Marcus

Even as some of the largest investment banks on Wall Street are assembling a $24 billion loan package to further Charter Communication’s next effort to acquire Time Warner Cable, CEO Robert Marcus has learned not to take his eyes off the day-to-day business of running the country’s second largest cable operator.

Marcus turned up late last week at Le Parker Meridien in New York to speak at the 2nd Annual MoffettNathanson Media & Communications Summit, largely an affair putting Wall Street investors together with top cable executives to learn about industry trends.

Immediately peppered with questions about the failed merger between Time Warner and Comcast, Marcus sought to turn the page on the deal that would have handed him an $80 million golden parachute.

“The horse is dead,” Marcus said in response to continued questions about the deal.

But Marcus did say he felt the deal was rejected for reasons that were never explained to him or the industry, which could have an impact on future cable mergers and acquisitions. Regulator-inspired uncertainty could make some companies think twice about pursuing the next big deal, but so far that does not seem to apply to Charter Communications — still hot on the trail for a deal with the much larger Time Warner Cable.

Marcus claims he understood Time Warner Cable’s image with customers was a real problem that needed to be addressed immediately after becoming the company’s new CEO in January 2014.

Marcus claims he understood Time Warner Cable’s image with customers was a real problem that needed to be addressed immediately after becoming the company’s new CEO in January 2014.

“The residential business was where the work needed to be done,” said Marcus.

Reliability became the top priority for Marcus’ team.

“It trumped features and functionality,” Marcus said, noting that if its network performed as it should, that would result in fewer calls into its customer care centers and reduced “truck rolls” to customer homes, saving Time Warner Cable time and money and improving its image. Marcus claims those efforts paid off.

“It works, we’re not pixelating, and we don’t have [huge] outages,” Marcus said.

Under Marcus’ leadership, Time Warner has adopted a “non-sexy stuff” approach to the cable business, focusing on making sure its existing products work before jumping into new products. That may explain why Time Warner has traditionally been behind other operators introducing vast broadband speed increases, cloud-based set-top boxes with improved user interfaces, more TV Everywhere contract arrangements allowing Time Warner customers to access online video content from third-party cable network websites, and the largest on-demand video libraries.

Not much is likely to change for the time being. Marcus reiterated his plan for major network upgrades under his Time Warner Cable Maxx program remain on track to reach 75% of Time Warner Cable service areas by the end of 2016.

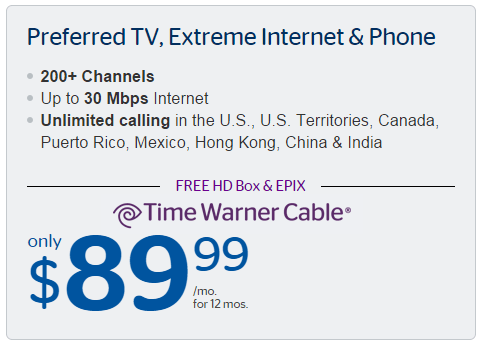

When Maxx upgrades are complete, customers are transitioned to an all-digital television platform and Standard broadband customers move from 15/1Mbps service to 50/5Mbps at no additional charge. Although the top speed for Time Warner Cable broadband is currently 300/20Mbps in Maxx markets like New York, Los Angeles, Austin and Kansas City, Marcus said he was ready to bring 1Gbps broadband to Time Warner Cable customers sometime in late 2016, after DOCSIS 3.1 equipment becomes available.

“As the market evolves to that place, we’ll make it available,” Marcus said.

Recent movement at the Federal Communications Commission to introduce additional oversight over the cable industry has not made much impact at Time Warner Cable, which plans business as usual.

“I live in a different world than Chairman Wheeler in terms of the competitive dynamic,” Marcus said. “We’re fighting it out everyday in the trenches to gain and keep High Speed Data subscribers. The idea we would pull back and not press any competitive advantages of product enhancements we’re capable of delivering, just feels counter-intuitive and bad business.”

The idea that policy changes in Washington would somehow impact the investment in and introduction of new and better services from Time Warner Cable was ridiculous to Marcus.

“I cannot translate that into holding back the product and I can’t imagine what the policy objective would be that would encourage holding back the product,” Marcus said.

Subscribe

Subscribe Time Warner Cable is notifying its customers in Charlotte, N.C. to prepare for the transition to all-digital cable television service which will be complete by the end of this summer. Further south, San Antonio customers can swing by their local cable store and pick up Time Warner Cable’s new terabyte DVR, which can record up to six different programs at the same time and store six times more content than current DVR boxes.

Time Warner Cable is notifying its customers in Charlotte, N.C. to prepare for the transition to all-digital cable television service which will be complete by the end of this summer. Further south, San Antonio customers can swing by their local cable store and pick up Time Warner Cable’s new terabyte DVR, which can record up to six different programs at the same time and store six times more content than current DVR boxes. In the last week, executives from both Charter Communications and Time Warner Cable

In the last week, executives from both Charter Communications and Time Warner Cable  Bright House is coveted by Charter as a stepping stone to a much larger acquisition of Time Warner Cable. Charter’s balance sheet is loaded with debt and its stock isn’t worth as much as that of Time Warner Cable. Combining Bright House’s two-million subscribers with Charter’s own five million customers strengthens Charter’s balance sheet and increases its borrowing capacity as it prepares to acquire Time Warner Cable for a second time.

Bright House is coveted by Charter as a stepping stone to a much larger acquisition of Time Warner Cable. Charter’s balance sheet is loaded with debt and its stock isn’t worth as much as that of Time Warner Cable. Combining Bright House’s two-million subscribers with Charter’s own five million customers strengthens Charter’s balance sheet and increases its borrowing capacity as it prepares to acquire Time Warner Cable for a second time. The Newhouse family is sitting in a lucrative position as it is courted by the two larger cable operators. One of those familiar with the talks suggested Time Warner was offering the Newhouse family influence in a combined Bright House-Time Warner Cable, because its offer would leave the Newhouse family as the largest individual shareholder of the combined company. Charter’s offer would hand power to John Malone’s Liberty Broadband, and leave the Newhouse family with little, if any voice.

The Newhouse family is sitting in a lucrative position as it is courted by the two larger cable operators. One of those familiar with the talks suggested Time Warner was offering the Newhouse family influence in a combined Bright House-Time Warner Cable, because its offer would leave the Newhouse family as the largest individual shareholder of the combined company. Charter’s offer would hand power to John Malone’s Liberty Broadband, and leave the Newhouse family with little, if any voice.

Comcast’s claims of “deal benefits” for consumers was perceived to be tissue-thin by legislators like Rep. Tony Cárdenas (D-Calif.), whose district would have seen Time Warner and Charter customers absorbed into the Comcast Dominion.

Comcast’s claims of “deal benefits” for consumers was perceived to be tissue-thin by legislators like Rep. Tony Cárdenas (D-Calif.), whose district would have seen Time Warner and Charter customers absorbed into the Comcast Dominion. “They talked a lot about the benefits, and how much they were going to invest in Time Warner Cable and improve the service it provided,” said one senior Senate staff aide, who spoke on the condition of anonymity because he was not authorized to speak publicly. “But every time you talked about industry consolidation and the incentive they would have to leverage their market power to hurt competition, they gave us unsatisfactory answers.”

“They talked a lot about the benefits, and how much they were going to invest in Time Warner Cable and improve the service it provided,” said one senior Senate staff aide, who spoke on the condition of anonymity because he was not authorized to speak publicly. “But every time you talked about industry consolidation and the incentive they would have to leverage their market power to hurt competition, they gave us unsatisfactory answers.”