More than half (52 percent) of all U.S. consumers say Internet service is their home’s most important utility, according to a survey conducted by Verizon Communications as part of their Verizon FiOS Innovation Index project.

But Verizon’s research surveys go well beyond simply identifying who loves Internet access. Verizon’s real interest is identifying so-called “borderless consumers,” — customers who are seeking a seamless online experience and connectivity both inside and out of the home.

The convergence of wired and wireless broadband networks is a potentially enormous money-maker for Verizon, especially if you happen to be a Verizon Wireless customer.

“As the borderless consumer segment continues to grow, so will the need to identify, understand and anticipate what consumers truly want in their increasingly connected lives – today and in the future,” said Eric Bruno, vice president of FiOS strategy and development for Verizon.

Fran Shammo, Verizon’s chief financial officer, has previously told investors that monetizing data usage goes beyond text messaging and web browsing. The next frontier for enhanced revenue will come from the machine-to-machine segment. As consumers strive for a more connected future, enabling wireless connectivity for home appliances, automobiles, medical equipment, and other devices will create new revenue streams for the company.

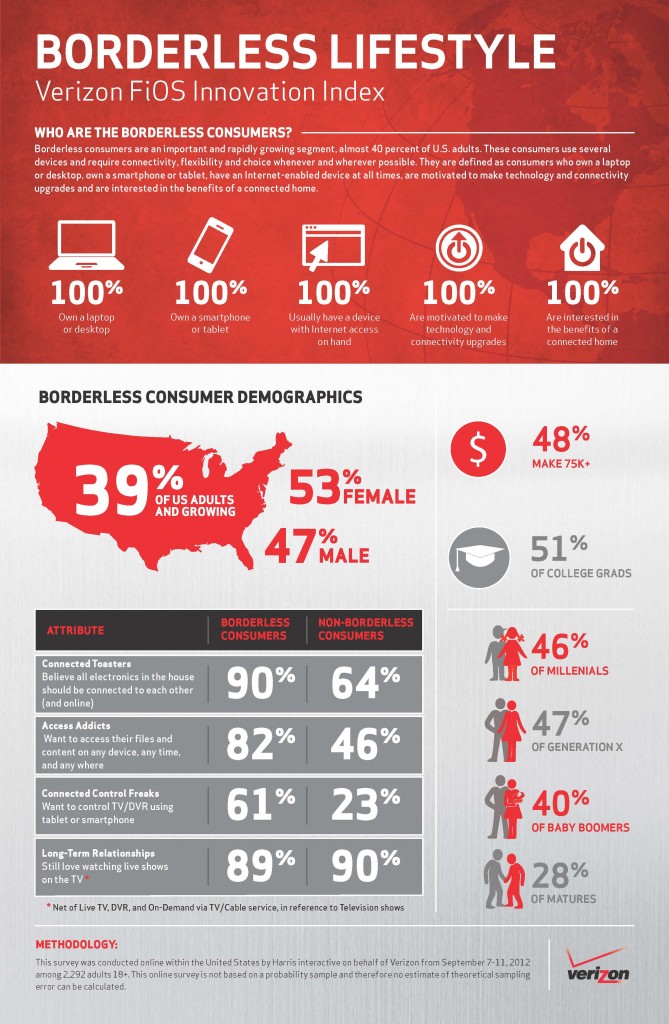

Verizon’s new research surveys help the company target its future marketing to consumers most likely to be living the “borderless lifestyle.” Are you? Here are some key attributes:

- Above average income: Most are college educated, own their home, and nearly half earn $75,000 or more annually, so they can afford higher broadband bills;

- They are 18-34: Generation X and Millenials grew up in an increasingly connected world. Baby boomers are not far behind, but seniors are;

- Women somewhat outnumber men in their need to remain connected;

- You already have a computer, smartphone, or tablet and are connected to high speed Internet. Most of you want faster speed, if you can get it.

Verizon’s study becomes murkier over the issue of cord cutting. Verizon found that video streaming continues to drive Internet traffic growth, but at least 89% still prefer watching shows on their televisions. Verizon defines that as live TV, DVR, or on-demand from “TV/Cable service.”

But they did not ask whether consumers are watching more or less television provided by their cable, satellite, or phone company or if a larger proportion of viewing now comes from Netflix or other streamed content. That is a key indicator of whether a customer is gradually shifting viewing habits, which could ultimately make it easier to dump cable television.

With 90 percent of those surveyed looking forward to the day when every connectable device in their house can seamlessly interconnect and work together, Verizon’s potential revenue opportunities are enormous, if customers use Verizon Wireless for connectivity and not free Wi-Fi. Machine-to-machine wireless traffic can boost profits without costing the company much, especially under Verizon Wireless’ new Share Everything pricing. The impact of short data exchanges likely from home appliances and other similar devices is expected to be negligible. The profits from charging at least $10 a month to add each of those devices to a Verizon Wireless account are not.

Subscribe

Subscribe