AT&T has once again scored dead last in a nationwide survey (subscription required) of wireless providers commissioned by consumer magazine Consumer Reports.

Among national coverage carriers, Verizon Wireless again scored the highest, but not highest overall when including smaller independent and regional carriers. Top honors were won by Consumer Cellular, a relatively small company in Portland, Ore. that ironically depends on bottom-rated AT&T’s network to deliver service. What sets Consumer Cellular apart from other carriers is its near-exclusive focus on selling phone service to America’s senior population. Working with groups like the AARP to market simple cell phones to older, less technologically-comfortable customers, over 85% of Consumer Cellular customers are over the age of 50. The vast majority are occasional cell phone users, primarily using cell phones to make and receive calls.

Regional carrier U.S. Cellular, which used to top Consumer Reports‘ surveys, scored second. Most U.S. Cellular customers are in the Pacific Northwest, Midwest, and parts of the East including New England. CREDO, better known under its former name Working Assets Wireless, scored third. It provides service over the Sprint network.

Among major-sized providers, only Sprint managed to escape the poor ratings for value received by AT&T, Verizon, and T-Mobile. Also ironic, T-Mobile continued to score better than AT&T, which is still working feverishly to acquire the German-owned carrier.

AT&T also did poorly in delivering reliable voice and data services, according to respondents. Customer service was also deemed lacking.

“Our survey indicates that subscribers to prepaid and smaller standard-service providers are happiest overall with their cell-phone service,” said Paul Reynolds, electronics editor for Consumer Reports. “However, these carriers aren’t for everyone. Some are only regional, and prepaid carriers tend to offer few or no smart phones.”

Consumer Cellular being a prime example.

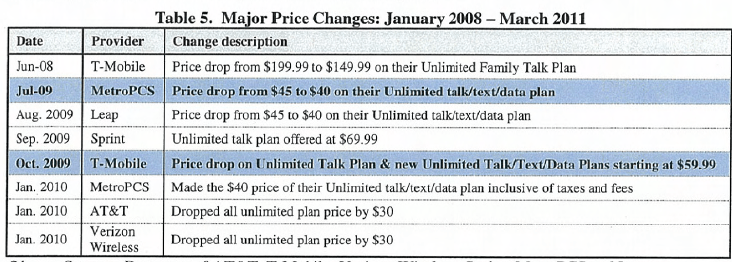

Consumer Reports surveyed 66,000 Americans for its 2011 Wireless Satisfaction Survey and found little had changed from last year. The consumer magazine recommends consumers who don’t make or receive a lot of calls or are not addicted to wireless data services consider a prepaid plan instead of a two-year contract. Competition in the prepaid arena continues to force prices down, and most providers offer month-to-month service plans that can be automatically renewed through a checking account or credit card, eliminating any hassle purchasing “top up” cards.

Most of the prepaid providers resell service provided by AT&T, Sprint, or Verizon Wireless. Two that don’t: MetroPCS and Leap Wireless’ Cricket, received little regard from those surveyed. MetroPCS scored second from the bottom and Cricket didn’t make the ratings at all. Two prepaid plans to consider first: TracFone, excellent for occasional calling, and Straight Talk, sold by Wal-Mart — better for those who like to talk a lot on their phones. If you don’t need the sexiest handset around, Stop the Cap! also recommends Page Plus, which relies on the Verizon Wireless network, especially if you don’t need a lot of data services.

Subscribe

Subscribe