Stop the Cap! has suddenly started receiving a larger number of complaints about AT&T’s Internet Overcharging scheme in the past two weeks, indicating to us the company has started cracking down more forcefully on usage cap “violators.”

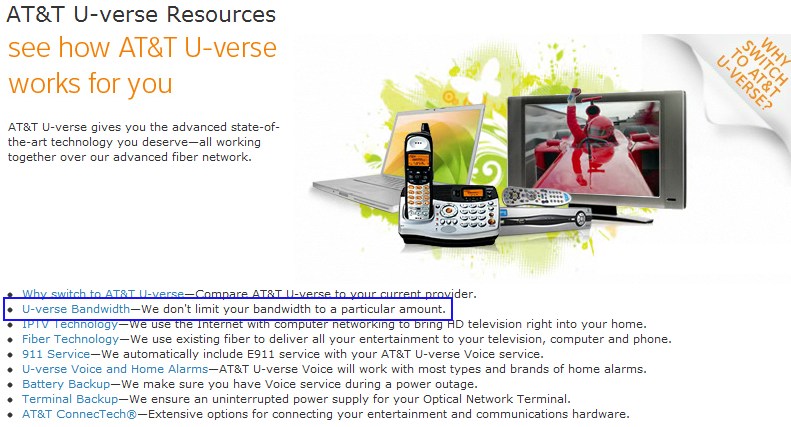

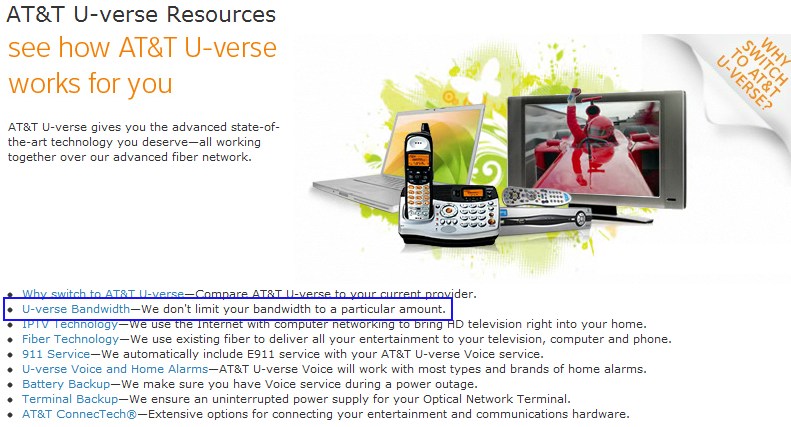

Those who purchased AT&T U-verse in an effort to avoid usage caps from their local cable company are particularly upset, because the phone company still markets its U-verse service as being ‘bandwidth-limit-free.’

AT&T advertises its U-verse service to this day as bandwidth limit free.

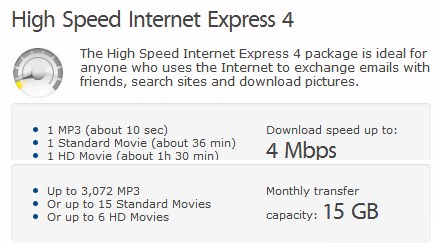

“We don’t limit your bandwidth to a particular amount,” promises AT&T in prominent language on its website. The fine print says something very different — AT&T limits the amount of usage customers get before being exposed to overlimit fees — 150GB for DSL, 250GB for U-verse. It is part of what the company calls wired “data plans.”

AT&T U-verse has a 250GB usage cap hidden in the fine print.

“It’s false advertising,” counters AT&T customer Don Brown. “Anyone who reads their promise of ‘no bandwidth limitations’ is going to assume that means no limits, but when I questioned company representatives about the promise, they pull out every trick in the book.”

Brown says one customer service representative told him ‘bandwidth limits’ refer to broadband speed — AT&T does not throttle its customers. Another said the ad claim meant that customers could keep paying AT&T additional money for as much usage as they want or need. But Brown believes AT&T knows better than that.

“When I signed up for service, I asked the salesperson who took my order if there were limits and they said there were none, period,” Brown says. “Not a word was spoken about 250GB limits or overlimit fees. I’m not buying their excuses — what wired ISP throttles customer speeds?”

In fact, AT&T itself defines “bandwidth” much the same way Brown does (underlining ours):

The term bandwidth can take on many meanings. In the case of AT&T U-verse products and services, the term bandwidth is commonly used when referring to computer networking and measuring Internet usage.

The amount of Internet usage is displayed in upload and download amounts. This would commonly be known as the amount of bandwidth the User used during a particular time.

