BEIJING — A recent decision by the United States’ Federal Communications Commission to repeal net neutrality, which are rules designed to prevent the selective blocking or slowing of websites, has wide-ranging implications for China, which never believed in net neutrality and banned hundreds of foreign websites. The decision could result in a major trade war involving Chinese telecom and Internet companies, which are interested in accessing the U.S. market, analysts said.

BEIJING — A recent decision by the United States’ Federal Communications Commission to repeal net neutrality, which are rules designed to prevent the selective blocking or slowing of websites, has wide-ranging implications for China, which never believed in net neutrality and banned hundreds of foreign websites. The decision could result in a major trade war involving Chinese telecom and Internet companies, which are interested in accessing the U.S. market, analysts said.

The move will allow American telecom service providers to charge differential prices for various services and even examine the data of their customers. Though this aspect has stirred controversy in the United States, the situation there is still very different from the realities in China.

“In China, the government is monitoring and controlling the networks whereas [in U.S.] it is, at least so far, it is telecommunication companies. At this point, the government does not have access, we know it does not have access to manipulating the flow of traffic in the U.S. Internet,” Aija Leiponen, a professor at Cornell University’s Dyson School of Applied Economics and Management, said.

The FCC decision could help U.S. telecom service providers offer high-priced premium services.

Trade war

But this would also open up an opportunity for U.S. service providers to charge high rates from foreign customers. At present, foreign companies can easily access the U.S. cyber market without facing the kind of resistance American companies encounter in China and elsewhere.

“I think it (FCC decision) has an impact potentially for Chinese technology companies that want to do business in the U.S.,” said Benjamin Cavender, a senior analyst at the Shanghai-based China Market Research Group (CMR). “You are asking about companies like Alibaba or Tencent, what this means for them in the U.S. markets– and I could very possibly see this being used as a trade war tool–and the U.S. government saying, ‘Look, we are going to restrict access to companies to our ISPs and force them to pay a lot of money.”

“I think it (FCC decision) has an impact potentially for Chinese technology companies that want to do business in the U.S.,” said Benjamin Cavender, a senior analyst at the Shanghai-based China Market Research Group (CMR). “You are asking about companies like Alibaba or Tencent, what this means for them in the U.S. markets– and I could very possibly see this being used as a trade war tool–and the U.S. government saying, ‘Look, we are going to restrict access to companies to our ISPs and force them to pay a lot of money.”

U.S. telecom companies are getting increasing integrated with content providers and might look at foreign players as a source of serious competition. They might go further and even consider blocking some foreign players, including Chinese Internet giants, he said.

“I can also see this happening that they (Chinese Internet firms) just get completely blocked because of the U.S. using this more as a trade tool trying to get more access to the Chinese market because if you are a U.S. technology company you are working at a great disadvantage in the Chinese market. I do see this being used as a trade tool,” Cavender said.

The point is about applying pressure on China to open up its Internet market to American players in exchange for similar treatment in the United States. Washington has usually avoided this kind of tit-for-tat game, but the situation may be changing under the Trump administration, analysts said.

“They (U.S. telecom companies) could at some point say, ‘Look, if you want to have confidential, fast access to the U.S. you have to kind of allow us to do the same thing, allow us to invest more heavily in Chinese firms.’ I could see that happening,” Cavender said.

Moral high ground

China has been advocating the idea of ‘Internet sovereignty,’ which allows governments to create boundaries in cyber space and block foreign sites that it perceives as potential threats to security. Proponents of ‘open Internet’ have been protesting against the idea of ‘Internet sovereignty.’

The Obama administration lobbied and argued with China for nearly a decade to open up Internet access for American companies like YouTube, Twitter and Netflix. It was an important aspect of the annual strategic economic dialogue between the two countries.

The Obama administration lobbied and argued with China for nearly a decade to open up Internet access for American companies like YouTube, Twitter and Netflix. It was an important aspect of the annual strategic economic dialogue between the two countries.

The FCC decision coupled with the controversy over alleged cyber spying by Russia is a moral boost of support for China’s online restrictions, which include a ban on major sites like Google, YouTube and Twitter. The moral high ground enjoyed by the United States under the past administration may be at risk, analysts said.

“Even democracies are beginning to think about the need to regulate content. So the Chinese, you know, might take a little comfort in that,” James Lewis, senior vice president of the Center for Strategic and International Studies in Washington, said. “When you look at Europeans talking about blocking each other’s content, when you look at the U.S. talking about blocking Russian political warfare, the Internet cannot be the wild west that it’s been for a couple of decades. So, everyone’s moving in this direction and I guess the Chinese can take comfort from that.”

