More than three years after Canadian regulators required Bell Canada’s northern subsidiary, Northwestel, to undertake a $233 million modernization and upgrade plan, the CRTC has ruled the company is overcharging consumers for Internet access and has ordered rate cuts.

More than three years after Canadian regulators required Bell Canada’s northern subsidiary, Northwestel, to undertake a $233 million modernization and upgrade plan, the CRTC has ruled the company is overcharging consumers for Internet access and has ordered rate cuts.

Customers in Nunavut, the Northwest Territories and Yukon pay some of the highest prices in the world for DSL Internet access, more than three times higher than what comparable broadband costs in southern Canada. The CRTC has found those prices unjustifiable, especially after its 2011 finding that Northwestel enjoyed strong financial performance while chronically underinvesting in its network.

The CRTC decision requires the company to cut prices for its DSL Internet 5 (5Mbps/512kbps) and DSL Internet 16 (16Mbps/768kbps) in N.W.T. and Yukon by 30% this May. Northwestel’s budget plans DSL Internet Lite (768/128kbps) and DSL Internet 2 (2.5Mbps/384kbps) will be reduced in price by 10 percent.

Customers of Northwestel’s most popular DSL plans pay between $65-90 a month for 2.5 or 5Mbps service with usage caps of 40 and 125GB per month, respectively.

Customers will also no longer face a $20/month broadband-only surcharge if they don’t want landline service and Northwestel’s overlimit fee, now $2-3/GB in the Northwest Territories, will be cut by at least $0.50/GB.

“Although we recognize the exceptional situation that exists in Northwestel’s territory, we must not let these challenges hinder the development and affordability of telecommunications services in the North,” said Jean-Pierre Blais, the CRTC’s chairman, in a March 4 release. “Access to reasonably priced Internet services plays an essential role in the North’s economic and social development. With this decision, we are reducing the gap between what consumers pay for Internet services in the northern and southern parts of Canada.”

Because of the company’s past pricing practices, Northwestel will not be permitted to increase residential Internet rates until the end of 2017 at the earliest, and will need CRTC approval for any other rate increases.

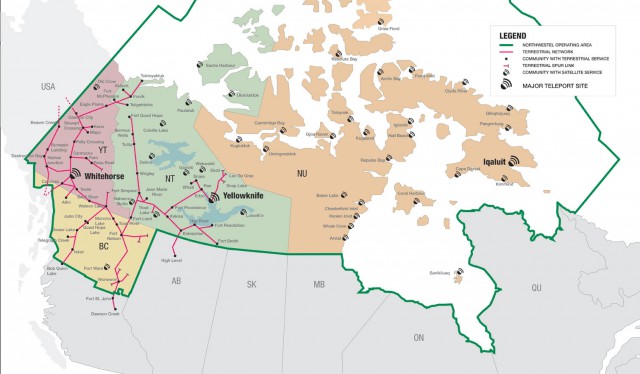

Northwestel’s operating service area includes the Yukon, Northwest Territories, northern British Columbia and Nunavut.

Residents in the northwestern and north-central regions of Canada have complained for years about poor service and high prices charged by Northwestel for Internet access.

[flv]http://www.phillipdampier.com/video/CBC North Northwestel gets slammed in Whitehorse 6-20-13.flv[/flv]

Back in the summer of 2013, Northwestel was the subject of a CRTC public hearing that got heated after customers and competitors complained the company had a de facto monopoly. (2:53)

At a 2013 hearing, Blais heard from a number of angry residents upset about Northwestel’s performance.

“I know you are frustrated; we heard it from the interveners, but we’ve pushed things considerably,” Blais said at the time.

“The DSL package that I pay for out at Lake Lebarge is absolutely ridiculous in comparison to high-speed in town,” said Jeremy Jones. “[Northwestel charges] $90 for [5Mbps DSL with a usage cap of] 125GB. The only way to increase it would be to put in another phone line and second modem and that would have ended up being another $100+ per month. We’ve decided it is cheaper just to go over it if we need to.”

“The DSL package that I pay for out at Lake Lebarge is absolutely ridiculous in comparison to high-speed in town,” said Jeremy Jones. “[Northwestel charges] $90 for [5Mbps DSL with a usage cap of] 125GB. The only way to increase it would be to put in another phone line and second modem and that would have ended up being another $100+ per month. We’ve decided it is cheaper just to go over it if we need to.”

