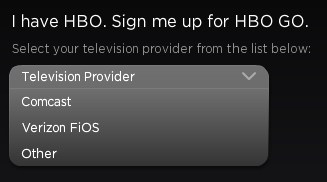

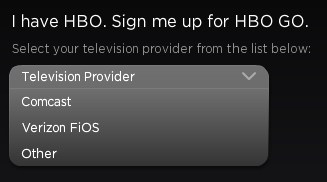

HBO Go is currently only available directly to Verizon FiOS customers. Comcast customers have access through Fancast, and Time Warner Cable indicated it wasn't interested in participating in HBO Go, for now.

HBO subscribers who are also Verizon FiOS TV customers are the first to get access to the premium channel’s new online video portal — HBO Go, launched Wednesday with over 600 hours of HBO programming, available free to authenticated HBO and FiOS subscribers.

HBO Go is another project spawned from the cable and pay television industry’s TV Everywhere project — putting television programming online for anytime viewing, for free, as long as you maintain a cable or pay television subscription.

Ironically, the service launched Wednesday on Verizon’s telco-TV service FiOS, leaving lots of cable subscribers waiting for access. If you subscribe to HBO through cable, satellite, or U-verse, the service remains unavailable to you, for now. Comcast subscribers already had access to HBO’s programming through the Fancast Xfinity TV website. If you don’t pay for television, the service remains unavailable to you indefinitely — they won’t sell it to you at any price.

“Ultimately this is about extending the subscriber lifecycle,” HBO co-president Eric Kessler said. “It’s more about subscriber retention.”

Subscriber retention through incumbent providers, he means. HBO doesn’t want to risk selling direct to online consumers who might want to cut ties with their cable or other pay television provider.

Stop the Cap! reader Jared has FiOS and HBO and let us sample the service through his FiOS connection (his 25Mbps/25Mbps connection with remote access maxed out our Road Runner Turbo connection and still left him plenty of leftover speed).

Let’s start with the viewing experience.

It’s a big improvement over HBO’s Wisconsin trial in 2008 with Time Warner Cable, which required viewers to download Windows Media-encoded video files protected with Microsoft’s annoying digital rights management scheme. It was cumbersome for trial participants, and dealing with Microsoft’s player and DRM cut Mac owners out of the trial.

It’s a big improvement over HBO’s Wisconsin trial in 2008 with Time Warner Cable, which required viewers to download Windows Media-encoded video files protected with Microsoft’s annoying digital rights management scheme. It was cumbersome for trial participants, and dealing with Microsoft’s player and DRM cut Mac owners out of the trial.

HBO Go is Flash-based, using Adobe’s Real-Time Messaging Protocol to keep viewers from saving permanent copies for themselves (and potentially their friends.) Using Verizon FiOS, viewers should rarely encounter any artifacts or speed-related viewing problems. The picture was fine, even for me using remote access software. Of course, if your Internet connection is considerably slower than FiOS or your neighborhood suffers from online congestion, you could experience issues streaming HD content, but HBO Go is designed to buffer when encountering slower connections. The files are encoded in MPEG-4 at 1.2Mbps and 2.6Mbps, which theoretically should be fine for the majority of viewers. Comcast subscribers – remember watching counts against your usage cap.

Wandering around the HBO Go library was simple — easier to navigate and less cluttered than Hulu. The site was intuitive and should be easy to use for just about everyone.

Up to three members of your household can each watch programming from the service at the same time, even away from home, anywhere in the country.

HBO Go claims to be a work in progress — about 25% of the content will be refreshed by HBO every week, with new episodes available on the service immediately following their TV premiere.

But the service hardly offers a comprehensive viewing experience. It’s much closer to Hulu or your cable company’s HBO on Demand service.

For example, rights issues limit virtually all of HBO’s original series to a handful of recent episodes or seasons. Only The Wire has a complete library to watch from its premiere forward. Curb Your Enthusiasm, aptly named when considering HBO Go, is missing completely. So is Real Time with Bill Maher, although four of his earlier specials are archived on the site.

As for movies, there are gaping holes there as well. Available titles resemble Cinemax’s selection of movies you’ve already seen. There are gaps between what you can watch on HBO itself and what is available on HBO Go. Babe is online, for instance, but anything Harry Potter isn’t.

In other words, what could have been a compelling addition for HBO subscribers feels redundant. I would never pay anything extra for HBO Go, nor will it be a factor in keeping HBO.

Online viewers need not apply.

HBO could have used the opportunity to sell the service to non-cable subscribers for a monthly fee and pick up some additional revenue, but that wouldn’t sit well with the pay television cartel that is behind the TV Everywhere concept. They don’t want you cord cutting — those that have are locked out of the HBO Go Clubhouse. For now, I suspect few were clamoring to get in.

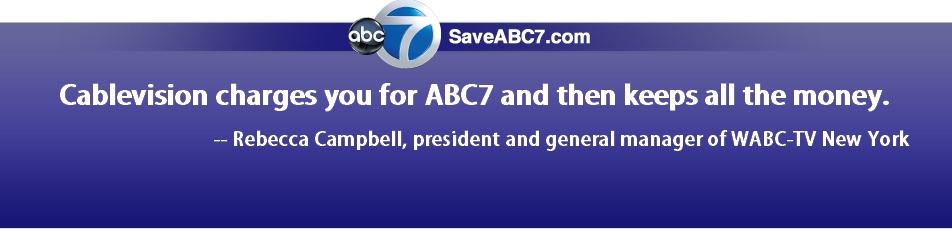

Cablevision subscribers: Just two months after facing the loss of HGTV and the Food Network, get ready to lose WABC-TV — the ABC affiliate in New York, just hours before the Oscars telecast is set to begin.

Cablevision subscribers: Just two months after facing the loss of HGTV and the Food Network, get ready to lose WABC-TV — the ABC affiliate in New York, just hours before the Oscars telecast is set to begin. “Cablevision’s position is that ABC7 is worth little to nothing to its business and its proposed offers have been consistently unreasonable and unrealistic,” said Rebecca Campbell, president and general manager of WABC-TV. “We think these shows are valuable, and your bill shows that Cablevision must agree since you already pay for ABC7 as part of your Broadcast Basic Tier – a service for which, as a Cablevision customer, you pay as much as $18 each month. Cablevision charges you for ABC7 and then keeps all the money.”

“Cablevision’s position is that ABC7 is worth little to nothing to its business and its proposed offers have been consistently unreasonable and unrealistic,” said Rebecca Campbell, president and general manager of WABC-TV. “We think these shows are valuable, and your bill shows that Cablevision must agree since you already pay for ABC7 as part of your Broadcast Basic Tier – a service for which, as a Cablevision customer, you pay as much as $18 each month. Cablevision charges you for ABC7 and then keeps all the money.”

Subscribe

Subscribe