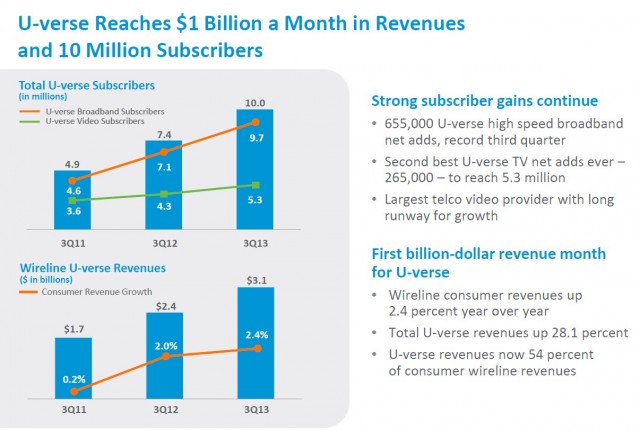

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

AT&T is protecting its broadband flank by convincing current DSL customers to switch to higher-speed U-verse broadband as the network upgrade reaches into more homes across AT&T’s service areas. In the last quarter U-verse picked up 655,000 new broadband customers nationwide, many upgraded from traditional DSL. Where AT&T has not invested in U-verse upgrades and cable competition exists, results are not as good. AT&T lost 26,000 DSL customers last quarter, most moving to cable broadband.

“This latest milestone shows how U-verse is helping transform AT&T into a premier IP broadband company,” said Lori Lee, senior executive vice president, AT&T Home Solutions. As of the third quarter of this year, total U-verse high-speed Internet subscribers represented about 60 percent of all wireline broadband subscribers, compared with 43 percent in the year-earlier quarter.

Verizon FiOS, in comparison, has signed up just 5.9 million customers FiOS Internet subscribers on its stalled fiber optic network. Most Verizon broadband customers with no FiOS in their future either stick with DSL service or, increasingly, switch to a cable competitor for faster speeds.

Some of AT&T’s strongest U-verse growth came from its TV package. At least 265,000 cable and satellite cord-cutters looking for a better deal switched to U-verse TV in the last three months, a gain from 198,000 at the same time last year. That’s the second-best quarterly gain ever. A total of 5.3 million AT&T customers subscribe to U-verse TV.

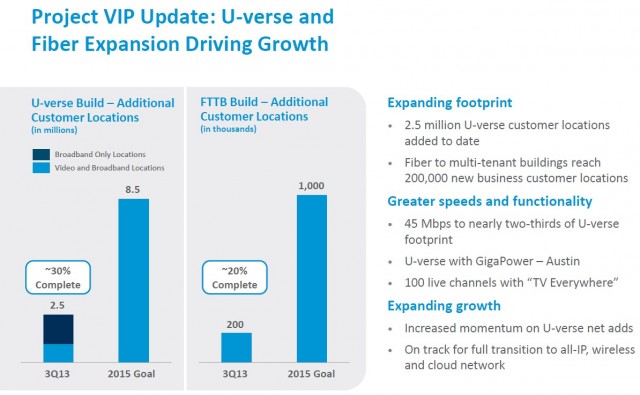

Much of the growth has come from AT&T’s investment in expanding U-verse to new areas. Project Velocity IP is a three-year, $14 billion plan to upgrade AT&T’s wireless and wired broadband networks. AT&T has added almost 2.5 million more homes to its broadband footprint so far this year and hopes to expand broadband availability to reach about 57 million customers by the end of 2015.

Although $14 billion is a significant investment, AT&T has spent considerably more on its shareholders. John Stephens, AT&T’s chief financial officer told Wall Street analysts AT&T has bought back 684 million shares of stock that will save the company more than $1.2 billion in future dividend payouts. Combined with its dividend payout, AT&T has handed shareholders $18 billion so far this year and more than $40 billion since the beginning of 2012. AT&T expects to spend $20 billion on wireless and wireline network improvements in 2014.

AT&T’s speed upgrades have also not run as smoothly as AT&T claims. Efforts to increase speeds to 45Mbps in 79 markets has had mixed results with a significant number of customers complaining they cannot get qualified for the faster speeds because of infrastructure problems with AT&T’s network. The company still says it is on track to offer 75 and 100Mbps speed tiers in the future and is building a fiber to the home network in Austin to compete with Google.

Many customers who have been with AT&T for more than a year are learning better service does not come for free. AT&T has filed rate increases for its television service beginning Jan. 26, 2014 for customers not on a pricing promotion. The monthly price for the following U-verse TV service plans will increase $3, along with fee hikes for local stations and equipment, bringing AT&T at least $15 million in extra revenue each month:

- U-family to $62;

- U200 to $77;

- U200 Latino to $87;

- U300 to $92;

- U300 Latino to $102;

- U450 to $124;

- and U450 Latino to $134.

- Grandfathered plans also will increase $3: U100 to $64 or $69, depending on when first ordered; and U400 to $119.

- The monthly price of each non-DVR TV receiver will increase from $7 to $;

- Beginning on February 1, 2014, the Broadcast TV Surcharge will increase $1 to $2.99 per month to recover a portion of the amount local broadcasters charge AT&T to carry their channels.

Those customers who have a U-verse TV pricing promotion will continue to receive the promotional benefit until the applicable promotion ends or expires. Customers are being notified of these changes via bill messaging occurring in November and December and a reminder in January and February 2014. In addition, customers will be notified of these changes online at www.att.net/uversepricechange and att.com/uversesupport.

[flv]http://www.phillipdampier.com/video/ATT U-verse with GigaPower — Reactions 11-13.mp4[/flv]

AT&T is trying to get ahead of Google by advertising AT&T U-verse with GigaPower, a 1,000Mbps fiber to the home service promised in Austin sometime in the future. (0:30)

Subscribe

Subscribe Cord-cutting is a real, measurable phenomena and is especially common among those under 30 who don’t care about traditional cable television service.

Cord-cutting is a real, measurable phenomena and is especially common among those under 30 who don’t care about traditional cable television service.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.