Your contract with Sprint ends in June, but why wait, beckons the cell phone company, when you can upgrade your phone today (with a new two-year service agreement).

Your contract with Sprint ends in June, but why wait, beckons the cell phone company, when you can upgrade your phone today (with a new two-year service agreement).

Two years earlier, providers wheeled and dealed upgrade-reluctant customers, particularly those considering their first smartphone, thanks to the bill shock that results when customers see a $30 mandatory data plan added to their monthly bill. Sprint went one step further, handing 4G-capable customers Clearwire WiMAX — a technology even Russian cell phone companies can’t wait to abandon — and added a $10 premium data surcharge for the privilege.

In Sprint’s favor: their willingness to deal discounts on phone upgrades and their truly unlimited data plans. But while Sprint continues to bank on unlimited data, the bill on cheap phone upgrades may now be coming due.

The American wireless industry is increasingly taking a page from the airlines, adopting irritating fees and surcharges while curtailing the perks and rewards that used to come with customer loyalty and family plans that routinely run into the hundreds of dollars.

Equipment Upgrade Fees

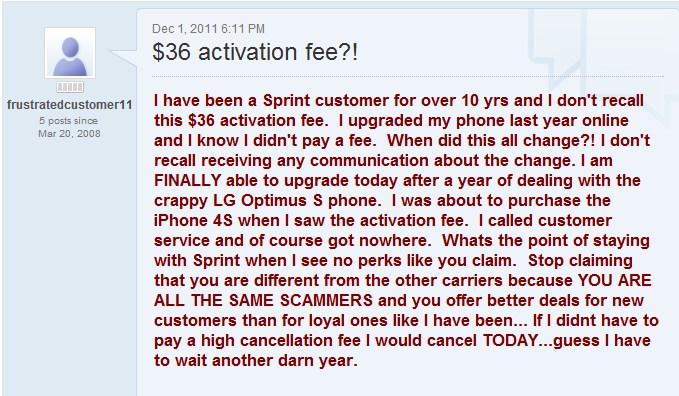

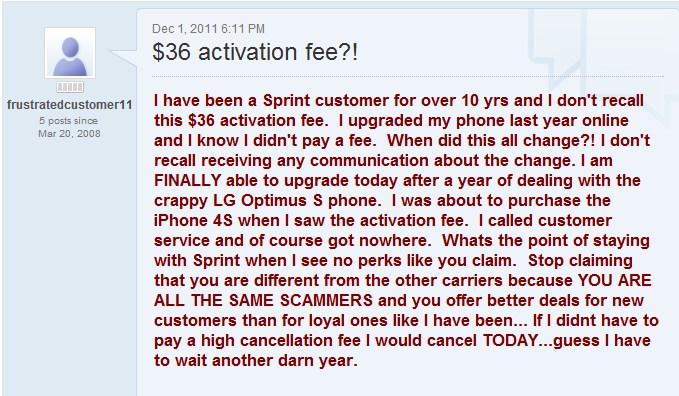

Sprint, Verizon, AT&T, and T-Mobile all have a nasty surprise in store for customers who have not upgraded their smartphones in the last year or so: the equipment upgrade fee. Sprint and AT&T both charge $36 per phone, Verizon Wireless now charges $30, T-Mobile $18.

Sprint, Verizon, AT&T, and T-Mobile all have a nasty surprise in store for customers who have not upgraded their smartphones in the last year or so: the equipment upgrade fee. Sprint and AT&T both charge $36 per phone, Verizon Wireless now charges $30, T-Mobile $18.

Verizon customers are especially peeved because that wireless company used to reward loyal customers with a $50 credit off any new phone at contract renewal time. Today, instead of getting “New Every Two” discounts, Big Red will charge you $30 for every new phone when you renew your contract.

Verizon’s excuse is that the new fee will be used to offer customer “wireless workshops” and “online educational tools,” according to Verizon spokeswoman Brenda Rayney. The company also claims the fees will cover more sophisticated consultations with “company experts” that are trained to provide advice and guidance on today’s sophisticated smartphones. In other words, these fees are supposed to compensate Verizon’s store and kiosk employees.

