Time Warner Cable today announced major improvements in its service, including a tripling of broadband speeds and equipment upgrades that will first arrive in New York City and Los Angeles.

With the cable company facing a hostile takeover effort by Charter Communications with Comcast’s help, CEO Rob Marcus sought to appease shareholders that worry the cable company’s recent lackluster results originate from outdated technology, poor customer service, and broadband speeds that are well below the cable industry average.

Time Warner Cable will have to increase capital spending to pay for the upgrades, expected to cost $3.8 billion annually for the next three years.

CEO Rob Marcus calls the effort a “transformation of the Time Warner Cable customer experience.” The upgrade program is called TWC Maxx for now inside Time Warner Cable, but will have its own brand when it publicly launches later this year.

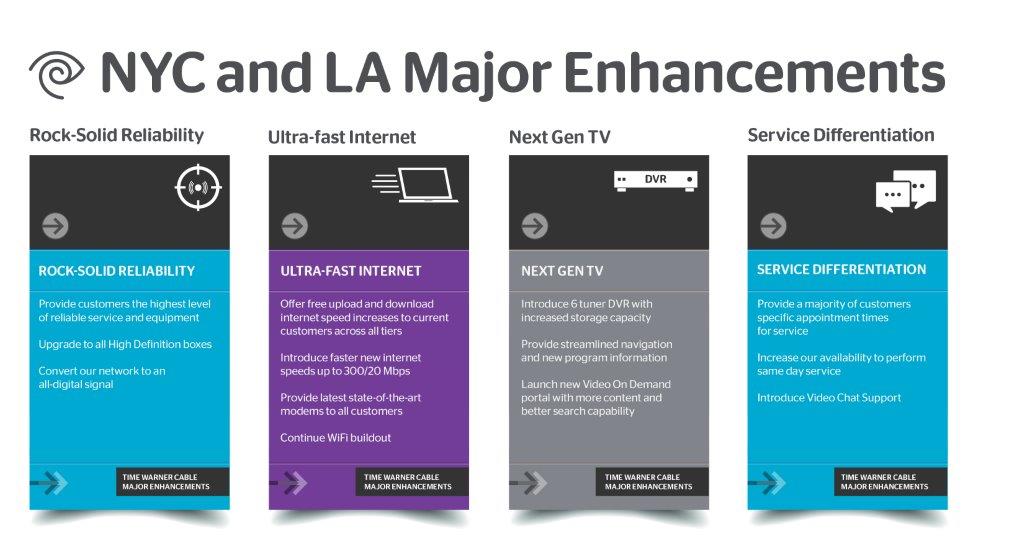

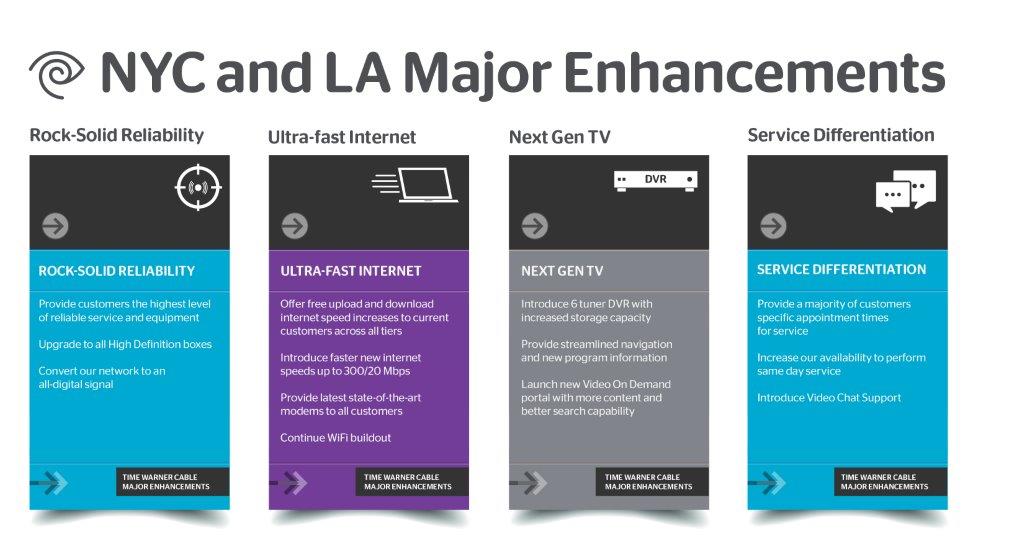

Here are some highlights:

Marcus

TV Service

- Network infrastructure upgrades to enhance reliability

- New advanced set-top boxes

- A six-tuner DVR

- A cloud-based interface and navigation

- An expanded on-demand library

Internet

- Dramatic free speed boosts for all customers

- A new Ultimate speed tier of 300/20Mbps

Unfortunately, customers outside of Los Angeles and New York will have to wait up to two years for the upgrades to reach their community.

