Sen. Chip Rogers, a new-found friend of Comcast, AT&T, Charter Cable, Verizon, and the Georgia state cable lobby.

A new bill designed to hamstring local community broadband development with onerous government regulation and requirements has been introduced by a Republican state senator in Georgia, backed by the state’s largest phone and cable companies and the astroturf dollar-a-holler groups they financially support.

Sen. Chip Rogers (R-Woodstock), is the chief sponsor of the ironically-named SB 313, the ‘Broadband Investment Equity Act,’ which claims to “provide regulation of competition between public and private providers of communications service.” The self-professed member of the party of “small government” wrote a bill that creates whole new levels of broadband bureaucracy, and applies it exclusively to community-owned networks, while completely exempting private companies, most of which have recently contributed generously to his campaign.

SB 313 micromanages publicly-owned broadband networks, regulating the prices they can charge, the number of public votes that must be held before such networks can be built, how they can be paid for, where they can serve, and gives private companies the right to stop the construction of such networks if they agree to eventually provide a similar type of service at some point in the future.

Even worse, Rogers’ bill would prohibit community providers from advertising their services, defending themselves against well-financed special interest attacks bought and paid for by existing cable and phone companies, and requires publicly-owned networks to allow their marketing and service strategies to be fully open for inspection by private competitors.

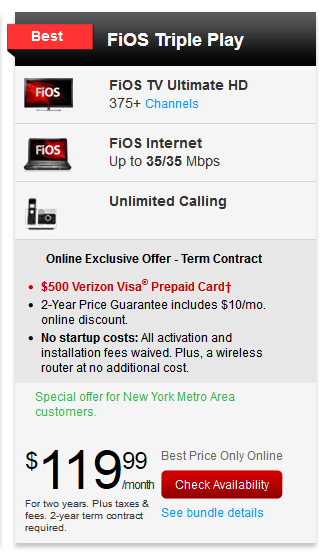

Rogers’ legislation is exceptionally friendly to the state’s incumbent phone and cable companies, and they have returned the favor with a sudden interest in financing Rogers’ 2012 re-election bid. In the last quarter alone, Georgia’s largest cable and phone companies have sent some big thank-you checks to the senator’s campaign:

- Cable Television Association of Georgia ($500)

- Verizon ($500)

- Charter Communications ($500)

- Comcast ($1,000)

- AT&T ($1,500)

A review of the senator’s earlier campaign contributions showed no interest among large telecommunications companies operating in Georgia. That all changed, however, when the senator announced he was getting into the community broadband over-regulation business.

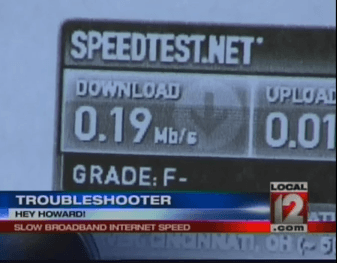

It is difficult to see what, besides campaign contributions, prompted Rogers’ sudden interest in community broadband, considering Georgia has not been a hotbed of broadband development.

Rogers claims cities like Tifton, Marietta and Acworth have tried unsuccessfully to be public providers and that the legislation “levels the playing field for public and private broadband providers.” Hardly, and the senator’s dismissal of earlier efforts fails to share the true story of broadband expansion in those communities.

The new owner of Tifton's CityNet carries on the tradition the city started providing broadband to a woefully underserved part of Georgia.

Tifton: Either the city provides broadband or no one else will

Tifton’s misadventure with the city-owned CityNet, eventually sold to Plant Communications, was hardly all bad news. When city officials launched CityNet a few years ago, much of the community was bypassed by broadband providers. Today, the new owner Plant continues competing with bottom-rated Mediacom, which admitted in 2001 it bought an AT&T Broadband cable system that “underserved” the residents of Tifton. At the same time, the Tifton Gazette, which has loathed CityNet in editorials from its beginnings, freely admits the network brought lower prices and competition to Tifton residents over its history:

At the same time, having CityNet here has meant increased competition and therefore lower service rates for residents. We would probably have had to wait longer for high-speed Internet to make it to Tifton, and the system makes it possible for local governments to receive services here.

That’s a far cry from Rogers’ claim that the “private sector is handling [broadband] exceptionally well.”

“What they don’t need is for a governmental entity to come in and compete with them where these types of services already exist,” Rogers added.

In fact, in Tifton they needed exactly that to force Mediacom to upgrade the outdated cable system they bought from AT&T.

The Curious Case of Marietta FiberNet: When politics kills a golden opportunity

On track to be profitable by 2006, local politics forced an early sale of the community fiber network that was succeeding.

In Marietta, the public broadband “collapse” was one-part political intrigue and two-parts media myth.

