Verizon Communications has opened preliminary talks with officials close to Charter Communications about a possible merger of the two companies, concerning regulators worried the massive combined telecommunications company would have a near-monopoly on residential broadband service in New York and western Massachusetts.

Verizon Communications has opened preliminary talks with officials close to Charter Communications about a possible merger of the two companies, concerning regulators worried the massive combined telecommunications company would have a near-monopoly on residential broadband service in New York and western Massachusetts.

The Wall Street Journal reports Verizon is working with advisers to study the potential transaction, and warned there is no guarantee a formal deal will materialize. A merger of Verizon and Charter would combine more than 114 million Verizon Wireless customers, 16 million landline customers, and over 6 million broadband customers with Verizon DSL or FiOS with Charter’s 21 million television, phone and broadband customers. The deal could fetch a price of more than $80 billion, no small amount for Verizon, already $100 billion in debt. An acquisition by Verizon would be a remarkable development for a cable company that became America’s second largest only eight months ago with the acquisition of Time Warner Cable and Bright House Networks.

Preliminary Talks

The newspaper reported Verizon CEO Lowell McAdam has talked with Liberty Broadband CEO Greg Maffei. Liberty has a 25% voting stake in Charter Communications, and Maffei is a close ally of John Malone, Charter’s largest single shareholder. McAdam’s back channel discussions have likely been designed to test Charter’s potential interest in a deal. For Malone and the former owners of Bright House Networks who control another 7% of Charter’s shares, making money appears to be their primary motivation and neither would likely to stand in the way of a deal.

McAdam

The newspaper was less certain about Charter’s CEO Thomas Rutledge. Rutledge is approaching his fifth anniversary as president and CEO of Charter Communications, now greatly enlarged with the combination of Time Warner Cable and Bright House. He spent the last 34 years in lesser roles at Cablevision, Time Warner Cable, and its predecessor American Television and Communications (ATC). Rutledge is reportedly interested in continuing his leadership role at Charter as it seeks to grow even larger, something unlikely to happen if Verizon acquires the cable company and rebrands it as Verizon under their own management. However, Rutledge’s personal interests will likely be secondary to the potential shareholder and executive windfall likely to come from any deal.

A Verizon/Charter Merger Would Establish a Broadband Monopoly in New York and Western Massachusetts

Verizon and Charter are the only significant direct competitors in residential broadband and landline telephone service in western Massachusetts and most of New York State, except a portion of New York City, Long Island and Westchester County (served by Altice’s Cablevision) and Rochester (served by Frontier Communications). A source at the New York Department of Public Service told Stop the Cap! this morning New York regulators would have a tough time approving a merger of this size and scope unless Verizon divested its landline and FiOS network in the state or Charter sold its cable properties in New York. A Verizon divestiture would likely attract Frontier Communications as a buyer, while a Charter sale of New York assets would probably bring bids from companies like Comcast or Altice.

“We would be very concerned about how this would impact broadband service competition and to lesser degree wireline service for New York,” the source, not authorized to speak to the media, told us this morning. “Gov. Cuomo has an ambitious agenda for broadband deployment in rural New York and this deal could also be a problem for the governor’s office. Verizon is perfectly aware of the regulatory challenges such a deal would face in Albany.”

Verizon’s Heavy Dependence on Wireless Was a Mistake

Verizon’s Heavy Dependence on Wireless Was a Mistake

Verizon is under significant pressure to act after Wall Street punished the company for a poor fourth-quarter earnings report that illustrated the days of easy money in the wireless business seem to be over. Verizon suffered the third quarter in a row of sales declines after six years of continuous growth. Analysts point to increasing competition from T-Mobile and Sprint as the single biggest factor for Verizon’s struggles. As Verizon Wireless remained slow to cut prices and remained militant about not giving new and current customers access to unlimited data plans, customers have cut back on services or switched to other providers. Revenue dropped 4.9% in the last quarter and a growing number of Verizon’s most valuable postpaid customers are now leaving — mostly for T-Mobile and Sprint. Wireless churn reached a higher-than-expected 1.1% in the last three months.

Verizon Wireless is also having trouble attracting new customers. Analysts expected Verizon would add 726,000 customers during the last quarter, but only managed to attract 591,000. Wall Street punished Verizon’s latest financial results with a 4.4% slash in the stock price, Verizon’s worst day in more than five years.

Several Wall Street analysts have urged Verizon to diversify its business to reduce its dependency on wireless. In the last three years, Verizon has invested most of its attention and resources on bolstering its wireless network. In 2014, AT&T decided to spread its risk around with significant investments in its U-verse wireline broadband network, an acquisition of satellite-TV provider DirecTV, and its bid to buy content company Time Warner, Inc. In contrast, in 2014 Verizon spent $130 billion buying out its partner’s share of Verizon Wireless. That made UK-based Vodafone cash-rich and left Verizon mired in debt.