For people like my cousin, upgrading to a new Sprint phone at contract renewal time is an exercise in frustration. In addition to the $149-199 subsidized equipment price, Sprint now tacks on a $36 upgrade fee (per phone). What miffs him is that Sprint is treating new customers better than existing ones, willing to waive one-time activation fees (coincidentally the same $36) for new customers, but steadfastly refusing to credit equipment upgrade fees for existing loyal customers.

Sprint will tell you they are not alone charging upgrade fees, and they would be right. All four major national carriers now charge the fees, effectively a penalty when customers decide to upgrade their phones.

Sprint will tell you they are not alone charging upgrade fees, and they would be right. All four major national carriers now charge the fees, effectively a penalty when customers decide to upgrade their phones.

Many also find it nearly impossible to get companies like Verizon Wireless to waive the fees, even when some of their best customers ask.

“Verizon Wireless was willing to throw away my 12 year account, earning them more than $500 a month in revenue, over the upgrade fee issue,” reports Stan Dershau. “Our contract expired this month and it was time for new phones, and Verizon absolutely insisted that we pay $150 in upgrade fees for new equipment on our account, even after the $600 they’ll collect from the smartphones we intended to buy.”

Dershau found absolutely nobody willing to relent on Verizon’s upgrade fees. Even supervisors told him the company has a no-waiver policy that is strictly enforced, and they could do little more than offer a token service credit even if Dershau threatened to take his business somewhere else.

“I haven’t decided what to do yet, but I canceled my upgrade plans for now,” he reports.

Dershau was always able to get Verizon to waive earlier fees because of the monthly business he brings them, but those days are over.

“It’s a whole different attitude with them now,” Dershau says. “They just want money.”

AT&T's fine print.

Ben Popken recently wrote about his efforts to avoid Verizon’s $30 upgrade fee, with mixed results.

Verizon’s suggested solution is to sell your old phones back to the company through their trade-in program, using the money to offset the equipment upgrade fee. But unless you own an iPhone, Verizon’s trade-in offers are strictly low-ball, often under $30 on non-Apple phones. That leaves you with a slightly lower upgrade fee and the loss of your old phone, which Verizon may recycle or resell refurbished to someone else.

Popken explains he found one convoluted way around Verizon’s fees:

First, start a new line of service with the new phone you want. Then, port your old phone number to a 3rd party service, like Google Voice (here’s a guide from Lifehacker on doing so). Lastly, cancel the line with the old phone and port the old phone number back onto the new phone, thus keeping the new phone, the old number, and dodging the fee. But there’s a catch. It only works if you wait three months to port the number back. If you do it before then, Verizon’s system treats it like you’re continuing the same service, and they hit you with the $30 upgrade fee. Curses.

Popken forgets, however, that Google itself charges a $20 fee to port cell phone numbers to Google Voice, eliminating 2/3rds of your potential savings.

In fact, outside of purchasing a phone at the full, unsubsidized price from a third party, Verizon’s $30 fee will be visiting your phone bill sooner or later, if you decide to upgrade.

The Phone Subsidy: Slaying North America’s Sacred Cow Wireless Business Model

Consumers who crave the newest smartphones should thank their lucky stars they live in Canada or the United States, where the wireless industry heavily discounts the upfront cost of the phone when customers sign a service contract. But phone companies like AT&T and Verizon are not giving you a gift. In return for fronting a discount of as much as $400, companies set their monthly rates higher to recoup that subsidy over the life of your two-year contract.

Consumers who crave the newest smartphones should thank their lucky stars they live in Canada or the United States, where the wireless industry heavily discounts the upfront cost of the phone when customers sign a service contract. But phone companies like AT&T and Verizon are not giving you a gift. In return for fronting a discount of as much as $400, companies set their monthly rates higher to recoup that subsidy over the life of your two-year contract.

