- Wireless is just as susceptible to wireline or fiber failures on the ground. Cell towers typically connect to providers through wired backhaul circuits, which knock out cell service if they fail;

- Cell phone users need power to recharge their power-hungry smartphones. Batteries drain even faster searching for a weak or non-existent cell signal;

Hardest hit remains Verizon, which allowed reporters access inside damaged facilities to help New Yorkers better understand the scope of the problem.

[flv width=”384″ height=”228″]http://www.phillipdampier.com/video/WSJ Wireless Network Outages 11-1-12.mp4[/flv]

The Wall Street Journal takes a look at the state of the wireless communications networks across the northeastern U.S. and when service will be back. (4 minutes)

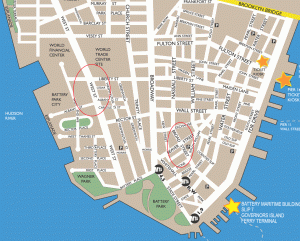

Eleven years after the 9/11 terrorist attacks that took out Verizon’s West Street office when buildings collapsed at the nearby World Trade Center, Verizon is likely going to have to re-learn some lessons about catastrophe management as flood waters recede.

Verizon has deployed this 53-foot Emergency Mobile Communications Center for use by the Nassau County Office of Emergency Management that provides Internet and phone service.

The Wall Street Journal was able to obtain access inside the damaged facilities, and the reporter covering the event was left somewhat stunned by the scope of the damage.

In the middle of organized, yet chaotic recovery efforts was Verizon’s chief technology officer Tony Melone who had seen enough to declare the damage worse than 9/11.

The pictures of several feet of muddy water from the nearby Hudson River covering the lobby of the company’s headquarters on West Street said it all. The mostly salt water was an unwelcome guest in Verizon’s building, especially considering the five level basement below the lobby contains critical cables and telecommunications equipment. Almost four of those basement floors were completely flooded. After the water was pumped out, dampness and leaves from nearby trees remain littered on the floor.

One lesson learned after 9/11 was not to place critical phone switches below ground level. After reconstruction, the switches were moved to a higher floor and consequently were left undamaged. But while Verizon moved its backup generators upstairs, it left the pumps and fuel tanks that power them in the basement — leaving them inoperable.

This morning, passersby on West Street have to step around Verizon’s network of generators now running outside of the building, right next to large temporary fuel tanks to power them.

Verizon central offices in other parts of Manhattan, particularly further southeast on Broad Street, were never upgraded and are in worse shape, with electrical equipment damaged perhaps beyond repair. The force of the water was strong enough to bend the 86 year-old steel and bronze doors. Workers there are still trying to get water out of the building, shoving a pipe down an elevator shaft to facilitate pumping.

Verizon has some redundancy built into its network to protect its most valuable customers. That kept the landline phones working at the New York Stock Exchange, even though other landline and wireless customers will have to wait longer for service to resume.

Some critics of the increasingly concentrated telecommunications landscape think Verizon and other companies have still not learned enough to prevent the kinds of service disruptions that will leave some customers without service for weeks.

It is hard to miss the bustle outside of Verizon’s offices damaged by the storm, watching flood water drain down the street. But things are murkier at cell phone providers who have been less than forthcoming about specific outage information and service restoration assessments.

Some have advocated the federal government step in and require cell phone service, now deemed essential by an increasing number of Americans, be protected with robust backup solutions to keep service up and running after catastrophic weather events.

After Hurricane Katrina, the FCC in 2007 tried to issue new rules that required a minimum of eight hours of backup power for all cell sites. The industry balked, predicting it would lead to “staggering and irreparable harm” for the cell companies. One wireless trade association warned their members might take several cell sites down if they were forced to provide backup power.

The CTIA Wireless Association and Sprint-Nextel sued the agency in federal court and the Bush Administration’s Office of Management and Budget eventually killed the proposed regulations.

T-Mobile and AT&T have cut an emergency deal to share their cellphone networks in areas affected by Superstorm Sandy. They’re trying to make it a little easier for customers to get a signal as carriers restore their networks. Some say companies should be forced to make their networks more resilient. National Public Radio’s Morning Edition has the story. (November 1, 2012) (3 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Subscribe

Subscribe