With a declining number of Americans willing to pay AT&T’s prices for smartphones and wireless service plans, AT&T’s future revenue growth will increasingly depend on getting the company’s current customers to pay more for data and adopt new types of wireless communications services.

With a declining number of Americans willing to pay AT&T’s prices for smartphones and wireless service plans, AT&T’s future revenue growth will increasingly depend on getting the company’s current customers to pay more for data and adopt new types of wireless communications services.

After a quarterly earnings report found AT&T subscriber growth falling far behind its larger rival Verizon Wireless, AT&T appears ready to concede there is a finite number of new customers to be won from endless battles for market share.

AT&T was expected to add 358,000 new customers in the previous quarter, but only managed to attract 151,000. Demand for the latest Apple iPhone has yet to meet available supply, with most iPhones obtained by AT&T allocated to existing customers. AT&T exclusively launched the iPhone in the United States in 2007 and retains the largest share of iPhone owners, even after the phone became available from other carriers. Verizon Wireless had fewer problems adding new customers because it is not nearly as dependent on Apple.

de la Vega

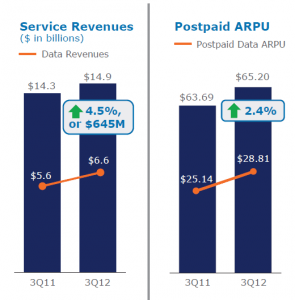

Despite lackluster subscriber growth, AT&T reported stellar revenue during the quarter, partly from rate increases and the launch of usage-limited, family share plans. AT&T also continued to benefit from tax savings, share buybacks, and refinancing debt at lower interest rates. With fewer customers adding subsidized phones, AT&T also paid fewer subsidies.

AT&T’s profit rose to $3.64 billion, or 63 cents per share, up from $3.62 billion, or 61 cents per share — $.03 ahead of Wall Street expectations.

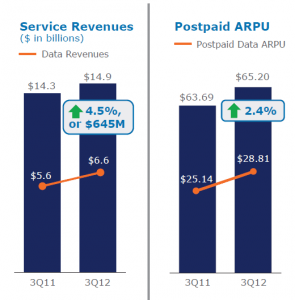

AT&T can thank its wireless data services for a significant chunk of their earnings, with more to come.

The company reported more than 2/3rd’s of their customers (28+ million) are now on usage-based pricing plans. That is 10 million more than a year ago. The company’s new mobile share plans have attracted almost two million subscribers during the first five weeks they were on offer. More than one-third of those customers are choosing the company’s 10GB data allowance, which costs the customer $150 a month with unlimited talk and texting ($30 a month for each additional smartphone on the account.) Around 15% of new mobile share customers are choosing to abandon their grandfathered unlimited data plans.

AT&T’s forthcoming strategic redirection, to be announced Nov. 7, is likely to center around increasing revenue from the company’s wireless data network.

The average AT&T customer’s wireless broadband data bill is on the increase.

Ralph de la Vega, president and CEO of AT&T Mobility and Consumer Markets, told investors it is taking “this massive data growth and building products and services on top of that.”

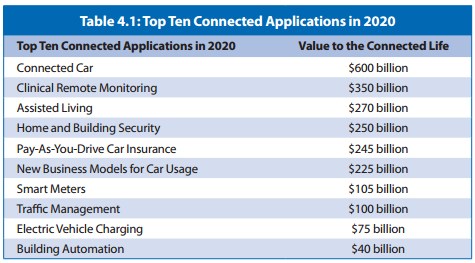

“One of the best examples I can give you is our launch of Digitize that will happen next year,” de la Vega said. “It leverages this huge smartphone database and adds services on top of it and not just data access, but services that differentiate us from the competition. So you’re talking about connecting the home with service automation and security monitoring. We’re talking about connecting your car with all kinds of entertainment services.”

That means AT&T sees its future revenue coming mostly from existing customers paying more.

“Those services are not dependent on adding more customers per se, but connecting more houses, connecting more cars and connecting more things that drive significant revenue streams with good margins for us,” de la Vega said. “In terms of what we see happening with others in the industry, I don’t think anything we have seen changes our plan. We’re going to execute [and] let others react to our plan, instead of us reacting to them.”

AT&T seemed unconcerned by competition in the current marketplace, especially from those offering cheaper plans. de la Vega predicted other carriers will come around to AT&T and Verizon’s way of thinking about mobile plan pricing.

“I think these mobile share plans are very compelling to customers,” de la Vega told investors. “And I think those that don’t put them in, in the industry will probably have to rethink down the road because I think the reception has been exceptional.”

John Stephens, AT&T’s chief financial officer, called AT&T’s data growth important, as long as those customers are on tiered data plans. With three-quarters of their customers buying “higher-priced plans,” AT&T can grow revenue by encouraging data usage that forces customers into ever-higher allowance plans that deliver revenue boosts indefinitely.

“I think some of the things driving our pricing and the price moves we made almost a year ago where we increased our data pricing are driving our revenue growth,” de la Vega admitted. “But we’re also seeing people sign up for more data. And the fact is, as you sell more smartphones or more tablets, people need more data. Usage-based data pricing means as usage goes up, we can see some of that lift also coming from additional average revenue per customer. So not only do we feel good where we are, but I feel really good about where we’re going, because you have to have that base of usage base in order to be able to monetize the data growth that we foresee in the future.”

