Billing problems, promotions-not-honored, and passing the buck are all common complaints from cable and phone customers, especially when employees of large providers don’t communicate with each other and saddle customers with the role of “go-between.”

Two recent examples of Customer Service From Hell reached our desk this week, one involving Verizon which has the “not my job” mentality firmly entrenched in their call centers, and the other from Time Warner Cable, where “Diego” told a new customer he couldn’t install their service until they disguised themselves as an old customer to cancel someone else’s service first.

The Case of the Persnickety Promotion – You Don’t Qualify Because We Never Added It to Your Account

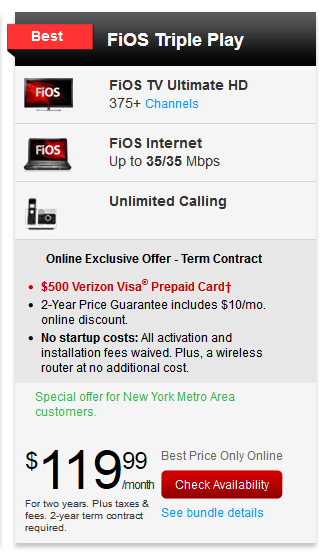

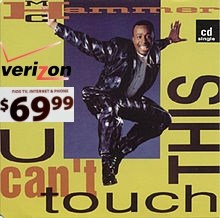

You can't touch this Verizon offer when the company forgets to apply it to your account for eight months.

Anthony Caruso received an offer he couldn’t refuse from Verizon FiOS: $69.99 a month for a triple play package of phone, Internet, and television service good for 12 months, with a reduced discount of $89.99 per month for the second year — still a great deal over what Comcast was selling.

He signed up for service in June and was happy with the installation and the service… until the bill came.

Over the last eight months, Caruso has never received a single bill that reflected the offer he signed up for, resulting in monthly calls to customer service lasting between 30 and 75 minutes each. Every month, Verizon told Caruso the promotion he received never existed, but they would issue certain credits as a gesture of goodwill.

The Star Ledger exhaustively details the entire debacle, but suffice to say, Caruso was a victim because nobody at Verizon applied the promotion to his account. The company also never bothered to investigate why a customer had to keep calling (eight times in the last eight months) to receive those credits. The newspaper illustrates how complicated it all got:

In early July, Caruso received the first bill, for $176.44.

It was more than a little confusing: $470.32 in “Current Activity” charges minus $289.96 in “Specials & Promotions” minus $21.24 for a partial month. The bill also included a “Showtime Starz Entertainment Pack” for $16.99 and “Multi-Room DVR Package” for $24.99, neither of which Caruso ordered.

The bill also included a “first bill estimate” showing monthly charges would be $139.31.

“Very confusing collection of charges and credits,” he said. “I paid the full amount to avoid billing issues for my first payment.”

He called Verizon on July 29 to discuss the bill. Caruso was transferred three times, and a rep named Sandy helped. Caruso said she dropped the “Showtime Starz” package and applied a one-time $30 credit. Caruso decided to keep the “Multi-Room DVR Package,” so his future billing should be $104.43. Because of the overpayment on the first bill, the amount due on the August bill would be $43.21.

“I was also told I was getting $9.99 “Epix” movie channel free for three months,” he said. “The FIOS lineup shows Epix is included in my package, but I decided not to fight this.”

Caurso said he paid the August bill, but there were still problems. It showed the normal monthly price to be $133.63.

He called again, and this time spoke to a rep named Jason, who said he had never heard of a $69.99 bundle offer. Caruso faxed a copy of the offer letter to the rep, who then recomputed the bill to reflect the correct package amount.

But the September bill was for $127.26.

Caruso called Sept. 7 and spoke to two different reps. The second rep also denied the existence of a $69.99 bundle offer, but asked Caruso to again fax a copy of the offer.

The rep applied another one-time credit and said the correct amount would now be $92.16.

This continued for the next several months. The bill would be wrong, Caruso would call and the reps would apply credits.

After months of endless frustration, Caruso had to appeal to the newspaper’s Bamboozled column for Star Ledger readers seeking a solution to their endless customer service nightmares.

Tom Maguire, a senior vice president for Verizon, figured out what at least 10 Verizon customer service representatives couldn’t — the company never applied the original promotion to Caruso’s account because the service order was not written in a way that would allow the promotion to be applied. Instead of the two year promotion, Caruso was signed up for month-to-month service, at a price of $129.99 a month, not $69.99.

