Although the cable trade press reports it is business as usual at most of the nation’s largest cable companies, news that several companies are losing more cable-TV subscribers than they are adding is creating concern in boardrooms and on Wall Street. Although the power of the perennial “rate increase” has kept revenues up, cable operators like Time Warner Cable are beginning to realize they can’t just keep raising rates expecting customers to sit still for it.

Although the cable trade press reports it is business as usual at most of the nation’s largest cable companies, news that several companies are losing more cable-TV subscribers than they are adding is creating concern in boardrooms and on Wall Street. Although the power of the perennial “rate increase” has kept revenues up, cable operators like Time Warner Cable are beginning to realize they can’t just keep raising rates expecting customers to sit still for it.

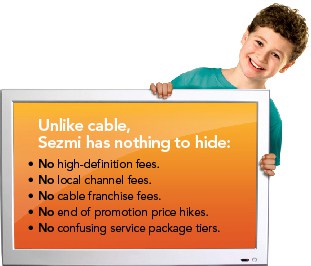

For more than 30 years, cable operators have assumed (correctly) that raising rates far in excess of inflation will bring about a lot of grumbling from upset subscribers, but few will actually resort to cutting the cord and going back to free TV (or books). But as many cable households now routinely pay “triple-play” bills well in excess of $200 a month, that is finally starting to change:

- For many households, the switch to digital TV and an increasing number of sub-channels has proved adequate to meet the needs of many viewers, so long as they receive a decent picture and at least a handful of digital sub-channels;

- Online access to at least some cable programming, movies, and television shows on-demand has solved the problem of having too few viewing options. If nothing of interest is running on local channels, a quick visit to Netflix or Hulu can satisfy most viewers;

- Many increasingly prefer spending their free time online instead of parked in front of the television;

- The realities of the current economy and tightened middle class budgets make many cable packages simply unaffordable, even if customers wanted them.

Time Warner Cable has recognized the growing strain on their video side of the business and has initiated some strong marketing efforts to hold onto customers who are one rate increase away from canceling.

This fall, the cable company unveiled its $33 per service promotion, charging that price for each component of their triple-play package for a year. While Time Warner has more aggressively priced individual services in the past for new customers, this one is unique because it is open to existing customers as well. Customers speaking to Time Warner’s retention agents are being offered this package in an effort to keep customers hooked up to the company’s video, broadband, and phone services. Currently, many markets also include a free year of Showtime or at least six months of DVR service, and a year of Road Runner Turbo. In highly competitive markets, informal promotions can bring even lower prices or extra add-ons.

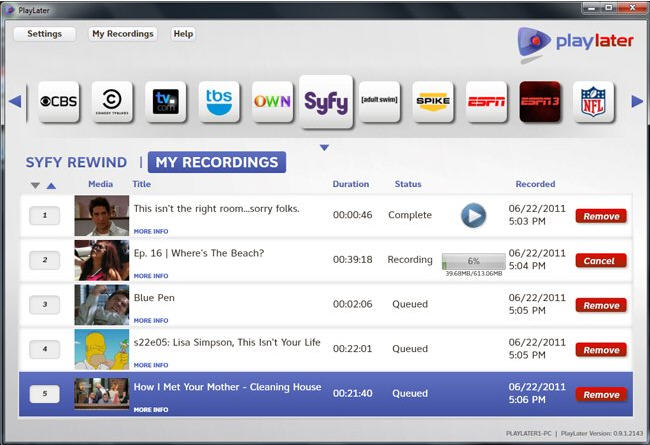

A few weeks ago, the cable company unveiled online video streaming of ESPN Networks for existing cable subscribers, and an online remote DVR-programming application that lets subscribers set up recordings while away from home.

Now the company is further bolstering its video packages:

- As part of its long term agreement with Disney, ABC and ESPN, this week Time Warner Cable added over 300 hours of new On Demand programming content from ABC, Disney and ESPN. In addition, the company will launch Primetime HD On Demand tomorrow, which will also be available to Digital Cable customers at no additional cost. The new channel Primetime HD On Demand will carry primetime programming from ABC, NBC and CBS in High Definition. Subscribers will have over 100 hours of the networks’ popular primetime programs including NBC’s 30 Rock and The Office; ABC’s Grey’s Anatomy and Desperate Housewives; and CBS’ Medium and CSI.

- Time Warner Cable Look Back will bolster the existing “Start Over” feature by archiving up to three days of programming on more than two dozen different networks and cable channels. Now, if you missed a favorite show that aired the evening before, you can watch it on demand. As with “Start Over,” Time Warner has disabled fast-forwarding, so no zipping through commercials is allowed. But the service comes free of charge, and includes an impressive lineup of participating networks including ABC, NBC, Fox Cable Networks, Discovery Networks, and Scripps’ Food Network, Cooking Channel, HGTV, and DIY.

- HBO Max and Go Max, part of TV Everywhere, will reach more than 50 million Time Warner Cable customers by the end of the month. These services deliver online on-demand access to movies, series, and specials airing on HBO and Cinemax and will be available to customers paying for the premium channels at no additional charge. More than 70 million customers will have access by the second quarter of 2011.

