Apparently the “fight back” component of Time Warner Cable’s campaign against the high cost of cable has not been a stunning success because the nation’s second largest cable operator continues to roll over its subscribers with some striking rate hikes, this time across upstate New York.

Apparently the “fight back” component of Time Warner Cable’s campaign against the high cost of cable has not been a stunning success because the nation’s second largest cable operator continues to roll over its subscribers with some striking rate hikes, this time across upstate New York.

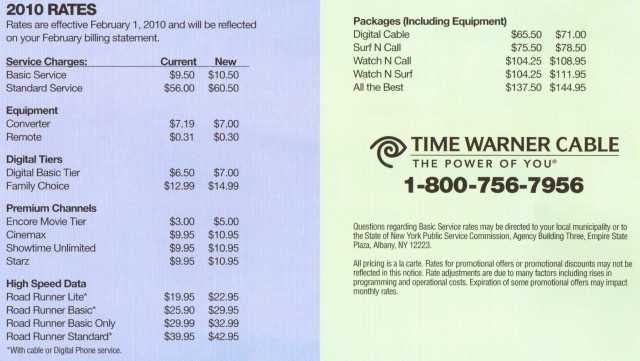

The usual promotional brochure began appearing in mailboxes across the state, filled with glowing words about all of the wonderful things Time Warner Cable did for you since your last rate increase, and promises for more wonderful things to come… along with fine print language at the bottom subtly labeled “2010 Rates.” They don’t even call it a rate increase anymore, although it will cost most video and broadband subscribers in Rochester an additional $7.70 a month — $92.40 a year, effective February 1st.

After the company complained back in April it “needed” to engage in Internet Overcharging experiments to use that revenue to upgrade networks, the additional $3 a month/$36 a year they will get from millions of Road Runner subscribers in New York alone should be more than enough to do just that. Those on lower speed economy tiers are also facing rate hikes: $3 a month for Road Runner Lite and $4 a month for Road Runner Basic, reaching $22.95 and $29.95 a month in Rochester, respectively.

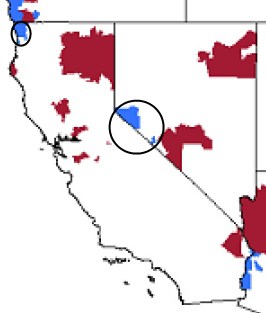

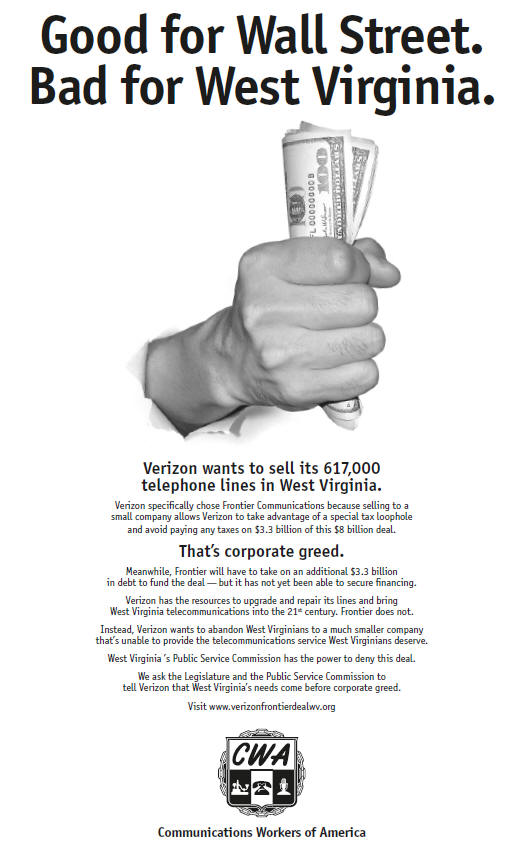

As a concession to Rochester, one of the last remaining cities in New York still stuck with 384kbps upload speeds, the company will increase the upload speed for the division’s Standard Road Runner service customers to 1Mbps sometime in 2010. Those with Road Runner Turbo will probably see upload speed increasing to 2Mbps, accordingly. But Rochester still isn’t on the upgrade list for DOCSIS 3, bypassed because of the very limited competition Frontier offers the cable company locally. Verizon FiOS fiber to the home service is being provided in most other large New York cities.

You probably didn’t ask for it, but you’re going to get it anyway: NBA TV HD and the Sundance Channel was added today to the Rochester-area’s digital cable tier.

Time Warner Cable's new rates for the Rochester/Finger Lakes region of western New York become effective February 1st.

Meanwhile in the state capital Albany, news of the rate increase was particularly unwelcome in the hard hit upstate economy. The Albany Times-Union called the rate increase “an insult” on hard-hit New Yorkers:

Your neighbor lost his job, the housing market is in the tank, and the economic recovery is nowhere in sight.

