Dispensing with “all-you-can-eat” data plans was the first step towards monetizing mobile broadband. Now some mobile operators are considering how to implement stage two: charging different pricing for different online applications to boost profits.

Dispensing with “all-you-can-eat” data plans was the first step towards monetizing mobile broadband. Now some mobile operators are considering how to implement stage two: charging different pricing for different online applications to boost profits.

At the TM Forum Management World conference in Dublin, Ireland, mobile operators discussed managing and monetizing data usage, charging customers different rates for using various online services and applications. Total Telecom covered the conference and found mobile operators conjuring up new pricing schemes to maximize revenue opportunities.

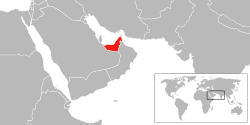

Vikram Chadha, senior marketing director at United Arab Emirates-based Du, offered that mobile operators should bill for video traffic separately from standard data.

″Video is another beast,″ Chadha told the audience of executives. ″Operators need to look at video data in a totally different manner. It’s important to treat video as a different data element.″

Monetizing video streaming can “get high value out of that customer,” Chadha said.

He also believes as general browser traffic declines, real money can be made charging different rates for customers accessing different apps. Providers could charge higher data pricing when customers use certain non-preferred apps, at the same time discounting traffic from apps that partner with wireless phone companies.

Chadha pointed to NTT DoCoMo’s partnership with Hulu. Both Hulu and the service provider market the service, with the one making the sale the beneficiary of most of the proceeds. That technically takes revenue away from Hulu and diverts it to NTT, which can engineer customized marketing efforts to target customers for the service.

But it does not stop there, according to Chadha. Mobile operators can generate even greater revenue by introducing Quality of Service (QoS) technology and billing customers extra for additional priority on the company’s wireless network, an important consideration for online video.

Chadha says his company now charges $1.25 for 30 minutes of video streaming from YouTube using “best available” network protocols. Customers who want to assure minimal buffering can buy a VIP Pass from Du for $2.50 for the same 30 minutes, and get priority on Du’s network.

″The [VIP pass customer] is assured of the bandwidth he gets and that gives the operator the opportunity to maximize his revenue,″ he said. ″[Apply] different QoS for different apps and you can charge differently. Or use location, and sell data more cheaply where networks are less congested, or at less busy times of day.”

Chadha’s worst enemy would be a strong Net Neutrality policy, which would prohibit operators from discriminating against or prioritizing different types of traffic. None of these pricing schemes would likely work if Du provided a flat rate mobile service either.

In the absence of such net protections, revenue and profit opportunities abound.

″Application-based charging is going to be very important and so is value-based charging,″ he predicted.

Subscribe

Subscribe