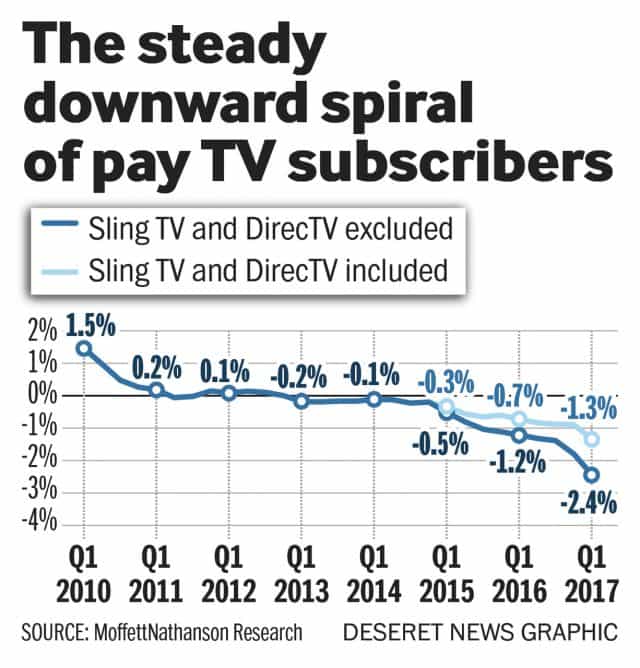

Charter Communications has introduced internet-delivered cable television packages that its cable TV subscribers have requested for years, including one offering a true a-la-carte lineup of network TV channels and the customer’s choice of 10 cable channels for $25 a month.

Spectrum Choice was soft-launched this week and is a companion to a larger internet-delivered package of TV services targeting cord-cutters called Spectrum Stream, which is also available in many areas.

Although Spectrum customers can visit the order page to sign up for Spectrum Choice immediately, when we tested it this afternoon we found the website was not able to complete an order. It turns out Spectrum is initially “hand-selecting” about 100,000 customers in selected areas for Spectrum Choice, but won’t disclose exactly where those areas are. We know from some reviews, it is available in parts of Ohio.

Although Spectrum customers can visit the order page to sign up for Spectrum Choice immediately, when we tested it this afternoon we found the website was not able to complete an order. It turns out Spectrum is initially “hand-selecting” about 100,000 customers in selected areas for Spectrum Choice, but won’t disclose exactly where those areas are. We know from some reviews, it is available in parts of Ohio.

For now, would-be customers can try building their own package from at least 65 cable networks, including several networks Spectrum usually bundles into higher cost Silver and Gold packages. For example, Turner Classic Movies, Hallmark Movies and Mysteries, and FX Movie Channel are all available to choose. Spectrum Choice also offers all three major cable news networks as well as Spectrum News (where available). ESPN, ESPN II, FOX Sports, NBC Sports Network, and NFL Network are also available for sports fans. Even Music Choice is included.

Spectrum Choice customers are not tied down with a bloated package of channels, except for the included large bundle of local stations, which includes ABC, CBS, NBC, FOX, CW, MyNetworkTV, PBS, and independent/foreign language over the air stations. The availability of public television is a rarity among online cable TV alternatives. In most areas, digital subchannels like Grit and MeTV are also included, depending on what networks are provided by stations in your area. You will also get several shopping channels, C-SPAN I, II, and III, and local Public, Educational, and Government Access channels as seen on your local cable system.

If you visit their website can complete an order online, you are qualified to receive their service. If there is no option to move forward to complete an order, you are not qualified to sign up at this time, but check back later or call Spectrum and ask.