Marietta FiberNet was never built as a fiber-to-the-home service for residential customers. Instead, it was created as an institutional and business-only fiber network, primarily for the benefit of large companies in northern Cobb County and parts of Atlanta. The Atlanta-Journal Constitution reported on July 29, 2004 that Marietta FiberNet “lost” $24 million and then sold out at a loss to avoid any further losses. But in fact, the sloppy journalist simply calculated the “loss” by subtracting the construction costs from the sale price, completely ignoring the revenue the network was generating for several years to pay off the costs to build the network.

In reality, Marietta FiberNet had been generating positive earnings every year since 2001 and was fully on track to be in the black by the first quarter of 2006.

So why did Marietta sell the network? Politics.

Marietta’s then-candidate for mayor, Bill Dunway, did not want the city competing with private telecommunications companies. If elected, he promised he would sell the fiber network to the highest bidder.

He won and he did, with telecommunications companies underbidding for a network worth considerably more, knowing full well the mayor treated the asset as “must go at any price.” The ultimate winner, American Fiber Systems, got the whole network for a song. Contrary to claims from Dunway (and now Rogers) that the network was a “failure,” AFS retained the entire management of the municipal system and continued following the city’s marketing plan. So much for the meme government doesn’t know how to operate a broadband business.

Acworth: Success forces the city to sell to a private company that later defaults

Acworth CableNet: Too popular for its own good?

But of all the bad examples Rogers uses to sell his telecom special interest legislation, none is more ironic than the case of Acworth, Ga. The Atlanta suburb suffered for years with the dreadfully-performing MediaOne. Throughout the 1990s, MediaOne spent as little as possible on its antiquated cable system serving the growing population, many working high-tech day jobs in downtown Atlanta. MediaOne had no plans to get into the cable broadband business, while other cable systems around metro-Atlanta had already begun receiving the service. That left Acworth at a serious disadvantage, so local officials issued $6.8 million in tax-exempt bonds to construct Acworth CableNet. Demand was so great, the city simply couldn’t keep up.

As Multichannel News reported in 2002, “the Atlanta suburb of Acworth, Ga., isn’t selling because business is bad. Rather, officials said they’ve received so many requests for service from outside the city limits that they’ve decided to sell the operation to an independent company that may expand beyond Acworth’s borders.”

That is where the trouble started. The city contracted with United Telesystems Inc. of Savannah, Ga., a private company, first to lease and then eventually buy the cable system, maintaining and expanding it along the way. But in 2003, United Telesystems defaulted on its lease-sale agreement, forcing the city to foreclose on the system and ultimately sell it to a second company.

Acworth’s “failure” wasn’t actually the city’s, it was the private company that defaulted on its contract.

So much for Rogers’ record of municipal broadband failure.

The Hidden Problems of Industry-Funded Research Reports

In fact, many of Rogers’ talking points about his new bill come courtesy of the industry-backed astroturf group, the “Coalition for the New Economy.” With chapters in the Carolinas, Georgia, and Florida, this tea-party and AT&T/Time Warner Cable-funded group takes a major interest in slamming community broadband.

Most of their findings come courtesy of a shallow dollar-a-holler study, The Hidden Problems with Government-Owned Networks, by Dr. Joseph P. Fuhr, Jr., professor of economics at Widener University. The report, mostly an exercise in Google searching for cherry-picked bullet points highlighting what the author sees as weaknesses and failures in community broadband, even slams success stories like EPB Fiber. The Chattanooga, Tenn., network just earned credit for helping to attract hundreds of millions in new private investment and jobs from Amazon.com, but Fuhr’s conclusion is that EPB operates without any “real business plan concerning EPB’s investment.”

Fuhr and his friends at Heartland Institute even misrepresent EPB as delivering only 1Gbps service at $350 a month in an attempt to illustrate municipalities are out of touch with the private broadband marketplace.

Christopher Mitchell at Community Broadband Networks dismisses the bill as more of the same from a telecommunications industry that wants to tie down community broadband networks in ways that guarantee they will fail:

In short, this bill will make it all but impossible for communities to build networks — even in areas that are presently unserved. The bill purports to exempt some unserved areas, but does so in a cynically evasive way. The only way a community could meet the unserved exemption is if it vowed to only build in the least economical areas — meaning it would have to be significantly subsidized. Serving unserved areas and breaking even financially almost always requires building a network that will also cover some areas already served (because that is where you can find the margins that will cover the losses in higher expense areas).

The bill is presently in the Senate Regulated Industries and Utilities committee. Stop the Cap! urges Georgia residents to contact state legislators and ask they oppose this special-interest legislation that is designed primarily to protect the broadband status quo and provider profits in Georgia, instead of allowing communities to manage their broadband needs themselves. After all, they are accountable to the voters, too.

Subscribe

Subscribe