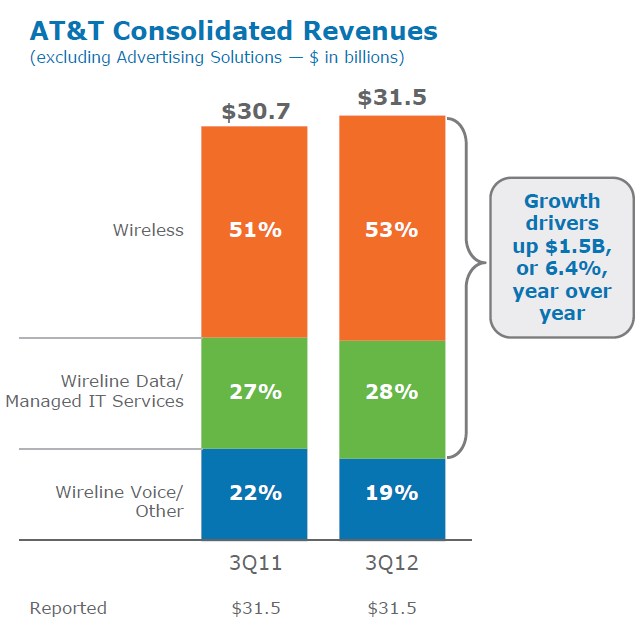

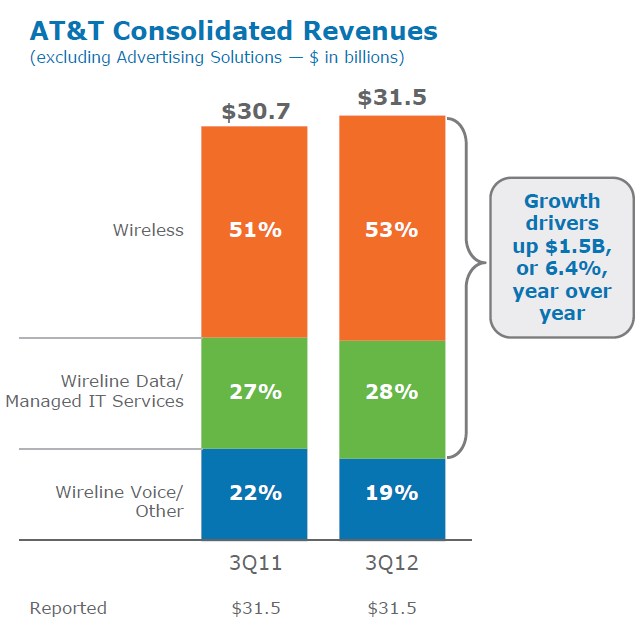

AT&T continues to depend primarily on its wireless division for most of its revenue, but as growth slows, the demand for ever-increasing average revenue from each customer will have to come from increasing prices or finding new services to sell that customers want.

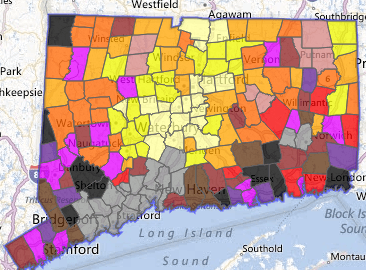

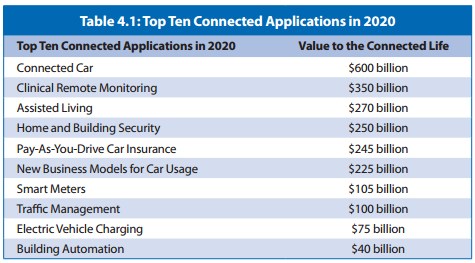

Applications that wireless carriers seek to monetize

Some other highlights:

- AT&T was questioned by Wall Street about its decision to voluntarily contribute a $9.5 billion preferred equity interest in AT&T Mobility into the Pension Plan Trust. Some analysts consider that amount unnecessary and above the amount required by law, despite the company’s assertion this would help protect the long-term health of AT&T’s pension fund. But some retirees note AT&T’s generosity benefits itself — the company’s contribution to the pension plan is invested entirely in AT&T’s wireless business;

- AT&T now has 7.4 million U-verse subscribers, driving wireline revenue growth to levels not seen in more than four years. But AT&T still only averages less than a 15% market share in the cities where U-verse is available, suggesting cable operators are maintaining their market dominance;

- AT&T’s new upgrade policy, which curtails early upgrades and imposes new upgrade fees, is having a dramatic impact on discouraging customers from upgrading their phones. That has kept AT&T’s upgrade rate at a steady 7%, even with the introduction of the wildly popular new iPhone. AT&T has effectively cut their subsidy costs and took a 28% increase in equipment revenue from new upgrade fees to the bank;

- Capital expenditures are on target at $13.8 billion, with more than half of that invested in the wireless business. Landlines and U-verse upgrades took a back seat.

- AT&T receives enough iPhones to activate 5,000-10,000 new iPhone customers a day and still that is insufficient to meet demand;

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/ATT Quarterly Earnings 10-24-12.flv[/flv]

AT&T’s Ralph de la Vega explores the company’s latest quarterly earnings, focused on its profitable wireless business. (3 minutes)

The rate increase comes at the same time Time Warner is introducing a $3.95 monthly modem rental fee for its broadband service. Unlike cable modems, however, Time Warner will not allow customers to purchase their own set top boxes, so it represents a rate increase customers can only avoid by canceling service or negotiating a lower rate.

The rate increase comes at the same time Time Warner is introducing a $3.95 monthly modem rental fee for its broadband service. Unlike cable modems, however, Time Warner will not allow customers to purchase their own set top boxes, so it represents a rate increase customers can only avoid by canceling service or negotiating a lower rate.

Subscribe

Subscribe