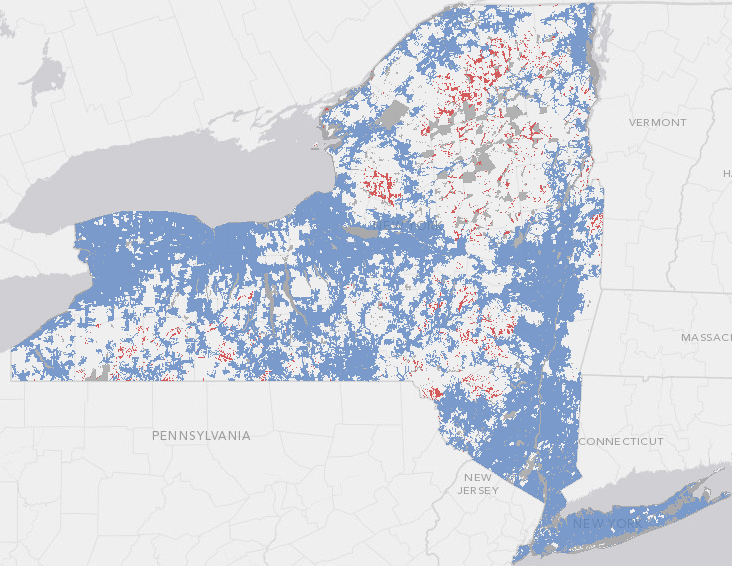

Would-be customers of Time Warner Cable’s broadband service in Vienna, a small town in Oneida County, N.Y. are confused about why the cable company will not provide them with broadband service, even though cable company lines pass right over their respective driveways.

Pete Rauscher sees neighbors within a mile away happily using Time Warner’s Internet service, even though he cannot buy it for himself.

“I’d like to get the service…so do [my neighbors],” Rauscher told WSYR-TV in Syracuse. “It isn’t right that somebody within a mile of us has the same cable service, but we don’t.”

Rauscher and his neighbors are victims of a de-facto cable industry standard that says wiring fewer than 35 homes within a mile is not financially viable. Rauscher might understand this, if a Time Warner-owned cable line didn’t pass straight over his driveway.The cable company says it would cost at least $17,000 to provide Rauscher with broadband service, an installation fee way out of his budget.

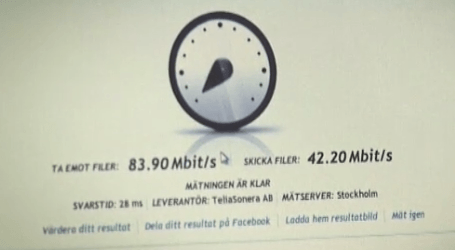

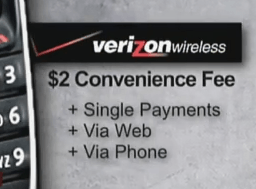

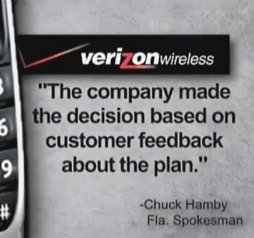

Parts of Oneida County are still without any broadband service, except for those lucky (and wealthy enough) to receive and pay for a wireless 3/4G broadband connection from Verizon Wireless. That company charges $80 a month for up to 10GB of usage, much more expensive than what Time Warner would charge. DSL is not provided in that section of Vienna.

Time Warner says it regularly re-evaluates expansion into currently unserved sections of its service area. Two sections of nearby Camden now receive cable service from the company, partly thanks to new housing developments in the rural region. But for now, the cable company remains resolute in not serving customers who do not meet its population density test.

[flv width=”480″ height=”290″]http://www.phillipdampier.com/video/WSYR Syracuse Fight for High Speed Internet 1-12-12.mp4[/flv]

WSYR-TV tells the story of rural Oneida County residents who cannot get Time Warner Cable broadband service, even though the cable company lines cross their driveways. (2 minutes)

Subscribe

Subscribe