- Time Warner Cable CEO Glenn Britt told investors on a conference call held last week that the cable company is aggressively pursuing renewal agreements with programmers that allow the cable company to begin offering smaller, budget priced packages of cable-TV programming. While it won’t be the a-la-carte option many consumers crave, cable programming packages could begin to resemble what home satellite dish customers used to receive — a core package of two dozen channels with theme or network-based add-on “programming packs” for additional fees. For example, customers looking for reality or educational programming might buy a “Home and Garden” package consisting of Food TV, HGTV, The Weather Channel, Discovery and The Learning Channel. Movie fans might get a package of Encore, AMC, Turner Classic Movies, Fox Movies and MGM. “We have negotiated some additional flexibility beyond what we had a few years ago that will allow us to begin to offer some smaller packages at lower prices. Probably not all the way where we’d like to be. But we’re moving in the right direction,” Britt told investors.

The cable company’s friendly former owner — Time Warner, Inc., has also helped man the barricades against cable’s competitors. For Netflix and Redbox customers: longer waiting times for access to the latest Time Warner movies are likely. The current delay of 28 days could be extended, according to CEO Jeff Bewkes.

The cable company’s friendly former owner — Time Warner, Inc., has also helped man the barricades against cable’s competitors. For Netflix and Redbox customers: longer waiting times for access to the latest Time Warner movies are likely. The current delay of 28 days could be extended, according to CEO Jeff Bewkes.

“So far the 28-day window has clearly been a success versus no delay,” Bewkes told investors. “The question of whether we ought to go longer is very much under scrutiny. It may well be a good idea.”

Even local movie theaters face some potential competition, as Time Warner considers introducing a premium pay-per-view option that would allow cable customers to watch movies currently in theaters at home. But they’ll pay a heavy price to watch — reportedly between $30-50 per title, and the cable operator will insert anti-recording technology into the signal to prevent digital recordings.

Will these new services ultimately stop the bleeding from departing cable customers? For most it’s a matter of dollars and sense.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Cutting Cable’s Cord 11-9-10.flv[/flv]

The media has gotten aggressive about talking to viewers about how they can get rid of their cable-TV subscription and save plenty. (10 minutes)

Thomas Clancy Jr., 35, in Long Beach, N.Y., canceled the family’s Cablevision subscription this spring. He said he has been happy with Netflix and other Internet video services since then, even though there isn’t a lot of live sports to be had online.

“The amount of sports that I watched certainly didn’t justify a hundred-dollar-a-month expense for all this stuff. I mean, that’s twelve hundred dollars a year,” Clancy told the Associated Press. “Twelve hundred dollars is … near a vacation.”

Customers like Clancy are comfortable with technology and well-versed on how to hook up Internet video and integrate it with the family’s TV sets. For customers like him, online video will increasingly be an attractive alternative to high cable TV bills.

For some western New Yorkers, Wegmans' Redbox kiosk is their new "cable company."

For homes with less tech-savvy subscribers who have watched their wages fall over the past decade even as cable rates keep increasing, economic realities driven home by the Great Recession are making the decision for them.

“The price of cable TV has risen to the point where it’s simply not affordable to lots of lower-income homes. And right now there are an awful lot of lower-income homes,” Craig Moffett, a Wall Street analyst who favors the cable industry said. “The evidence suggests that what we’re seeing is a poverty problem rather than a technology phenomenon.”

For these customers, including many in the middle class, each time cable companies like Time Warner increase cable rates, they drop a service or two.

“First it was Showtime, the Movie Channel, and Starz!,” writes Stop the Cap! reader Joanne in Penfield, N.Y., a suburb of Rochester. “Then when they raised the rates again on the premium channels, we dropped them all — bye bye HBO and Cinemax.”

“When Time Warner sends us their rate increase notice right after Christmas as they’ve done for years, we’re dropping digital cable and returning our cable boxes,” she writes. “If they keep it up, we’ll drop cable altogether — something we might have done earlier if we had some competition around here.”

“I don’t care how much they claim it’s a ‘great value,'” Joanne says. “My husband got laid off from his job at Xerox in 2009 and was just let go from his new job at Carestream. I already work myself and we have three kids, and our health insurance premiums are skyrocketing at the end of the year. We haven’t had a real raise in five years, so that made the decision for us.”

Joanne now rents movies from Redbox just inside the local Wegmans grocery store and has a $9 monthly subscription with Netflix, mostly for online streaming.

“It’s more than made up for the $40+ a month we used to spend on premium channels with Time Warner,” she said.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/WISN Milwaukee Time Warner Cable Offers Start Over For WISN 12 ABC Programs 11-9-10.flv[/flv]

WISN-TV in Milwaukee introduces viewers to Time Warner Cable’s newest on-demand features. (1 minute)

Wireless operator (and cable company) Rogers Communications likes to spend big dollars pushing the message Canada is in the midst of a wireless spectrum crunch — a big reason why it wants “equal treatment”-bidding in upcoming spectrum auctions that may include “set-asides” exclusively for emerging Canadian wireless competitors.

Wireless operator (and cable company) Rogers Communications likes to spend big dollars pushing the message Canada is in the midst of a wireless spectrum crunch — a big reason why it wants “equal treatment”-bidding in upcoming spectrum auctions that may include “set-asides” exclusively for emerging Canadian wireless competitors.

Subscribe

Subscribe