“They basically dropped the ball from my perspective,” Maguire admitted.

What irritated Maguire (and Caruso even more) is that repeatedly-faxed copies of the promotional offer made no difference.

Caruso’s consolation prizes for his eight month ordeal:

- A direct number to a senior customer service representative already aware of Caruso’s service history;

- A restart of Verizon’s promotion, effectively extending it for nine additional months;

- A multi-room DVR package at a discounted price for the life of his service.

Tips for Living With Verizon:

Keep a copy of the promotional offer you select until it expires. If Verizon does not apply it correctly, or it mysteriously drops off your account at some point, you will have evidence the offer existed. If you experience a repeated billing problem, ask the representative that answers to transfer you to a senior customer service supervisor.

Time Warner Cable’s Mind Games Threaten Our Relationship

Julie Jacobson chose Time Warner Cable over AT&T for her new Carlsbad, Calif. condo located to the north of San Diego. The deciding factor: no cable box required for extra sets hooked up to expanded basic cable. (Unfortunately for Jacobson, that won’t be true much longer as Time Warner embarks on a nationwide conversion to a virtually all-digital lineup, which will require extra equipment on most television sets.)

Unfortunately, ever since Jacobson signed up for service, Time Warner has been playing “hard to get.”

Jacobson painfully details her encounters with Time Warner customer service, who had no idea what a CableCARD was (much less an “M-Card” which allows multiple signal streams). She was also not impressed to discover the “free” HD-DVR promotion on offer evidently only applied to the cardboard box it came in.

“Your ‘free’ HD-DVR comes with an additional $11/month box-rental fee and $11/month service fee,” Jacobson discovered. “The HD-DVR is free + $22/month, which puts TWC pricing into U-verse territory.”

But even that wasn’t enough for Jacobson to declare Time Warner Cable “sucky.” It was this:

Julie,

Thank you for placing your Time Warner Cable order online. We were unable to complete your order with the information you provided.

Please call us at 855-889-4113 so we can proceed with your service order. Be sure to have your order confirmation number (########) and the four-digit PIN you created during your online order ready when you call. We look forward to hearing from you so we can complete your order as soon as possible.

Thank you for choosing Time Warner Cable.

So I called the number on a Sunday at 3:15 p.m., using the phone number in the email. The office was closed by then. Believe it or not, I started pining for Comcast back in Minnesota. At least their customer service is 24/7.

After being bounced from offices in Wisconsin and North Carolina, she was finally transferred to California, where Diego (with his barely decipherable English) was waiting to not provide customer service:

I’m sorry, but I had a really tough time understanding him. As it turns out, it didn’t really matter because he was flat-out wrong. He told me the old tenants returned their TWC equipment, but they didn’t call to cancel their service; my order wouldn’t go through because there was already an account associated with the address.

“You need to call them to cancel their service,” he said.

“What?! I don’t even know who they are!”

In that case, he said, I could go to the local TWC office and bring them a copy of my lease.

That’s real convenient, given we’re only in town for one day.

So I ask Diego for the store phone number, and he provides it.

“Where is it located?” I ask.

“I don’t know … somewhere in the LA/San Diego area.”

Thanks, that narrows it down.

A more encouraging experience with another representative later on seemed to have everything worked out, until a new message from the company reached her e-mail box earlier today:

3rd Attempt: Please call us to avoid cancellation of your Time Warner Cable order.

Tips for Living With Time Warner Cable:

Time Warner’s system for dealing with new customers always hangs up when it finds existing service already established at an address. We encountered this ourselves and had to arrange for the old owners of our home to arrange for a service disconnection before Time Warner could complete our order for new service. Usually it makes better sense to call and establish service directly with a Time Warner representative over the phone when a complication like this arises. The representative would have identified the problem immediately instead of dispatching cryptic e-mail messages about a generic “problem with your order.” Calling the local office nearest you is also a great way to cut through red tape and stop your call from being transferred to different call centers.

If your order went horribly wrong and you were inconvenienced, ask a representative to throw in free installation or some other extra promotion for your time and trouble.

We also suspect that “third attempt” notification was probably associated with the earlier e-mail and not the more encouraging, later experience with another representative by phone.

Subscribe

Subscribe