Laurence is the ex-CEO of Vodafone.

The new chief executive of one of Canada’s largest telecommunications companies has declared the country can’t support a fourth national wireless competitor because it will simply cost too much to build and maintain.

Guy Laurence has been very vocal about Canadian telecommunications policies since taking over for Nadir Mohamed who retired last year.

This week Laurence announced a reboot of Rogers Communications he dubbed v3.0, designed to face the “hard truth” that most Canadians despise the cable and wireless company.

“Every day I marvel at what an amazing company Ted [Rogers] built, Laurence said, referring to the company’s founder. “The mix of assets, the culture of innovation and depth of employee pride is extraordinary. But we’ve neglected our customers, and we’ve let our legacy of growth and innovation slip. The plan I’ve laid out will significantly improve the experience for our customers and re-establish our growth by better leveraging our assets and consistently executing as One Rogers.”

Most of the changes Laurence plans relate to its poorly-rated customer service. Laurence has insisted that all customer service functions, including call centers, customer service, service technicians and marketing will be combined into a single unit that will report directly to him.

But Laurence said nothing about improving service plans, dropping usage caps, or lowering prices.

Several long time Rogers executives are out the door, either voluntarily or quietly pushed out.

Several long time Rogers executives are out the door, either voluntarily or quietly pushed out.

“When you remove overlap and reduce bureaucracy, and you create agility, then it takes less people in management. So there will be job losses at the management level. No doubt of this,” Laurence said. “But because this is not a cost story, I don’t have a dollar value or a number of people. I don’t even have the vaguest idea in my head what that might be.”

Like many American cable companies, Rogers has lost video customers although it is still growing its broadband business by picking up ex-DSL customers. With overall growth flat during 2013, the new CEO wants to maximize shareholder value by limiting the number of costly new projects launched. Instead, Laurence promised “fewer, more impactful initiatives” under Rogers 3.0.

Rogers will continue to depend heavily on its profitable wireless division, which competes against Bell and Telus.

Although Canadian government officials have repeatedly sought a fourth national competitor willing to break with tradition in the wireless market, Laurence says the government is engaged in wishful thinking if it believed a fourth carrier would shake things up in Canada.

“I’m not saying the government is wrong. I’m not saying that they should change their policy. My personal view is that it is difficult to see a scenario where a fourth carrier will be successful,” Laurence said. “What you saw in Europe was a number of different countries who pursued the four-carrier option for a period of five to seven years. It was politically very popularist and they were happy to follow that. What you clearly see now, and I cite Germany and France, is that they’ve started to realize that given the capital complexity involved in these companies, it is very difficult to support a fourth carrier.”

Canadian wireless companies have recently embraced a study by the Montreal Economic Institute that declared the presence of a fourth national carrier would be “wasteful.”

“It may be preferable for financial resources … to be concentrated in the hands of a few strong players willing to invest in new technologies and services rather than scattered among several small and feeble competitors trying to survive by selling at prices barely above marginal costs,” the report said.

The Montreal Economic Institute won’t reveal its donor list of corporations that pay for its research.

The Montreal Economic Institute is “funded by the voluntary donations of individuals, businesses and foundations that support its mission.” The MEI does not disclose the specifics of its donors, however, for fears that “organizations similar to the MEI” would have an opportunity to solicit funds. The foundation of the MEI’s mission statement is couched in basic free market ideology, such as the Randian conception that “people who make money are creating wealth.”

Despite asking repeatedly, MEI will not disclose whether its telecom-related studies were funded by the telecommunications companies named in their reports. But there is little doubt of MEI’s economic philosophy.

Michel Kelly-Gagnon, the president and CEO of MEI, has written a number of opinion pieces that further illuminate the mission of the organization, notes The Telecom Blog. Included among them are articles that suggest “true entrepreneurs… deserve our gratitude” and pieces decrying a “tax the rich” mentality. There’s even a bit about the “dangers” of so-called “Soviet imagery,” citing the “intellectual and moral recklessness” in a pair of teens audacious enough to wear red T-shirts featuring USSR emblems.

Canada’s Competition Bureau, less concerned with Soviet nostalgia, found different results from increased competition – at least $1 billion in savings as competing carriers are forced to increase the wireless penetration rate while working to lower prices.

Laurence said the only way a four-carrier government policy could work in Canada is if the federal government put up taxpayer money to build, update, and run a “modern communications network” across the country. If that happens, Rogers and other companies will only be too happy to use it to offer expanded service and competition, with no commitment it will cost any less.

[flv]http://www.phillipdampier.com/video/MEI – The State of Competition in Canada’s Telecommunications Industry – Paul Beaudry IEDM.flv[/flv]

Paul Beaudry, associate researcher at the Montreal Economic Institute offers the amazing conclusion that more wireless competition in Canada is bad for consumers! (4:16)

