Verizon Communications has stepped up efforts in New York City to get intransigent landlords to let the company into their buildings to bring FiOS fiber optics to tenants, even as some property managers accuse Verizon of ignoring earlier requests to get the service.

Verizon Communications has stepped up efforts in New York City to get intransigent landlords to let the company into their buildings to bring FiOS fiber optics to tenants, even as some property managers accuse Verizon of ignoring earlier requests to get the service.

On at least 13 occasions in December, Verizon has filed petitions with the New York Public Service Commission requesting help to gain entry to a total of 476 buildings in the city after claiming to receive either no response from building management or active resistance to Verizon bringing FiOS to their tenants.

In an effort to stay compliant with its franchise agreement with the City of New York, Alyson Siegal, area manager for FiOS Franchise Assurance – New York City, has written a lot of letters lately:

Dear Property Owner/Manager:

I have been advised by Verizon New York Inc.’s (“Verizon”) NYC FiOS Real Estate Department of the difficulty Verizon has encountered in attempting to install and/or attach its FiOS facilities at [your property].

Our records indicate that you have not responded to our previous correspondence, that you have conditioned Verizon’s access on unreasonable terms and conditions or that you have denied Verizon access to the Property. The purpose of this letter is to restate our need to gain access to your Property.

By way of background, Verizon is attempting to gain access to your building because we have received a request for FiOS service(s) from a tenant(s) in your building and/or a resident(s) on your block, and our access to your Property is necessary to provide cable television services to those tenants and/or residents. We are very excited about the opportunity to provide world-class voice, data and video services to you and the area residents using a fiber based network to deliver these services at unprecedented speeds and capacities. Your cooperation in allowing Verizon access to your Property will enable your tenants and/or other residents on your block to receive the services they want in a timely manner.

Building owners don’t want a repeat of this kind of FiOS installation.

In a few earlier cases, some landlords refused entry without special financial compensation or gifts like free service for life. Others have unilaterally decided their tenants are happy enough being served by Time Warner Cable and don’t need a competitor. But a significant number claim the problem is with Verizon itself.

Hamdi Nezaj, who owns several buildings in Bronx, last summer refused entry to workers seeking to install FiOS, complaining Verizon performed shoddy work.

“On three properties that I own, the installation of FiOS was done recklessly,” complained Nezaj. “They never came back to fix the holes that were drilled, fix the boxes they installed and put molding on their respective wires. I am not interested once again in having Verizon drill holes and butcher my buildings.”

Several building owners responded to Verizon’s complaints indicating the phone company itself was responsible for dropping the ball on FiOS installation and were stunned the company was resorting to legal tactics to force entry.

Arthur Leeds from Leeds Associates LLC reports one of his properties has been waiting for Verizon to install FiOS since April 2014.

This customer found Verizon installing its FiOS cables up and down his doorways.

“We have responded every time we were asked for access most specifically to Thomas Miller, the FiOS franchise manager in NYC, and to Alyson Seigal (sic) another Verizon manager either by phone or via certified mail but all of our responses to them were ignored,” wrote Leeds. “Further we are well aware of the law and are certainly interested in supplying our tenants with alternatives to RCN and Time Warner Cable. However we do have a right to know how and with what materials Verizon intends to install their equipment in our building, [a request that] seems to stall any response on your part or that of your contractors.”

Amy Ward, an attorney representing the interests of 200 East 87”’ Street Associates, LP, has Leeds beat. She told the PSC Verizon first sought to install FiOS in the building in 2012, but Verizon kept stalling. When Verizon formally sought permission yet again in September 2014, a building representative asked for a delay because of “multiple intrusive projects occurring at and planned for the property.” No response to that request was forthcoming from Verizon until the December demand for entry was received.

Brian Loftman, property manager of the @The Aspen New York, wrote the PSC he was not happy to hear from Verizon’s legal team either.

Many building owners want Verizon to install crown molding like this that can effectively hide cables.

“I am appalled that Mr. Richard C. Fipphen, assistant general counsel for Verizon has contacted you stating that we have not complied with their request to give access to the property,” wrote Loftman.

Loftman included a copy of correspondence he sent to Ms. Siegal, claiming she is impossible to reach.

“I am writing to you because after several attempts to reach you via phone at 888 364 3467 it has been impossible,” wrote Loftman. “I find it hard to believe that you being in the telecommunications business that even your voicemail is full and I cannot leave a message on the number you provided us to contact your office.”