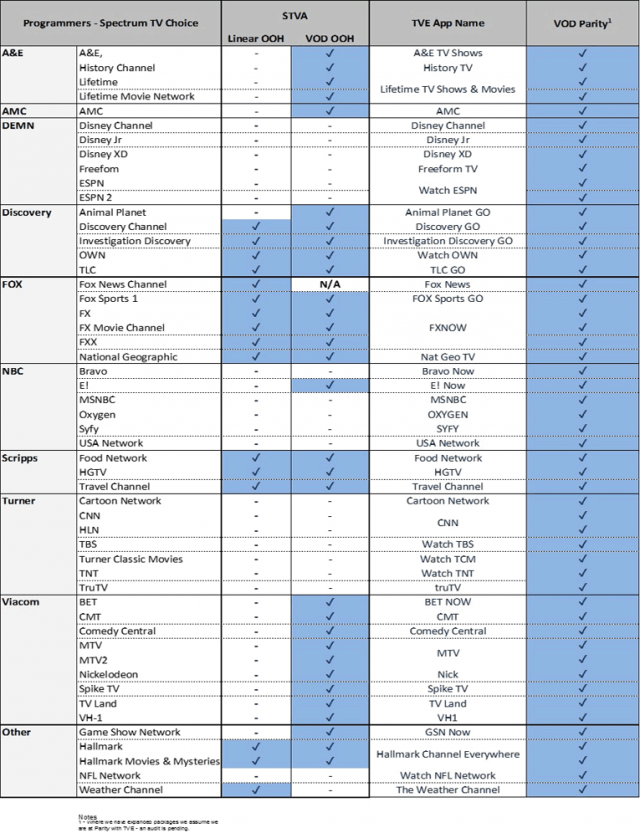

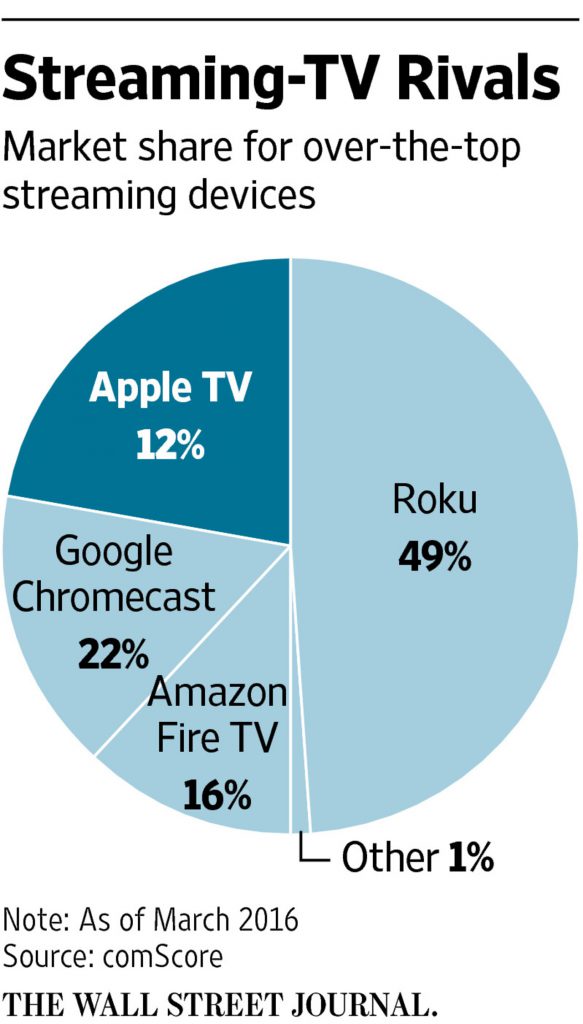

The service relies on the Spectrum TV app (available on iOS, Android, Roku, and Xbox One) and the Spectrum website to stream video programming to customers, and no set-top box is required. DVR service is not worth the effort or cost. It requires a traditional DVR set top box and you can only watch recorded shows on the television connected to the DVR. Be aware there are also restrictions viewing some channels outside of the home, just as Spectrum’s cable TV customers already understand:

Linear OOH: Watching a live channel while away from home

VOD OOH: Watching on-demand content while away from home

TVE App Name: TV Everywhere App Name – Independent apps used by programmers or viewing on their websites

VOD Parity: Cable TV and Spectrum Choice customers get access to the same on-demand programming options.

Details (click the name of the package for more information):

- 7-day money back guarantee/trial, then $15 for the first month

- To get the service, you must have an internet-only plan or an internet + voice plan from Spectrum. You cannot be a current traditional cable TV subscriber

- After the first month, the service costs $25 per month for the first two years, including the Broadcast TV Surcharge, but excluding tax

- After 24 months, price increases to $30 a month

- Your assigned Spectrum TV username and password will also work on websites that authenticate you as a qualified cable TV customer

- Premium channels are $7.50 each for HBO, Showtime, The Movie Channel, Starz, and Starz Encore or bundle all-five for $15 a month for two years. Epix is also available a-la-carte.

