Your modem needs an expensive upgrade, even if you own your own.

Stop the Cap! reader Paul in Illinois e-mailed us (along with several other readers) sharing news that Frontier Communications intends to charge their DSL customers a minimum of $6.99 a month for the rental of a DSL-ready modem-router, even if customers purchased and use their own equipment for Frontier’s High Speed Internet service. Even worse, some customers are being told the monthly combined rental fee for the company’s wireless-ready DSL equipment is a whopping $14 a month — just for the equipment.

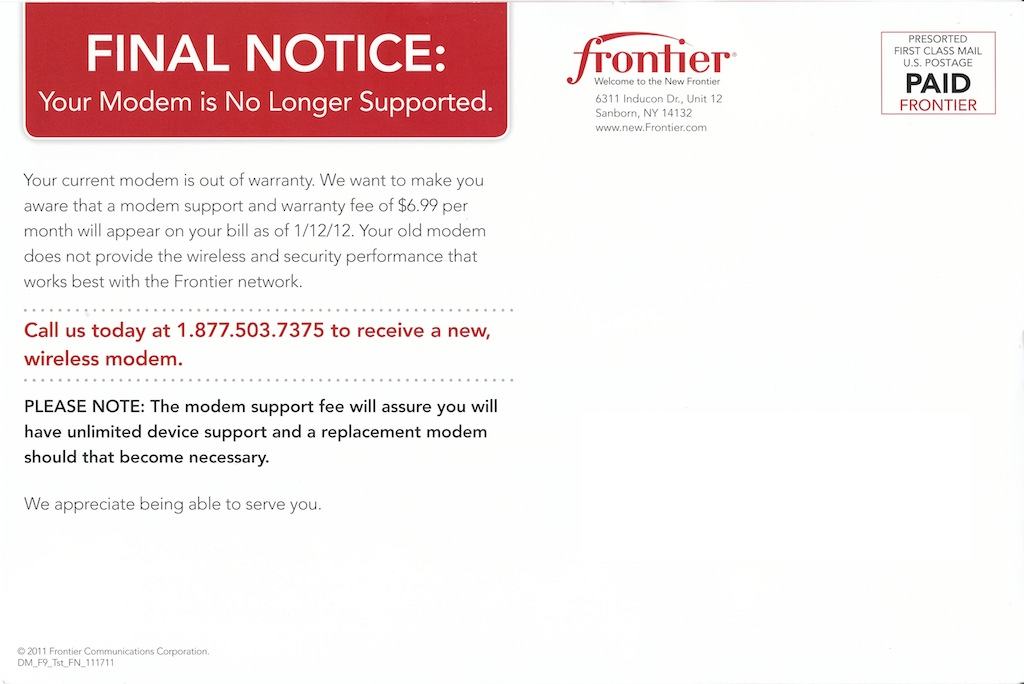

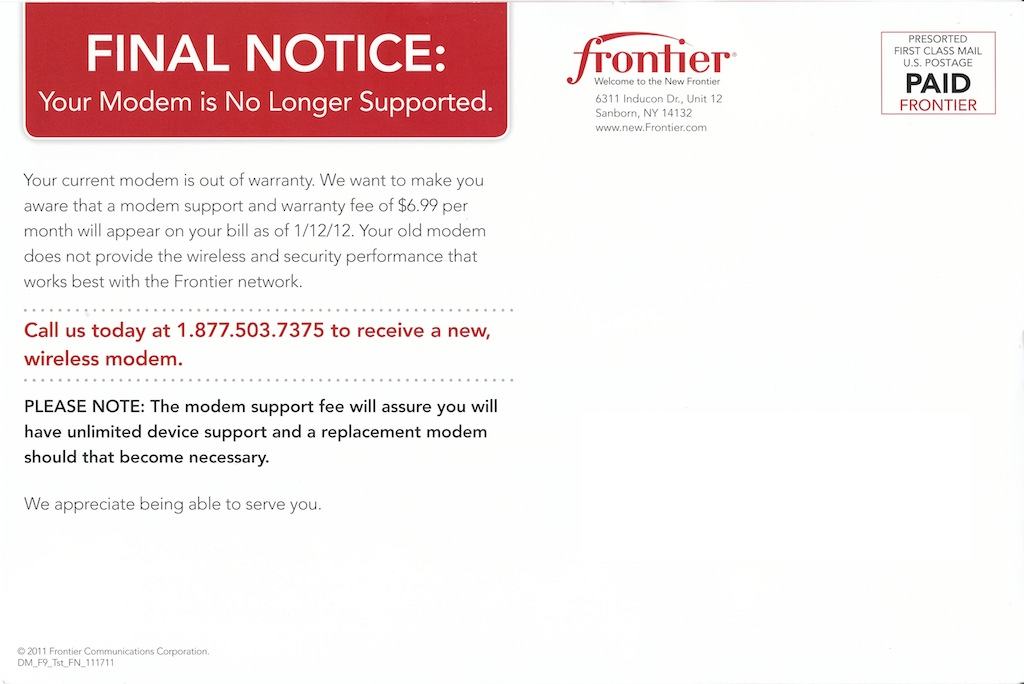

The bad news arrived in the form of a postcard notifying customers that their current modem is “out of warranty” and a new “modem support and warranty fee of $6.99 a month will appear on your bill as of 1/12/12.”