Meanwhile, Chinese experts are protesting a new bill introduced in the U.S. Congress that would prevent branches of the U.S. government from working with service providers that use any equipment from two Chinese companies, Huawei and ZTE, for security reasons.

“This (prejudice towards Chinese companies) seems like a problem that can’t be solved, at least not in the short term,” Liu Xingliang, head of the Data Center of China Internet, told the Global Times newspaper in Beijing.

At the same time, “Chinese firms can’t give up the U.S. market and just focus on smaller countries if they want to really achieve their global goals,” Liu Dingding, an independent tech expert told the paper.

Reported by: Saibal Dasgupta, VOANews

The Trump Administration is seeking billions in new “user fees” charged to broadcasters, cable and satellite providers that would likely be passed along to consumers as a new surcharge on their cable, wireless, and broadband bills.

The Trump Administration is seeking billions in new “user fees” charged to broadcasters, cable and satellite providers that would likely be passed along to consumers as a new surcharge on their cable, wireless, and broadband bills.

Subscribe

Subscribe

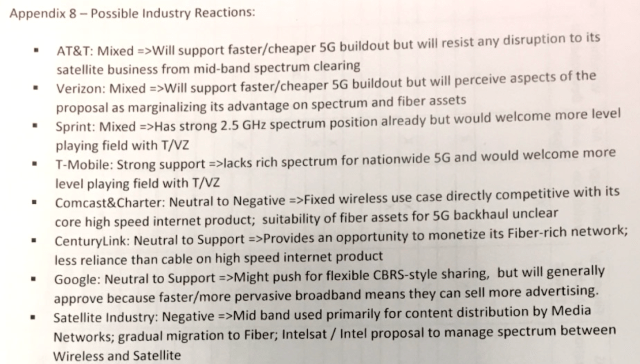

Verizon will spend most of the benefits gained from the Trump Administration’s tax cuts on writing off investments that will reduce the company’s tax exposure and boosting its dividend to shareholders.

Verizon will spend most of the benefits gained from the Trump Administration’s tax cuts on writing off investments that will reduce the company’s tax exposure and boosting its dividend to shareholders. The Republican-pushed corporate tax rollback will bring a $14.4 billion increase in available cash flow for Comcast to use for future mergers and acquisitions or share buybacks by 2021, even as the cable company has no plans to share its tax savings bonanza with subscribers in the form of lower rates.

The Republican-pushed corporate tax rollback will bring a $14.4 billion increase in available cash flow for Comcast to use for future mergers and acquisitions or share buybacks by 2021, even as the cable company has no plans to share its tax savings bonanza with subscribers in the form of lower rates. BEIJING — A recent decision by the United States’ Federal Communications Commission to repeal net neutrality, which are rules designed to prevent the selective blocking or slowing of websites, has wide-ranging implications for China, which never believed in net neutrality and banned hundreds of foreign websites. The decision could result in a major trade war involving Chinese telecom and Internet companies, which are interested in accessing the U.S. market, analysts said.

BEIJING — A recent decision by the United States’ Federal Communications Commission to repeal net neutrality, which are rules designed to prevent the selective blocking or slowing of websites, has wide-ranging implications for China, which never believed in net neutrality and banned hundreds of foreign websites. The decision could result in a major trade war involving Chinese telecom and Internet companies, which are interested in accessing the U.S. market, analysts said. “I think it (FCC decision) has an impact potentially for Chinese technology companies that want to do business in the U.S.,” said Benjamin Cavender, a senior analyst at the Shanghai-based China Market Research Group (CMR). “You are asking about companies like Alibaba or Tencent, what this means for them in the U.S. markets– and I could very possibly see this being used as a trade war tool–and the U.S. government saying, ‘Look, we are going to restrict access to companies to our ISPs and force them to pay a lot of money.”

“I think it (FCC decision) has an impact potentially for Chinese technology companies that want to do business in the U.S.,” said Benjamin Cavender, a senior analyst at the Shanghai-based China Market Research Group (CMR). “You are asking about companies like Alibaba or Tencent, what this means for them in the U.S. markets– and I could very possibly see this being used as a trade war tool–and the U.S. government saying, ‘Look, we are going to restrict access to companies to our ISPs and force them to pay a lot of money.” The Obama administration lobbied and argued with China for nearly a decade to open up Internet access for American companies like YouTube, Twitter and Netflix. It was an important aspect of the annual strategic economic dialogue between the two countries.

The Obama administration lobbied and argued with China for nearly a decade to open up Internet access for American companies like YouTube, Twitter and Netflix. It was an important aspect of the annual strategic economic dialogue between the two countries.