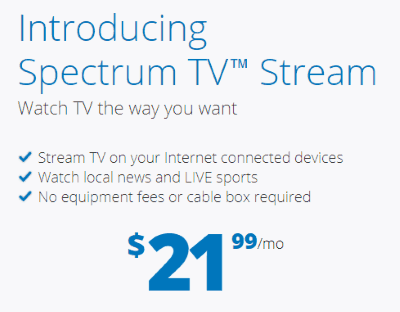

If you don’t mind Charter/Spectrum choosing your channel lineup, a second option offers more channels for about the same price.

- $21.99 a month (not including $3 Broadcast TV Surcharge) for 25+ pre-selected channels including local stations and major basic cable networks

- All features included with Choice TV work similarly except the lineup is not a-la-carte. But you may get more channels at a comparable price.

- After two years, the price increases to $26.99. Starting in year three, the price rises again to $34.99.

- The same $15 promotion for five premium movie networks noted above applies, if interested.

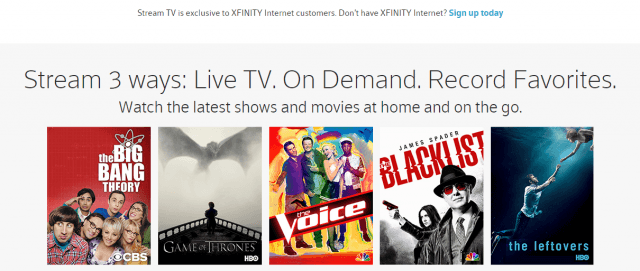

Spectrum’s promotion of Stream TV. (1:00)

Subscribe

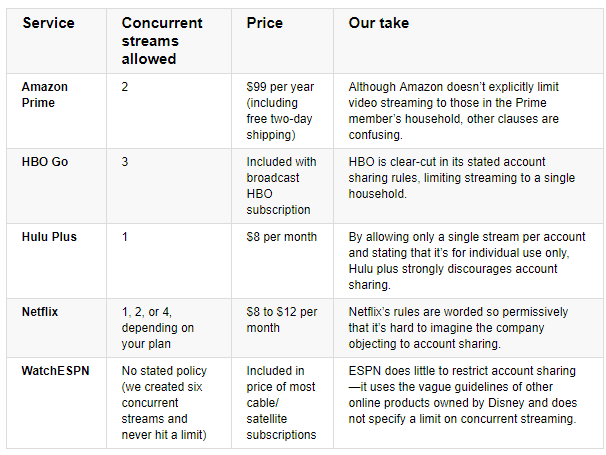

Subscribe Charter Communications CEO Thomas Rutledge is fed up with customers sharing their passwords to unlock television streaming services for non-subscribing friends and family and promises to lead an industry-wide crackdown on the practice in 2018.

Charter Communications CEO Thomas Rutledge is fed up with customers sharing their passwords to unlock television streaming services for non-subscribing friends and family and promises to lead an industry-wide crackdown on the practice in 2018.

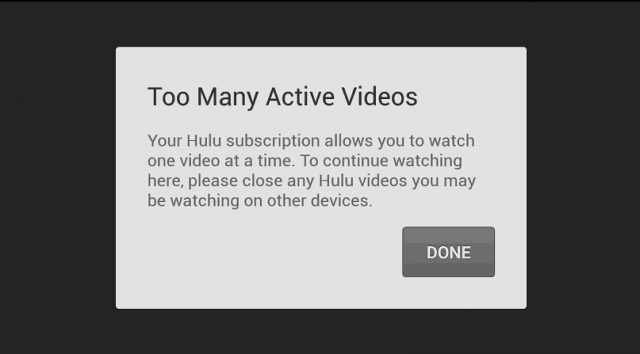

Viacom successfully negotiated the transition of its networks back to the Select TV plan beginning in late January, 2018. But those networks’ online viewing platforms and apps will now include stream limitations to keep simultaneous viewing and password sharing to a minimum.

Viacom successfully negotiated the transition of its networks back to the Select TV plan beginning in late January, 2018. But those networks’ online viewing platforms and apps will now include stream limitations to keep simultaneous viewing and password sharing to a minimum.

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.