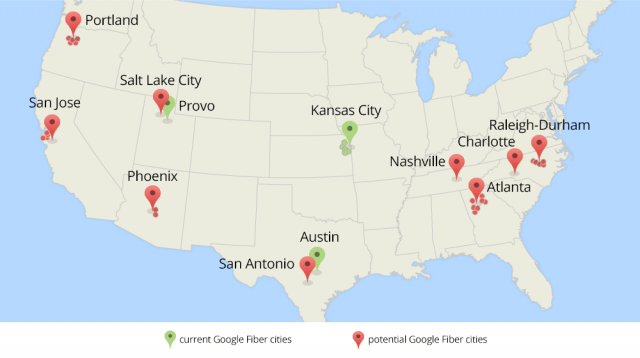

Google has proposed expanding its gigabit fiber network to nine metropolitan areas around the United States, but none of them include cities in the Mid-Atlantic and Northeast dominated by Time Warner Cable, Comcast, and Verizon FiOS.

Altogether, the expansion project could bring fiber to the home Internet service to 34 new cities:

- Arizona: Phoenix, Scottsdale, Tempe

- California: San Jose, Santa Clara, Sunnyvale, Mountain View, Palo Alto

- Georgia: Atlanta, Avondale Estates, Brookhaven, College Park, Decatur, East Point, Hapeville, Sandy Springs, Smyrna

- North Carolina: Charlotte, Carrboro, Cary, Chapel Hill, Durham, Garner, Morrisville, Raleigh

- Oregon: Portland, Beaverton, Hillsboro, Gresham, Lake Oswego, Tigard

- Tennessee: Nashville-Davidson

- Texas: San Antonio

- Utah: Salt Lake City

Now that we’ve learned a lot from our Google Fiber projects in Kansas City, Austin and Provo, we want to help build more ultra-fast networks. So we’ve invited cities in nine metro areas around the U.S.—34 cities altogether—to work with us to explore what it would take to bring them Google Fiber.

We aim to provide updates by the end of the year about which cities will be getting Google Fiber. Between now and then, we’ll work closely with each city’s leaders on a joint planning process that will not only map out a Google Fiber network in detail, but also assess what unique local challenges we might face. These are such big jobs that advance planning goes a long way toward helping us stick to schedules and minimize disruption for residents.

We’re going to work on a detailed study of local factors that could affect construction, like topography (e.g., hills, flood zones), housing density and the condition of local infrastructure. Meanwhile, cities will complete a checklist of items that will help them get ready for a project of this scale and speed. For example, they’ll provide us with maps of existing conduit, water, gas and electricity lines so that we can plan where to place fiber. They’ll also help us find ways to access existing infrastructure—like utility poles—so we don’t unnecessarily dig up streets or have to put up a new pole next to an existing one.

While we do want to bring Fiber to every one of these cities, it might not work out for everyone. But cities who go through this process with us will be more prepared for us or any provider who wants to build a fiber network. In fact, we want to give everyone a boost in their thinking about how to bring fiber to their communities; we plan to share what we learn in these 34 cities, and in the meantime you can check out some tips in a recent guest post on the Google Fiber blog by industry expert Joanne Hovis. Stay tuned for updates, and we hope this news inspires more communities across America to take steps to get to a gig.

Google does not guarantee every community will actually get the service, and a read between the lines makes it clear that a close working relationship between Google and city officials and utilities will be essential for projects to move forward. Bureaucratic red tape could be a fiber-killer in some of these communities, as could an intransigent utility fighting to keep Google fiber off utility-owned poles.

Google continues to completely ignore the northeastern United States for fiber expansion. Analysts suggest Google will not enter areas where fiber broadband service already exists, and this region of the country is home to the largest deployment of Verizon’s FiOS. Despite the fact Verizon has canceled further expansion, and large sections of the region have little chance of seeing a fiber upgrade anytime soon, Google seems more interested in serving the middle of the country and fast growing areas including North Carolina, Georgia, Phoenix and Texas. Its choice of San Jose obviously reflects the presence of Silicon Valley.

Subscribe

Subscribe

City officials and Google executives began quietly talking more than a year ago about Google buying the public-private network. A key selling point: the city was willing to let the operation go for a steal — just $1.00. In return, Google promised to invest in and upgrade the network to reach the two-thirds of Provo homes it does not reach. Google says iProvo will need technology upgrades in the office, but the existing fiber strands already running throughout the city are service-ready today.

City officials and Google executives began quietly talking more than a year ago about Google buying the public-private network. A key selling point: the city was willing to let the operation go for a steal — just $1.00. In return, Google promised to invest in and upgrade the network to reach the two-thirds of Provo homes it does not reach. Google says iProvo will need technology upgrades in the office, but the existing fiber strands already running throughout the city are service-ready today.

Provo, Utah will be the third city in the country to get Google’s gigabit fiber network, in part because fiber infrastructure installed by a defunct provider that ran into money problems is now likely available for Google’s use.

Provo, Utah will be the third city in the country to get Google’s gigabit fiber network, in part because fiber infrastructure installed by a defunct provider that ran into money problems is now likely available for Google’s use.