AT&T is offering T-Mobile customers — and only T-Mobile customers — up to $450 to switch their wireless service to AT&T, but is the switch actually worth it? A close inspection of AT&T’s fine print suggests some customers might want to think twice.

AT&T is offering T-Mobile customers — and only T-Mobile customers — up to $450 to switch their wireless service to AT&T, but is the switch actually worth it? A close inspection of AT&T’s fine print suggests some customers might want to think twice.

According to AT&T, beginning Jan. 3, under the limited-time offer, T-Mobile customers who switch to AT&T can trade-in their current smartphone for a promotion card of up to $250, which can be used toward AT&T products and services. Trade-in values will vary based on make, model and age of the smartphone, but many of the latest and most popular smartphones will qualify for a value of $250. T-Mobile customers can receive an extra $200 credit per line when they transfer their wireless service to AT&T and choose an AT&T Next plan, buy a device at full retail price or activate a device they currently own. The “Next” plan offers customers a chance to upgrade to a new device every year under an installment plan that divides the retail price of the phone over 20 months.

[flv]http://www.phillipdampier.com/video/CNN The Most Dangeous Man in Wireless 1-8-14.flv[/flv]

The Wall Street Journal’s ‘Digits’ explores the open marketing warfare between AT&T and T-Mobile. (3:34)

Although $450 sounds like an outstanding deal, some Wall Street analysts that usually panic when a company seems to be giving away the store, are still sleeping well at night.

“It’s not as great an offer as it appears on the surface,” Michael Hodel, equity analyst at Morningstar tells MarketWatch. “The fine print is critical.”

- Not every smartphone will qualify for the $250 “promotional card.” Only the latest model smartphones showing no signs of wear and tear are going to earn full value. Customers with older feature or basic phones will not qualify for anything at all. Customers may be able to get just as much selling their old phone themselves.

- AT&T is not offering a cash rebate. The value of the “promotional card” and the $200 ‘switch from T-Mobile’ bonus can only be spent on AT&T products and services. The promotional card will help defray the cost of buying a new smartphone from AT&T (which may not have the best price) and the $200 bonus will appear as a credit on a future AT&T bill.

- By accepting the $200 bonus, customers give up any device subsidies, an important distinction if you want an Apple iPhone. AT&T’s device subsidy on this phone is higher than $200.

- AT&T has tighter credit standards than T-Mobile. Customers with spotty credit may be asked to put down a deposit with AT&T before the company will take your business.

Legere

AT&T argues its offer will benefit T-Mobile customers by giving them access to the larger coverage area of AT&T’s wireless network and more widespread 4G service. But AT&T customers pay higher prices for access to that network. A T-Mobile customer is more likely to be sensitive to the price of the service — one of the strongest marketing points T-Mobile has in its favor. Most customers unhappy with T-Mobile’s less robust coverage tend to cancel service at the end of their contract (or earlier) and switch to either AT&T and Verizon Wireless.

According to an October report from MoffettNathanson Research, a typical T-Mobile family with 3-5 lines on a single account usually save around $50 a month off AT&T’s prices. That represents $600 a year in savings.

T-Mobile’s scrappy and aggressive marketing has had an impact, particularly on AT&T. Just a few years earlier AT&T tried to buyout T-Mobile in a consolidation move rejected by the Justice Department’s Antitrust Division. After the merger collapsed, incoming T-Mobile CEO John Legere has long forgotten whatever niceties existed between the two companies when they were trying to join forces. Legere has been on the attack against both AT&T and Verizon Wireless all year, and the effort is clearly beginning to pay off as T-Mobile adds customers.

Last year at the Consumer Electronics Show (CES) Legere called AT&T’s network “crap” on stage. So when Legere crashed AT&T’s party at this year’s CES convention, still sporting his pink T-Mobile t-shirt, AT&T’s security guards threw him out.

[flv]http://www.phillipdampier.com/video/CNN The Most Dangeous Man in Wireless 1-8-14.flv[/flv]

CNN calls T-Mobile’s John Legere the most dangerous man in wireless, for exposing “disgusting” AT&T and Verizon’s over 90% gross margin on their wireless services and their consumer unfriendly business practices. (2:41)

Subscribe

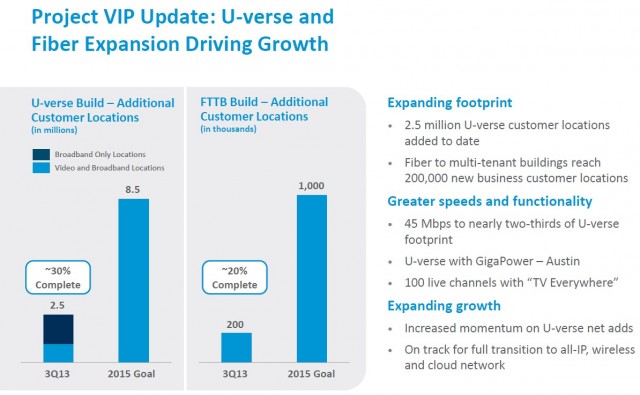

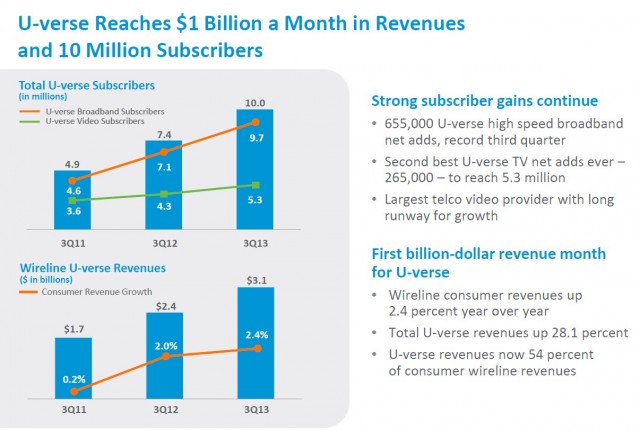

Subscribe AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

News that there were two potential rivals for Time Warner Cable excited investors, particularly when it was revealed possible suitor Comcast is also separately talking to Charter about a possible joint bid that would split up Time Warner Cable customers while minimizing potential regulatory scrutiny.

News that there were two potential rivals for Time Warner Cable excited investors, particularly when it was revealed possible suitor Comcast is also separately talking to Charter about a possible joint bid that would split up Time Warner Cable customers while minimizing potential regulatory scrutiny.

Ironically, when Malone sold TCI to AT&T, the telephone company would later sell its cable assets to Comcast, run by… and Brian Roberts.

Ironically, when Malone sold TCI to AT&T, the telephone company would later sell its cable assets to Comcast, run by… and Brian Roberts.

A portion of your cable bill pays for much more than programming, with millions diverted to Koch Brothers-backed astroturf groups, tea party candidates, fat paychecks for former public officials taking a trip through D.C.’s revolving door, and generous allowances for travel expenses racked up by high-flying industry lobbyists.

A portion of your cable bill pays for much more than programming, with millions diverted to Koch Brothers-backed astroturf groups, tea party candidates, fat paychecks for former public officials taking a trip through D.C.’s revolving door, and generous allowances for travel expenses racked up by high-flying industry lobbyists.