That worked fine when cell phone companies only paid a few hundred dollars for basic phones. But today’s most popular smartphones can cost companies $400 each, and that upfront revenue hit has annoyed Wall Street for years. Even worse, while providers hand you a discounted phone, they’ve already paid the asking price to companies like Apple and Samsung, who book that revenue immediately and never have to worry about a customer skipping out on their contract.

Wall Street has been putting pressure on companies to do something about the expensive phone subsidies, and companies are responding. The equipment upgrade fee, increased activation fees, and rising monthly service charges are all a part of a greater plan to discourage customers from upgrading their phones and increase profits.

Wall Street analysts love every part of it, especially if companies can do away with equipment subsidies -and- maintain today’s pricing:

“Optimism has increased that we are witnessing the leading edge of a more disciplined, and more profitable, future,” Craig Moffett, a telecom analyst at Bernstein Research, wrote in a recent research note. The question now, he wrote, is how much carriers can increase their profits thanks to “increased discipline and pricing power.”

The answer could be quite a lot. A marketplace experiment in Spain is being closely watched by wireless phone companies worldwide and could be coming to Canada and the United States before your next two-year contract is up for renewal.

The answer could be quite a lot. A marketplace experiment in Spain is being closely watched by wireless phone companies worldwide and could be coming to Canada and the United States before your next two-year contract is up for renewal.

In March, Telefónica SA, Spain’s largest cell phone company, stopped subsidizing smartphones for new customers. Vodafone, which co-owns Verizon Wireless, quickly followed.

As a result, Spanish customers looking for an iPhone will now pay $800 to purchase the phone at full price, or they can sign up for an “installment plan” that will add $45 a month to their cell phone bill for the next 18 months. Both companies say the new policy won’t apply to existing customers, in an effort to discourage them from switching companies.

Telefónica anticipates the changes will slash as least 25% off of their spending. Instead of fronting subsidies to attract new customers, the phone company will increase subsidies for existing customers who agree to stay. Unfortunately for Telefónica, early results are not promising. More than 500,000 customers left the same month the new policy was announced.

A handful of smaller Spanish players see the move by both major companies as a competitive opportunity to win over new customers. Orange, for example, has not stopped offering subsidies and as a result Telefónica has lost potential new customers who signed with Orange instead. The “churn rate” of customers coming and going remains a concern for company executives. But so far, Telefónica considers getting rid of phone subsidies more important than the customers they have forfeit over the new policy.

“We are pretty firm on our strategy of trying to change the paradigm of the sector, […] devoting the bulk of our efforts to our existing customers and, therefore, trying to move away from incentivizing churn of our customers either from us or from the others,” said company CEO Cesareo Alierta Izuel. “We are very firm on this new handset strategy. We need to fight to see if the trend is going to the right direction. And again, we think it is.”

The Wall Street Journal reports Telefónica’s bold plan has caught the attention of Verizon CEO Lowell McAdam, who sees it as a potential profit booster, and McAdam expects Verizon may cautiously follow the Spanish company’s lead.

“We’ll probably offer some things like that, and then we’ll see what the adoption is like,” McAdam said. “You can’t push this on customers before customers are ready for it.”

For now, some customers are not even ready for equipment upgrade fees. My cousin’s upgrade plans remain on hold for now, as are those of the Dershau family.

“I am not going to be browbeaten into paying these unjustified fees,” Dershau said. “Where does it stop?”

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/WSJ Dodging Verizon’s New 30 Upgrade Fee 5-9-12.flv[/flv]

Ben Popken talks about trying to avoid Verizon’s $30 equipment upgrade fee. (3 minutes)

Verizon Wireless will force customers off of their grandfathered unlimited data plans when they reach the end of their current two-year service contracts, according to the company’s chief financial officer.

Verizon Wireless will force customers off of their grandfathered unlimited data plans when they reach the end of their current two-year service contracts, according to the company’s chief financial officer.

Subscribe

Subscribe