“With ‘TWC Maxx,’ we’re going to essentially reinvent the TWC experience market–by-market,” said Marcus. “We’ll triple Internet speeds for customers with our most popular tiers of service, add more community WiFi, dramatically improve the TV product and, perhaps most importantly, we’ll set a high bar in our industry for differentiated exceptional customer service. We’re focused on providing the features and benefits that matter most to our customers.”

The most noticeable improvement will be free broadband speed upgrades. Customers with Standard or above Internet service will also receive the latest generation cable modems including Advanced Wireless Gateways for customers with Turbo to Ultimate tier service. Marcus did not say whether the company is ending is monthly equipment fees for cable modems.

Here are the new speed tiers:

- Everyday Low Price – Currently 2/1Mbps – New 3/1Mbps

- Basic – Currently 3/1Mbps – New 10/1Mbps

- Standard – Currently 15/1Mbps – New 50/5Mbps

- Turbo – Currently 20/2Mbps – New 100/10Mbps

- Extreme – Currently 30/5Mbps – New 200/20Mbps

- Ultimate – Currently 50/5Mbps – New 300/20Mbps

New York and Los Angeles Upgrade Schedule

The first four network hubs scheduled for upgrade are those in West Hollywood and Costa Mesa, Calif. and portions of Woodside (Queens) and Staten Island, N.Y. The rest of both cities will be upgraded by the end of this year.

Los Angeles customers will also see analog cable television service discontinued in favor of digital later this year. New York City has already been converted to all-digital television. Customers in both cities will be able to schedule same-day appointments and one-hour service windows.

Who Gets Upgraded Next?

Analysts expect Time Warner Cable will upgrade cities where they face competition from U-verse and FiOS after completing NYC and LA.

Analysts say Time Warner Cable’s upgrade plans are more aggressive than initially anticipated and many expect the company to move quickly, especially in competitive markets, to boost subscriber numbers and cut customer defections to help convince shareholders it is worthwhile to reject Charter’s hostile takeover bid.

The most likely markets to be targeted for upgrades after New York and Los Angeles are those facing stiff competition from Google Fiber and Verizon FiOS. Cities where AT&T U-verse delivers competition are likely to come next, and those cities where Time Warner Cable only faces competition from telephone company DSL service will likely be the last to be upgraded. However, long before that, Time Warner Cable could be sold off to other cable operators that will make these upgrade plans moot.

Marcus today reiterated his rejection of Charter’s latest $132.50 a share offer. Marcus said the cable company is only interested in an offer above $160 a share, and that at least $100 of that must be in cash, with the balance in Charter stock. Charter will have trouble delivering that amount of cash without the assistance of other cable operators.

Craig Moffett with MoffettNathanson Research isn’t sure Marcus’ plans are enough to keep TWC from being sold. He expects Charter to soon increase its offer above $140 with the help of Comcast, which is willing to pay cash for Time Warner Cable systems in New York, New England, and North Carolina after a deal with Charter is complete.

[flv]http://www.phillipdampier.com/video/Bloomberg Rob Marcus Interviewed 1-30-14.flv[/flv]

Robert Marcus, chief executive officer of Time Warner Cable Inc., talks about the cable company’s fourth-quarter earnings and its forthcoming upgrades, and Charter Communications Inc.’s $37.4 billion buyout bid. Time Warner Cable beat fourth-quarter profit estimates and forecast subscriber growth. Marcus speaks with Betty Liu on Bloomberg Television. (8:38)

Subscribe

Subscribe Time Warner Cable will provide a free pay-per-view movie or a $5 gift card to Los Angeles-area customers after the cable company lost the Standard Definition signal of Fox affiliate KTTV for about an hour during the Super Bowl on Sunday.

Time Warner Cable will provide a free pay-per-view movie or a $5 gift card to Los Angeles-area customers after the cable company lost the Standard Definition signal of Fox affiliate KTTV for about an hour during the Super Bowl on Sunday. Although analog cable customers were forced to watch a Spanish language channel’s coverage of the game, those viewing KTTV’s HD signal on Time Warner Cable were unaffected by the disruption.

Although analog cable customers were forced to watch a Spanish language channel’s coverage of the game, those viewing KTTV’s HD signal on Time Warner Cable were unaffected by the disruption.

Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources

Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources  Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.

Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.