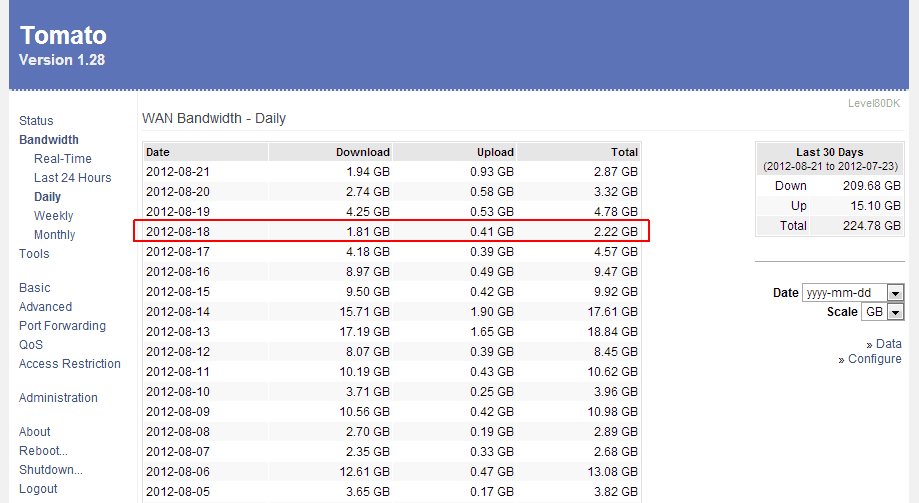

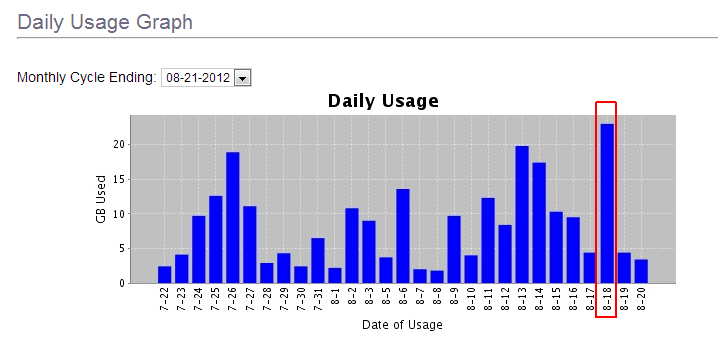

Brown also has no access to any usage monitor or measurement tool, and AT&T told him he “can relax” because the company would send warnings when it noticed his usage was coming perilously close to the limit. But that makes planning around monthly usage limits difficult, because he has no idea what his usage is from day to day.

A week ago, he received his first warning in an e-mail message from AT&T, which was the first indication he was living under a usage cap.

“They are in a real hurry to collect more money from me but they don’t have their ducks in a row on an accurate meter I can depend on,” Brown says. “Would the local power, water, or gas company get away with that? I don’t think so.”

Brown decided AT&T’s “dishonesty,” as he puts it, made him cancel his service. He does not trust the phone company to accurately measure anything.

“At least I know the cable company is a pocket-picking crook so I can be on guard for their next move,” Brown says. “AT&T is more like the thief in the night that robs you blind while you are upstairs, asleep in bed.”

Chris Savage discovered AT&T’s “stealthy” 150GB usage cap on his DSL account when he received an e-mail warning of his own. He gets one more, after which AT&T will “bill shock” him with overlimit fees.

You have exceeded 150GB this billing period.

[…] The next time you exceed 150GB you’ll be notified, but not billed. However if you go over your data plan in any subsequent billing period, we’ll provide you with an additional 50GB of data for $10. You’ll be charged $10 for every incremental 50GB of usage beyond your plan.

AT&T DSL service has a sneaky 150GB usage cap in the fine print.

AT&T really isn’t interested in hearing questions or concerns about their “data plan,” telling customers at the bottom of the message:

Please do not reply to this email. This address is automated, unattended and cannot help with questions or requests.

Savage never knew AT&T implemented an Internet Overcharging scheme:

“This e-mail seemed to say to me, ‘We changed the rules on you without telling you and now you’ve broken them, so we’ll let you off this time, but consider yourself warned!'”

Savage has already cut cable’s cord and watches his television shows online, exactly what big phone and cable companies do not want their customers doing.

The bottom line is that 150GB is not enough for people like me who work at home, rely on Netflix for any kind of TV/Movies (since I don’t have cable or any other TV), have gamers in the house and run a website. What this means for me is that, once again I will have to cancel Netflix because watching just one movie or show per day would mean I would reach my cap about 2/3 of the way into the month. And that is if nobody else in the house watches anything on it, plays any online games or downloads anything.

In the end, it appears AT&T won and Netflix lost. Savage reports after going over AT&T’s limit two months in a row, he canceled his Netflix account — the only television service he had. AT&T DSL cannot even support one movie a night and one or two streamed cooking shows here and there without pushing the family over the limit AT&T imposes.

Subscribe

Subscribe