And now to add insult to injury, as other household costs rise, your cable TV bill is going up next year too — in some cases by nearly 10 percent.

Time Warner Cable sent a flier to local customers this month with the new prices. Except for the most basic package, all the rates are going up. The “basic with standard” TV package, which includes dozens of mainstay cable channels such as CNN, ESPN and Comedy Central in addition to local broadcast channels, will rise 9.7 percent to $61.95 a month from $56.45 currently.

The company’s “All the Best” package that combines TV with Internet and phone service will go from $139.95 a month to $146.95 a month, an increase of 7 percent.

[flv]http://www.phillipdampier.com/video/WTEN Albany Time Warner Bill Increase 12-31-09.flv[/flv]

WTEN-TV Albany reports that Time Warner Cable’s latest rate increase will cause many upstate New York residents to drop premium channels in even greater numbers to economize. (2 minutes)

Verizon FiOS, for now anyway, will be cheaper than most of Time Warner Cable’s packages in Syracuse. The Salt City faces rate increases averaging six to eight percent. Time Warner Cable spokesman Jim Gordon blamed the rate hikes on the same things cable always blames rate hikes on — increased programming costs. From the Syracuse Post-Standard:

Time Warner spokesman Jim Gordon said there are two major reasons for the increase: higher prices charges by the providers of programs and the rising cost of doing business. Customers are using more services more often, Gordon said, and cable is becoming more important in people’s lives.

In 2009, the number of channels on which the “start over” feature is available rose from 45 to 90, and customers used the feature 10 million times, he said. Customers also watched 85 million videos on demand, he said. “People are staying home more, and they’re hunkering down and they’re utilizing these services,” he said.

Cable operators are free to raise rates on everything except the basic service of broadcast and educational channels, for which operators need permission of regulators.

Below is a list of popular packages and corresponding rate increases:

• Talk ‘n’ View package, of telephone and cable television service, will rise from $100.50 to $108.95 – an increase of about 8 percent.

• Surf ‘n’ View, a combination of Internet and cable television, will increase from $105.50 to $111.95, an increase of 6 percent.

• All the Best, which combines cable, internet and phone, will rise from $135.50 to $144.95, or 7 percent.Prices are slightly lower with Verizon Communications Inc.’s FiOS, which recently entered the Central New York market and offers a basic package of telephone, Internet and cable television for $109.99 to $129.99.

Further north in Watertown, rates are also increasing by 6 to 8 percent starting February 1st, the second increase in the past 11 months. Time Warner last raised its rates in March.

Time Warner Cable spokesman Jim Gordon said the current increases are due to price increases by programmers and an increase in the company’s cost of doing business. Gordon also cited an increase in the use of the company’s features including “Start Over” and video on demand.

“People are staying home more because of the current economic situation, and customers are finding value in these enhancements,” Gordon said. The Watertown Daily Times notes Gordon doesn’t think subscribers will mind enough to leave.

“Our goal in doing this is to enhance the customer experience,” Mr. Gordon said.

Mr. Gordon said he doesn’t think the rate increases will prompt many Time Warner Cable customers to switch to another provider, because of the local customer service the company offers.

“We’re more than ready to compete,” Mr. Gordon said.

Customers can expect to see the following increases on their cable bills this year:

- A combination of standard and basic cable service costs will increase from $62.50 to $67.75, an increase of about 8 percent.

- The Surf ‘n’ View package will increase from $105.50 to $111.95, an increase of about 8 percent.

- The Talk ‘n’ View package will increase from $100.50 to $108.95, an increase of about 8 percent.

- The All the Best package, including cable, phone and Internet service, will rise from $135.50 to $144.95, an increase of about 7 percent.

Verizon FiOS, a new cable provider in the area, has a basic package that includes cable, telephone and Internet service for $109.99 to $129.99.

Satellite television provider DirecTV also has announced rate increases of 3 percent to 5 percent, which also will take effect Feb. 1.

Watertown residents noted the irony of the company’s “Roll Over or Get Tough” campaign in light of today’s rate increase.

“Imagine if you went to the supermarket and they told you that you had to buy 100 items you didn’t want and would never use for ever item you actually wanted. This is how Time Warner Cable operates,” one writes.

A Raymondville resident remarks, “Isn’t it strange after Time Warner solicits its customers to support their get tough effort to fight with the Fox networks in negotiations over price increases for programming that they can institute one of their own? Is this the real reason that they lobbied all of their customers? Is this the beginning of setting things up so that we end up paying for every channel that we watch? If enough people push to get rid of the junk they give us, that we never watch, so we get a package we will? It almost sounds like a shell game in which the pea is not under any of the shells, a no win situation for subscribers no matter how it shakes out. New businesses have been created here ones in which someone has figured out how to get money from consumers without really doing anything to get it. The New American Way. Welcome to the new Millennium.”

Subscribe

Subscribe