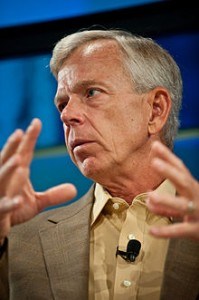

Incoming Rogers CEO Guy Laurence has a reputation for hating cubicles, desks, meetings, and paper. How many Rogers’ employees will be left to enjoy the changes is unknown.

Rogers Communications has tapped Guy Laurence, the head of one of Great Britain’s largest cell phone operators to lead eastern Canada’s biggest cable and wireless firm after current CEO Nadir Mohamed retires in early December.

The company has spent months on a global search to find its next chief executive and signaled how important its wireless business is by selecting the current CEO of Vodafone UK to run the business.

Shareholders barely registered this morning’s announcement, with little movement in the stock, but analysts at some of Wall Street’s largest investment banks think the choice will help Rogers better position itself against increasing competition from Bell/BCE and Telus, which have stolen away some of Rogers’ cable and wireless customers.

“Its unique mix of wireless, cable and media assets offer a brilliant platform to provide innovative service to Canadians. I intend to build on the strong foundation established under Nadir’s leadership to compete and win in the market,” Laurence said in the statement.

When Laurence relocates to Rogers’ headquarters in Toronto, he will be immediately confronted with a Conservative government that has made wireless competition a hallmark of its political platform. In January, Rogers will be a participant in federal spectrum actions for coveted new 700MHz frequencies that Rogers wants to expand its cellular network. Ottawa wants some of those frequencies to be set aside for new competitors to bolster wireless competition. Rogers, along with the other large incumbents, wants access to bid on all available spectrum.

The company has struggled with declining market share as a growing number of customers finishing their wireless contracts have taken the opportunity to change providers, mostly to Bell and Telus’ benefit.

Rogers Cable has also suffered subscriber losses in Ontario from increasing competition from Bell’s IPTV service Fibe, which continues to run aggressive new customer promotions.

Rogers Cable has also suffered subscriber losses in Ontario from increasing competition from Bell’s IPTV service Fibe, which continues to run aggressive new customer promotions.

Rogers may be hoping for an image reset in Canada, and Laurence’s unconventional way of doing business may help.

“I don’t believe in offices. They’re a thing of the past. Offices produce things like a conventional company,” Laurence told a British newspaper in 2011.

To underline his point, Laurence abolished offices and personal desks for Vodafone employees and underlined the new policy by ordering cleaning staff to incinerate any items left on desks overnight. Vodafone workers are given a laptop, a Vodafone mobile phone and an employee locker. Where they choose to conduct business is up to them. Meetings are heavily frowned upon.

The incoming Rogers CEO also despises paper, and wants employees to use as little of it as possible. At Vodafone, workers often had to buy paper themselves for use in the office and hide it from view.

Rogers’ dress code may also radically change. At Vodafone, Laurence insisted employees dress the same way customers do.

“When you remove the barriers of offices, meetings and all the rest of it, people can spend more time doing what they’re supposed to do,” Laurence said. “As a consequence, people start to perform better. It used to take us 90 days to do a pricing change. We do that in four days now.”

Analysts suspect fixing Rogers’ lousy reputation for customer service will be one of his top priorities. Rogers’ executives will also be updating their resumes — Laurence has a reputation for shaking up middle and upper management. But one priority Rogers’ investors expect will not change: protecting the company’s high profit margins and continued efforts to cut costs.

Laurence did not forget everything he learned while getting his MBA. After joining Vodafone, he initiated a brutal workforce reduction that separated 2,350 Vodafone employees from their desks and lockers – permanently, slashing the payroll from 9,500 to 7,150 workers.

Subscribe

Subscribe Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

Verizon hopes being the master of its own destiny will allow the company to innovate its wireless network towards future revenue opportunities, especially in the machine to machine connectivity business. Both AT&T and Verizon Wireless are racing to enable medical devices, home appliances, electric meters, and automobiles to communicate over their respective wireless networks. Both companies are concerned that the cell phone marketplace has become saturated in the United States, with most people desiring cell phone service already having it. With Wall Street demanding ongoing growth quarter after quarter, new revenue sources are more important than ever.

Verizon hopes being the master of its own destiny will allow the company to innovate its wireless network towards future revenue opportunities, especially in the machine to machine connectivity business. Both AT&T and Verizon Wireless are racing to enable medical devices, home appliances, electric meters, and automobiles to communicate over their respective wireless networks. Both companies are concerned that the cell phone marketplace has become saturated in the United States, with most people desiring cell phone service already having it. With Wall Street demanding ongoing growth quarter after quarter, new revenue sources are more important than ever. Buying shares in a public company used to be straightforward and simple. Buyers instructed their broker to trade shares with the simple maxim: “buy low, sell high.”

Buying shares in a public company used to be straightforward and simple. Buyers instructed their broker to trade shares with the simple maxim: “buy low, sell high.”

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey.

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey. Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.