The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

Robert Marcus is scheduled to take over the CEO role Jan. 1 after Glenn Britt retires. But there is a good chance Marcus won’t have a cable company to run if executives decide to accept anticipated takeover offers due within weeks that could turn ownership of Time Warner over to Charter Communications or split up subscribers among several potential buyers including Comcast, Cox, and Charter.

Reuters reports Marcus will earn the most if he can hold off buyers for the next four weeks until he becomes CEO. Under his employment contract, Marcus would then qualify for a generous goodbye package:

- A compensation bonus amounting to three times his base salary of $1.5 million;

- A departure award amounting to three times his usual $5 million annual bonus;

- Permission to cash out the large amount of stock he has earned as part of his compensation, now valued at $37 million.

In total, Marcus could earn $56.5 million for just one day of work — long enough to shake the hands of the new buyer(s) and head for the elevators for the last time. If the company sells before Dec. 31, Marcus will still land on his feet, earning a severance package valued at $47.5 million.

In a separate move, Time Warner Cable executive vice president Peter Stern dumped 4,253 shares of his company’s stock at $130 a share, taking $552,890 in compensation.

While top managers are routinely offered generous departure packages more commonly known as “golden parachutes,” thousands of lower-level Time Warner Cable employees will likely face the ax within months of any sale, predicted one analyst. In similarly sized mergers and buyouts, the largest job losses will impact call center workers and middle management. Other employees will likely leave if asked to move to regional operations centers in other cities where the buyer(s) operate. At least one analyst said it was unusual for Time Warner Cable to proceed with a CEO switch while the company is in play.

Marcus understands how the business of mergers and acquisitions work; he started his career as an attorney specializing in the practice.

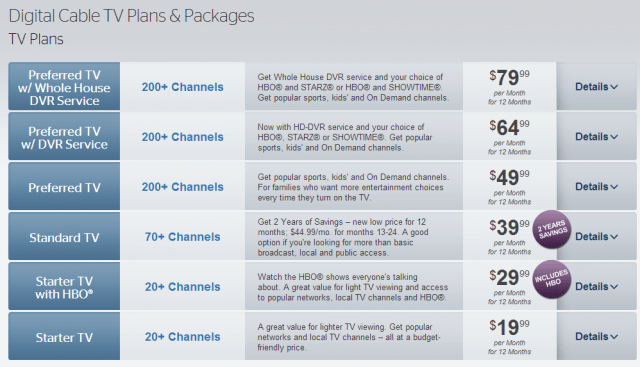

Time Warner Cable lost another 215,000 video subscribers during the fourth quarter of 2013, leaving the company with 825,000 fewer subscribers than it had one year ago.

Time Warner Cable lost another 215,000 video subscribers during the fourth quarter of 2013, leaving the company with 825,000 fewer subscribers than it had one year ago.

Subscribe

Subscribe Residents in Los Angeles and San Diego join those in New York and Kansas City that can now receive local over the air programming on their home computer, tablet, game console, or Roku box. Time Warner Cable requires viewers to subscribe to both its television and broadband services to watch, and only from your home’s Wi-Fi network.

Residents in Los Angeles and San Diego join those in New York and Kansas City that can now receive local over the air programming on their home computer, tablet, game console, or Roku box. Time Warner Cable requires viewers to subscribe to both its television and broadband services to watch, and only from your home’s Wi-Fi network. The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

Local ABC, CBS, NBC, FOX, PBS, and CW stations;

Local ABC, CBS, NBC, FOX, PBS, and CW stations; Cox Communications is contemplating jumping into the bidding for

Cox Communications is contemplating jumping into the bidding for