Loftman also questioned Siegal’s claims that Verizon has “world-class voice, data, and video services.”

“Has it improved since the last time our phones were out or the DSL went down for almost a week?” he asked.

Loftman’s previous experience with Verizon’s installation crews was not a positive one. He only learned after signing up for the service at another building he manages that Verizon intended to use visible basic plastic molding throughout the building’s hallways to hide FiOS wiring. Other property managers shared aesthetic objections to Verizon’s plans, requesting wiring be installed behind more visually attractive crown molding or run through ceiling ducts.

Part of New York State’s Public Service law covers the installation of cable television facilities, which also covers Verizon FiOS:

§228. Landlord-tenant relationship

1. No landlord shall:

(a) interfere with the installation of cable television facilities upon his property or premises, except that a landlord may require:

(1) that the installation of cable television facilities conform to such reasonable conditions are necessary to protect the safety, functioning and appearance of the premises, and the convenience and well being of other tenants;

(2) that the cable television company or the tenant or a combination thereof bear the entire cost of the installation, operation or removal of such facilities; and

(3) that the cable television company agree to indemnify the landlord for any damage caused by the installation, operation or removal of such facilities.§898.1 Prohibition

Except as provided in section 898.2 of this Part, no landlord shall demand or accept any payment from any cable television company in exchange for permitting cable television service or facilities on or within said landlord’s property or premises.

§898.2 Just Compensation

Every landlord shall be entitled to the payment of just compensation for property taken by a cable television company for the installation of cable television service or facilities. The amount of just compensation shall be determined by the commission in accordance with section 228 (1)(b) of the Public Service Law upon application by the landlord pursuant to section 898.5 of this Part.

Subscribe

Subscribe Beggars can be choosers if you are running Cablevision, the northeast’s largest non-conglomerate cable company, still run by the Dolan family.

Beggars can be choosers if you are running Cablevision, the northeast’s largest non-conglomerate cable company, still run by the Dolan family. Big Telecom companies like Verizon and AT&T use phony numbers and perpetuate myths about broadband traffic and network investments that have conned investors

Big Telecom companies like Verizon and AT&T use phony numbers and perpetuate myths about broadband traffic and network investments that have conned investors  “We just have to try harder to match those growth rates and catch up with WorldCom,” AT&T executives told Odlyzko and his colleagues, believing the problem was simply ineffective sales, not real broadband demand. When sales couldn’t generate those traffic numbers and Wall Street analysts began asking why, companies like Global Crossing and Qwest resorted to “hollow swaps” and other dubious tricks to fool analysts, prop up the stock price and executive bonuses, and invent sales.

“We just have to try harder to match those growth rates and catch up with WorldCom,” AT&T executives told Odlyzko and his colleagues, believing the problem was simply ineffective sales, not real broadband demand. When sales couldn’t generate those traffic numbers and Wall Street analysts began asking why, companies like Global Crossing and Qwest resorted to “hollow swaps” and other dubious tricks to fool analysts, prop up the stock price and executive bonuses, and invent sales. That isn’t a problem for wireless carriers because texting is where the real money is made. Odlyzko notes that wireless carriers profit an average of $1,000 per megabyte for text messages, usually charged per-message or through subscription plan add ons or as part of a bundle. Cellular voice calling is much less profitable, earning about $1 per megabyte of digitized traffic.

That isn’t a problem for wireless carriers because texting is where the real money is made. Odlyzko notes that wireless carriers profit an average of $1,000 per megabyte for text messages, usually charged per-message or through subscription plan add ons or as part of a bundle. Cellular voice calling is much less profitable, earning about $1 per megabyte of digitized traffic. Love can be a fickle thing.

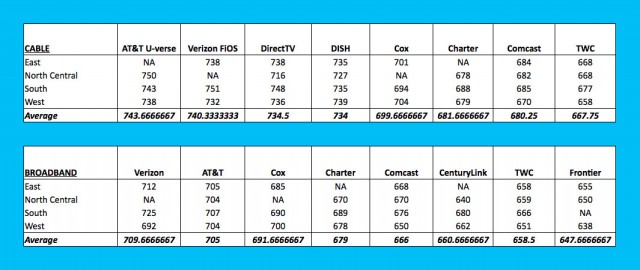

Love can be a fickle thing. The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.

The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.