Frontier’s alarming notice tries to scare customers, telling them their existing outdated equipment represents a potential security risk, and explains only with their new mandatory “modem support fee” will customers get “unlimited support” and a replacement modem, if necessary.

Eric, a Stop the Cap! reader and Frontier customer notes Frontier has been piling on price increases in the form of mandatory surcharges and fees this year, including a monthly $1.99 “High Speed Internet Surcharge.”

“Former Verizon customers are now being gouged an additional $9.00 per month or $108 dollars per year,” Eric notes, adding up just the cost of the modem rental and the surcharge.

Paul is especially upset because he purchased his DSL modem direct from Verizon just before the phone company sold its business in Illinois to Frontier.

“In fact, the Verizon modem is more ‘advanced’ than the Westell equipment they want to rent me,” Paul says. “The security is better on Verizon’s unit, and I got it as part of a $29.99 ‘Internet for life’ special offer Frontier now wants to renege on.”

“Frontier is running a scam from top to bottom, offering you l0wball Internet pricing that never includes the outrageous add-on fees that you only find out about on your next bill,” Paul says.

“Frontier is running a scam from top to bottom, offering you l0wball Internet pricing that never includes the outrageous add-on fees that you only find out about on your next bill,” Paul says.

Other Frontier customers on Broadband Reports’ Frontier forum are reporting Frontier has been inconsistent explaining the fees, and some are finding promotions that were supposed to protect them from price increases do nothing of the sort.

Stop the Cap! reader Isabella in Indiana wrote us to say her contact with Frontier customer service was likely going to be her second to last.

“Not only do they intend to collect the $7 a month from customers with their own equipment, those of us with wireless are being told it will cost $14 a month for two of their wireless routers we have on their ‘double DSL line’ promotion,” says Isabella. “The price for their 3Mbps Internet, on special, was $14.99 a month with a multi-year agreement. The add-on fees they never tell you about are more than the advertised price of the service.”

Isabella calls her Frontier service “bait and switch Internet” and says when the company applies any additional fees to her account, she will terminate her contract and will refuse to pay a penalty, claiming Frontier unilaterally changed the terms.

“The only ‘price protection’ Frontier offers is for the benefit of their bottom line; Frontier representatives told me there was no way for me to avoid these new fees, even though I am supposed to be guaranteed no price increase for two years,” she says.

Paul also ran into a brick wall with customer service.

“They will not exempt you from the fees — for my ‘convenience’ they will be automatically added to my bill starting next month, with or without the new equipment,” Paul shares. “I am beyond outraged.”

“I am contacting my state Attorney General on Monday to file a formal complaint against Frontier for cheating customers on ‘price protection’ plans,” Paul says.

Modem rental fees offer a lucrative opportunity for broadband providers to raise prices while still advertising a low monthly price for the service alone. Equipment rental fees often run extra and are typically only disclosed in the fine print. But must providers will exempt customers who purchase and use their own equipment. Frontier is apparently ending this policy, forcing some customers to pay the fee for equipment they neither need nor want. Frontier’s $7 a month fee is particularly steep, especially for equipment that can easily be purchased new or used for prices averaging $50 or less. Frontier will earn back the cost of the equipment within the first year, with the rest simply padding profits.

One of our readers notified us Frontier customer service agreed to “note their account” to not send the new equipment or charge the fee, despite the fact the representative repeatedly encouraged the customer to “upgrade their router.” But the customer isn’t so sure he believes the company, telling us an earlier victory getting them to waive the “HSI Surcharge” was hollow: Frontier simply began charging it anyway, and refused to remove it despite the earlier agreement.

“What is next — special fees for reading e-mail and visiting web pages?” asks Paul.

A Little Rock hairdresser’s electronic shrine to the rock group KISS has led to a standoff with Verizon Wireless, who claims the device is jamming their wireless signal.

A Little Rock hairdresser’s electronic shrine to the rock group KISS has led to a standoff with Verizon Wireless, who claims the device is jamming their wireless signal.

Subscribe

Subscribe