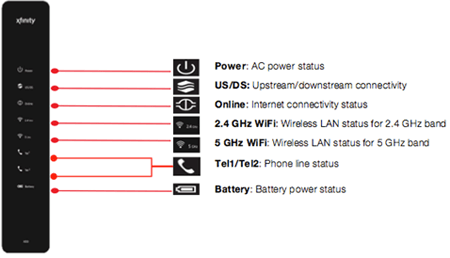

An older Comcast Wireless Gateway (Model 2)

Comcast customers may soon find themselves providing free Internet access to other Comcast customers under a new initiative announced today that will turn millions of homes into Wi-Fi hotspots.

The “xfinitywifi” project will activate a second 15-25Mbps Wi-Fi signal from Comcast’s XB2 and XB3 wireless gateways that any Comcast broadband customer can reach as long as they stay within 250-300 feet of the gateway.

“We’ve been able to add certain feature functionality to the firmware of our devices,” Tom Nagel, senior vice president of business development, told CED. “The way its architected is we sort of logically split the modem in two. On the private side, you still get the same things. You can do your own security, you can manage, you can do port forwarding and all the things that no one really understands but are available to you. On the public side what happens is it’s logically a separate network. We actually provision a separate service flow to that cable modem for the public side. If that public side uses up what we’ve given them, there is no getting from someone else.”

In simplified terms, Comcast is opening up a second dedicated Internet connection for its public Wi-Fi service that will not share your existing broadband service. The two networks will co-exist from the wireless gateway, and although the available bandwidth cannot be combined to increase connection speed, customers do have the option of connecting various wireless devices to either the home Wi-Fi or public Wi-Fi connection. The public Wi-Fi service is exempt from usage measurement, caps, and/or consumption-based billing at this time. (Comcast last year suspended usage caps in all of its service areas except Nashville and Tucson.)

In beta tests, Comcast claims customers did not object to sharing their Wi-Fi wireless gateways as long as it did not affect their speed and protected their privacy.

Nagel says the service was designed to address both concerns, noting a 50Mbps Blast customer will still have full access to 50Mbps service, regardless of how many wireless visitors are connected to the customer’s gateway.

Nagel says the service was designed to address both concerns, noting a 50Mbps Blast customer will still have full access to 50Mbps service, regardless of how many wireless visitors are connected to the customer’s gateway.

“There’s also no leakage of the public and private security functions as well,” Nagel said. “We do two totally different security regimes in the box and there’s really no way to get in between the two. We do provide people the ability to opt out of the service but there have been very few people that have done that, like sub fractions of 1 percent.”

Comcast enables the new service with a firmware upgrade automatically sent to customers when an area is ready for a Wi-Fi launch. Customers in Washington, D.C.; Philadelphia; Boston; Northern Virginia, Chicago, Atlanta; Delaware; and California will likely be among the first to receive the new service.

Some customers do have a problem with Comcast charging them for equipment Comcast is appropriating for its own benefit.

“This is a fine deal for Comcast, which can keep charging customers $7 a month for their gateway and benefit from millions of new hotspots they did not have to build themselves,” said Comcast customer David Tate. “If customers get wise and buy their own [gateway/cable modem], Comcast’s new Wi-Fi service will begin losing hotspots as customers return the equipment to avoid the fee. They should be charging a lot less or nothing at all for equipment if they want us to host their hotspots.”

Tate also believes Comcast will ruin its own service if they attempt to bring usage caps back.

“If Comcast brings back the cap, I wouldn’t want anyone else sharing my connection and I would avoid using Comcast’s Wi-Fi if they counted that usage against my allowance,” Tate explained. “If they exempt the wireless service from caps, customers can just connect to that network to avoid the cap so they would have a big loophole.”

Subscribe

Subscribe Time Warner Cable has laid the foundation to eventually begin charging broadband customers usage-based pricing, raise the modem rental fee originally introduced last fall, and continue to offer customers unlimited broadband service if they are prepared to pay a new, higher price.

Time Warner Cable has laid the foundation to eventually begin charging broadband customers usage-based pricing, raise the modem rental fee originally introduced last fall, and continue to offer customers unlimited broadband service if they are prepared to pay a new, higher price.

Cablevision will maintain unlimited Optimum Online broadband service to all of its customers and will not introduce usage-based pricing, according to Gregg Seibert, chief financial officer.

Cablevision will maintain unlimited Optimum Online broadband service to all of its customers and will not introduce usage-based pricing, according to Gregg Seibert, chief financial officer.

More than a year ago, Comcast

More than a year ago, Comcast  But if Comcast brings back the cap, Cox will downgrade his service back to where he started.

But if Comcast brings back the cap, Cox will downgrade his service back to where he started.