Subscribe

Subscribe

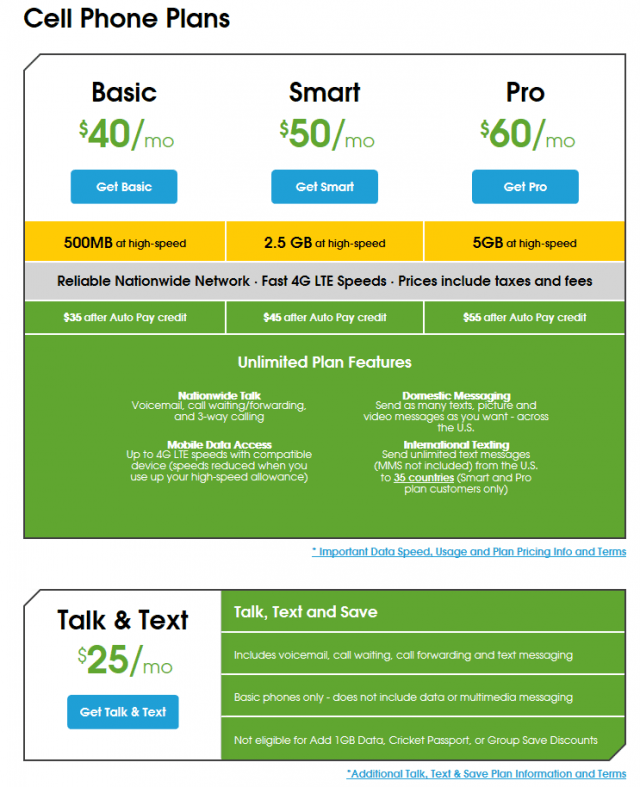

Cricket’s data plans do not carry automatic overlimit charges. Instead, your data connection is throttled to 128kbps until your billing period resets. Customers can buy an extra gigabyte of data at any time for $10.

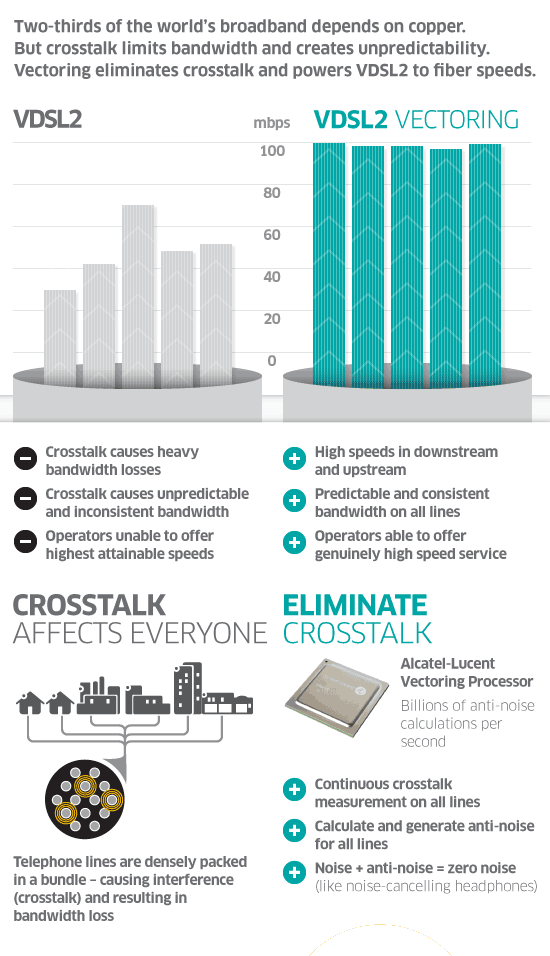

Cricket’s data plans do not carry automatic overlimit charges. Instead, your data connection is throttled to 128kbps until your billing period resets. Customers can buy an extra gigabyte of data at any time for $10. Alcatel-Lucent reported this month next generation DSL technology is a success for the company, with more than

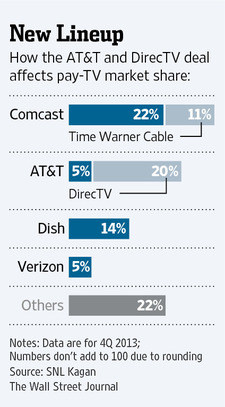

Alcatel-Lucent reported this month next generation DSL technology is a success for the company, with more than  The deal, finalized on Sunday, pays $95 per DirecTV share in a combination of stock and cash, about a 10% premium over DirecTV’s closing price on Friday. Including debt, the acquisition is AT&T’s third-largest deal on record, behind the purchase of BellSouth for $83 billion in 2006 and the deal for Ameritech Corp., which closed in 1999, according to data compiled by Bloomberg.

The deal, finalized on Sunday, pays $95 per DirecTV share in a combination of stock and cash, about a 10% premium over DirecTV’s closing price on Friday. Including debt, the acquisition is AT&T’s third-largest deal on record, behind the purchase of BellSouth for $83 billion in 2006 and the deal for Ameritech Corp., which closed in 1999, according to data compiled by Bloomberg. The deal would combine AT&T’s wireless, U-verse, and broadband networks with DirecTV’s television service, creating bundling opportunities for some satellite customers. As broadband becomes the most important component of a package including phone, television, and Internet access, not being able to offer broadband has left satellite TV companies at a competitive disadvantage. AT&T’s U-verse platform – a fiber to the neighborhood network – has given AT&T customers an incremental broadband speed upgrade, but not one that can necessarily compete against fiber to the home or cable broadband.

The deal would combine AT&T’s wireless, U-verse, and broadband networks with DirecTV’s television service, creating bundling opportunities for some satellite customers. As broadband becomes the most important component of a package including phone, television, and Internet access, not being able to offer broadband has left satellite TV companies at a competitive disadvantage. AT&T’s U-verse platform – a fiber to the neighborhood network – has given AT&T customers an incremental broadband speed upgrade, but not one that can necessarily compete against fiber to the home or cable broadband.