Cuomo

New York’s telecommunications providers are up in arms over Gov. Andrew Cuomo’s decision to yank permanent deregulation for the “digital phone” industry (otherwise known as “Voice Over IP/VoIP”) from his budget, even though the phone service is already deregulated in New York.

Now Verizon Communications and Time Warner Cable are claiming that without the deregulation they already enjoy, innovation, investment, and competition will be stifled.

“Verizon is very disappointed that New York’s lawmakers, who want the public to believe that New York is open for business, will not be acting on this important measure to modernize the state’s outdated telecommunications laws in this year’s budget,” Verizon spokesman John Bonomo told the Albany Times-Union.

“It’s about new technologies, it’s about new services,” echoed Rory Whelan, regional vice president of government relations for Time Warner Cable. “We want New York to be at the forefront of where we roll out our new products and services.”

That notion has left consumer groups and telecommunications unions scratching their heads.

“They are saying that this is going to open the flood gates to more investment,” said Bob Master, political director for one chapter of the Communications Workers of America, which represents Verizon workers. “It’s ridiculous.”

“They are saying that this is going to open the flood gates to more investment,” said Bob Master, political director for one chapter of the Communications Workers of America, which represents Verizon workers. “It’s ridiculous.”

Master says Verizon has been abandoning and ignoring their landline network for years, preferring to invest in Verizon Wireless and its limited FiOS fiber-to-the-home service which is available in only selected areas of the state.

New York’s Public Service Commission has largely not regulated competing phone service since Time Warner Cable first introduced the service as an experiment in Rochester. As part of then-Rochester Telephone Corporation’s (now Frontier Communications) “Open Market” Plan, competing telephone companies could offer landline service in the company’s service area, so long as Rochester Telephone received the same deregulation benefits. Only the cable company showed serious interest in providing home phone service, which it first delivered using traditional digital phone switches phone companies like Verizon and Rochester Telephone use. Time Warner later abandoned that service for a VoIP alternative it branded as “digital phone.”

Time Warner’s “digital phone,” as well as Verizon’s own VoIP service sold with FiOS, have co-existed regulation-free. Consumer advocates suspect the push to deregulate could eventually benefit Verizon more than cable operators, because it gives the phone company the right to question why any of its telephone services are regulated. Verizon’s FiOS fiber-based phone lines do not operate on the same network its still-regulated landlines do. Verizon, along with all traditional phone companies in New York, are subject to “universal service” guidelines which assure even the most rural New Yorkers have access to reliable telephone service.

Time Warner’s “digital phone,” as well as Verizon’s own VoIP service sold with FiOS, have co-existed regulation-free. Consumer advocates suspect the push to deregulate could eventually benefit Verizon more than cable operators, because it gives the phone company the right to question why any of its telephone services are regulated. Verizon’s FiOS fiber-based phone lines do not operate on the same network its still-regulated landlines do. Verizon, along with all traditional phone companies in New York, are subject to “universal service” guidelines which assure even the most rural New Yorkers have access to reliable telephone service.

But Verizon, like most traditional phone companies, sees substantial investment in “modernizing” legacy copper-based networks as an anachronism, especially as they continue to lose customers switching to cheaper cable providers or wireless phones. The company recently declared its fiber optic replacement network, FiOS, at the end of its expansion phase. That leaves the majority of New Yorkers with a copper-based telephone network companies only invest enough in to keep functioning.

Diaz

Bronx Borough President Ruben Diaz, Jr., joined many New York Assembly Democrats in strong opposition to the bill, which Diaz thinks undercuts New York consumers:

If this proposal were to become law, all consumers would lose out. For starters, customers would not be able to bring service complaints to the Public Service Commission, as they currently can with traditional service. Additionally, there would be no way for the state to set standards for quality or for service in underserved regions — meaning that customers could get stuck with exorbitantly high rates or be unable to obtain service at all in some areas of the state.

Verizon FiOS, one of the main options for VoIP coverage, has now been installed in many regions of the state, including most of downstate. However, Verizon has chosen not offer the service in upstate cities like Albany, Binghamton, Buffalo, Rochester, Syracuse and Utica. The result is both a virtual monopoly for the cable companies in those areas and another blow to lower-income working families who live in cities. That’s precisely why the state should be able to guarantee common sense regulations for VoIP service.

The problems with deregulating VoIP service are multifold. While traditional phone companies pay into a fund that supports “lifeline” phone access for elderly and disadvantaged New Yorkers, VoIP providers would not have to. We do not have to guess at how things would look if the state gives up its right to regulate internet phone service — we can just look at the states where traditional land line service has been deregulated. According to a recent survey of 20 states that have seen land line deregulation, 17 of those states have seen rate increases. We simply cannot afford that, particularly when our fragile national recovery is just beginning to take hold.

Verizon appears undeterred by the governor’s decision to pull the deregulation measure from consideration in his budget measure. Bills to deregulate continue to float through the Republican-controlled Senate and Democratic-controlled Assembly, but New York’s legislature is notoriously indecisive and slow to act. Time Warner’s Whelan believes the best chances for the deregulatory measure will be in the GOP-controlled Senate where a similar bill passed last year. Verizon says it will continue to push for the bill in both chambers.

“We intend to continue pushing for this important measure, and for other measures that will benefit the state’s consumers and businesses to keep up with technological change and help the state thrive and succeed,” Bonomo said.

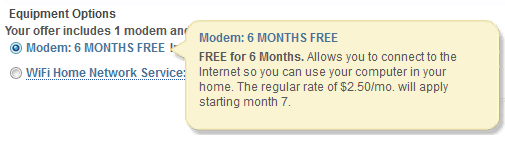

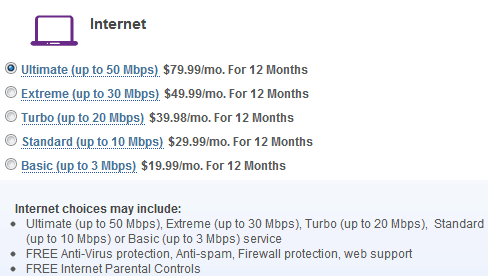

Time Warner Cable’s spring promotion for broadband service has gotten more aggressive on pricing, particularly for the company’s fastest tiers.

Time Warner Cable’s spring promotion for broadband service has gotten more aggressive on pricing, particularly for the company’s fastest tiers.

Subscribe

Subscribe