Customers are also frustrated by the fact the company receives over $20 million annually in federal subsidies, but those benefiting the most from Northwestel’s finances are its shareholders.

Native communities in isolated areas of northern Canada have learned it is better to build their own networks than wait for promises from Northwestel to be fulfilled.

The K’atl’Odeeche First Nation built its own fiber network on its reserve in Hay River, N.W.T. after Northwestel reneged on an agreement to improve existing DSL service. Today, the native community gets better Internet access than the rest of Hay River, and the community is willing to share their enhanced Internet connectivity with Northwestel for the benefit of others nearby if the company would agree to connect to it.

“We saved them millions of dollars in infrastructure upgrades and I think it’s only fair that they lease a small portion of that infrastructure for them to meet their CRTC mandate,” said Lyle Fabian, the IT manager for the First Nation.

Fabian believes other First Nations should strive for broadband self-sufficiency by also building their own networks to take control of their digital future. In almost every case, Fabian said, those networks will deliver better service than what is on offer from Northwestel.

While the CRTC-ordered rate cuts will help customers in the Yukon and Northwest Territories almost immediately, Internet access in satellite-based Nunavut will continue to be exorbitantly expensive until the CRTC completes a review of those rates. Nunavut residents pay $179.95 a month for 5Mbps/512kbps service with a 30GB usage cap.

[flv]http://www.phillipdampier.com/video/First Mile – First Mile Community Stories Tour Katlodeeche First Nation Community Network 5-23-12.mp4 [/flv]

Henry Tambour from K’atl’odeeche First Nation in the Northwest Territories of Canada gives a 2012 tour of the first phase of the locally owned and operated fiber network. The community of 300 elected to take control of their broadband future back from Northwestel. (4:12)

Subscribe

Subscribe The cable company that used to make you think twice about every online video you watch doesn’t want you to think about that anymore.

The cable company that used to make you think twice about every online video you watch doesn’t want you to think about that anymore.

Laszlo added Bell-owned content only comprises 20% of Bell Mobile TV programming and that the ruling would deprive more than 1.5 million current Bell Mobile TV subscribers from getting the service after the spring deadline to shut it down.

Laszlo added Bell-owned content only comprises 20% of Bell Mobile TV programming and that the ruling would deprive more than 1.5 million current Bell Mobile TV subscribers from getting the service after the spring deadline to shut it down.

Monopsony power is wielded when one very large buyer of a product or service becomes so important to the seller, it can dictate its own terms and win deals that no other competitor can secure for itself.

Monopsony power is wielded when one very large buyer of a product or service becomes so important to the seller, it can dictate its own terms and win deals that no other competitor can secure for itself. The FCC recognized the danger of monopsony market power and in the 1990s set a 30% maximum market share limit on the number of video customers one company could control nationally. That number was set slightly above the national market share held by the largest cable company at the time — first known as TCI, then AT&T Broadband, and today Comcast. Comcast sued the FCC claiming the cap was unconstitutional and won twice – first in 2001 when a federal court dismissed the rule as arbitrary and again in 2009 when it threw out the FCC’s revised effort.

The FCC recognized the danger of monopsony market power and in the 1990s set a 30% maximum market share limit on the number of video customers one company could control nationally. That number was set slightly above the national market share held by the largest cable company at the time — first known as TCI, then AT&T Broadband, and today Comcast. Comcast sued the FCC claiming the cap was unconstitutional and won twice – first in 2001 when a federal court dismissed the rule as arbitrary and again in 2009 when it threw out the FCC’s revised effort. If the Comcast merger deal ultimately fails, the company may have only itself to blame.

If the Comcast merger deal ultimately fails, the company may have only itself to blame. Even Comcast admits cable broadband enjoys a near-monopoly at 25/3Mbps speeds. controlling 89.7% of the market as of December 2013.

Even Comcast admits cable broadband enjoys a near-monopoly at 25/3Mbps speeds. controlling 89.7% of the market as of December 2013. Cox Communications is planning to expand its gigabit residential broadband service in Phoenix and Omaha and will be increasing the speeds of its cheapest Internet tiers to stay competitive with CenturyLink’s discounted DSL.

Cox Communications is planning to expand its gigabit residential broadband service in Phoenix and Omaha and will be increasing the speeds of its cheapest Internet tiers to stay competitive with CenturyLink’s discounted DSL.