So far, Verizon’s diversification efforts have relied on acquiring affordable companies whose best days are long past, including AOL and Yahoo. An effort to entertain Millennials with video clips and other content over its go90 mobile app has largely been a flop, and investments in telematics and machine-to-machine wireless communications are years away from paying off, if they ever do.

Verizon May Want Charter’s Extensive Fiber Backhaul Network

Verizon executives have shown little interest in acquiring assets that rely primarily on linear/live television, which is why the company never moved to counter AT&T’s acquisition of DirecTV with an offer for its satellite competitor Dish Networks.

Verizon executives have shown little interest in acquiring assets that rely primarily on linear/live television, which is why the company never moved to counter AT&T’s acquisition of DirecTV with an offer for its satellite competitor Dish Networks.

Verizon is very interested in fiber optics — ironic for a company that largely abandoned expanding its FiOS fiber to the home service seven years ago.

Verizon will need a lot of fiber assets to power the 5G wireless networks the company is interested in deploying. This will require a massive network of fiber-connected “small cells” that will deliver wireless services at speeds faster than today’s 4G networks. These small cells will be capable of serving individual neighborhoods or planned communities and could theoretically rely on Charter’s fiber backbone to deliver service. Without access to Charter’s network, Verizon would have to undertake to build out its own fiber network throughout its service areas.

Regulatory Climate Warms for Big Business Mergers

Although President Donald Trump has voiced his opposition to AT&T’s merger with Time Warner, Inc., his appointments to manage the day-to-day affairs of government are strident believers in deregulation and are unlikely to stand in the way of merger deals. The most likely opposition to a Verizon-Charter deal would come from state telecommunications regulators in New York and Massachusetts. On the federal level, significant opposition may be unlikely. Among the Trump appointees that would likely review a Verizon-Charter merger:

- Joshua Wright is the leading contender to head the Justice Department’s antitrust division. He’s a conservative law professor who believes regulator reviews of corporate mergers should be hands-off to a degree that has failed to withstand court scrutiny. Wright’s approach during his term as a commissioner at the Federal Trade Commission was so business-friendly, some joked his middle name should be “Laissez-Faire.” He believes mergers rarely have a bad impact on competition and prices and in fact offer consumer benefits. Courts have blocked mergers he supported and judges have criticized his standards of proof that “had no support in the law.”

- Sen. Jeff Sessions is Trump’s nominee for Attorney General. While Sessions claimed he had no problem blocking anti-competitive mergers and acquisitions, Wall Street believes the Trump Administration will not stand in the way of a frenzy of mergers. Evercore ISI’s Terry Haines made it clear what is likely to come from a Sessions-led Justice Department: “Sessions’ likely nomination and confirmation by the Senate, in which he has served since 1997, is a market positive for merger and acquisition activity. Sessions as attorney general would shift immediately from the current mostly ‘red light’ Obama antitrust/competition policy and move towards one that would be friendlier to M&A activity.”

- The Federal Communications Commission would also scrutinize the deal, but under the chairmanship of Ajit Pai and a Republican majority, any significant opposition to the deal seems unlikely. Pai has never opposed any major telecommunications merger deal on principle, although he has fought with former chairman Thomas Wheeler over the terms and conditions the FCC sought to impose in return for the agency’s approval.

Subscribe

Subscribe

A Verizon Wireless employee is facing up to five years in prison for peddling customer phone records and location data to private investigators for as little at $50 a month.

A Verizon Wireless employee is facing up to five years in prison for peddling customer phone records and location data to private investigators for as little at $50 a month.

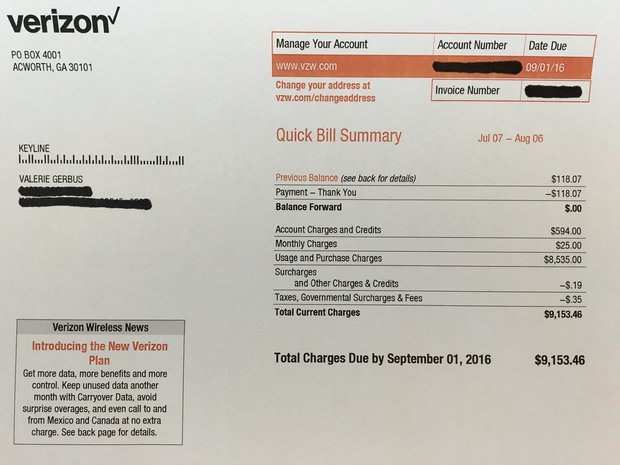

Some Verizon Wireless customers are reporting data usage numbers spiked on their bills to unprecedented levels this summer, giving the cellular company’s bean counters a heaping helping of overlimit fees, charged when customers exceed their data allowance.

Some Verizon Wireless customers are reporting data usage numbers spiked on their bills to unprecedented levels this summer, giving the cellular company’s bean counters a heaping helping of overlimit fees, charged when customers exceed their data allowance.