Gov. Haslam

Top officials of four southern states are coordinating efforts with Republican House members to oppose the Federal Communications Commission’s preemption of state laws that restrict or prohibit municipal/public broadband competition.

South Carolina Governor Nikki Haley, Tennessee Governor Bill Haslam, Alabama Attorney General Luther Strange, and Tennessee Attorney General Herbert Slattery have all backed efforts by House Republicans to curtail the regulatory powers of the FCC, claiming states’ rights should have precedence over the federal regulator. All four have sent letters to the House Energy & Commerce Committee putting their opposition on paper.

In 2014, FCC chairman Thomas Wheeler announced the FCC would seek to preempt state laws in North Carolina and Tennessee that severely restrict the development of broadband networks owned or controlled by municipalities and public utilities. The laws typically allow existing municipal networks to continue operating, but prohibit expansion beyond a pre-defined service area. Networks planning to launch after the laws took effect usually face onerous conditions and disclosure requirements that make many untenable. Large incumbent cable and phone companies were exempted from the law.

Wheeler’s efforts came in response to requests from community broadband providers seeking to deliver service to expanded service areas. The debate has put several local governments and utilities in an uncomfortable position of opposing their colleagues in state government.

In North Carolina, Attorney General Roy Cooper has taken the FCC to court in a petition to the U.S. Court of Appeals for the Fourth Circuit.

“Despite recognition that the State of North Carolina creates and retains control over municipal governments, the FCC unlawfully inserted itself between the State and the State’s political subdivisions,” Cooper wrote to the court. Cooper says the FCC’s actions are unconstitutional and exceeds the commission’s authority; “is arbitrary, capricious, and an abuse of discretion within the meaning of the Administrative Procedure Act; and is otherwise contrary to law.”

Much of the opposition to municipal broadband comes from Republican politicians on the state and federal level. Most claim municipal providers represent unfair competition to the private sector. The American Legislative Exchange Council (ALEC) considers municipal broadband a significant issue. The corporate-funded group offers state legislators the opportunity to meet with telecom company lobbyists. Legislators are also provided already-written sample legislation restricting municipal broadband developed by ALEC’s telecom company members, including AT&T, Comcast, and Time Warner Cable. In states where Republicans hold the majority in the state legislature, such bills often become law.

Much of the opposition to municipal broadband comes from Republican politicians on the state and federal level. Most claim municipal providers represent unfair competition to the private sector. The American Legislative Exchange Council (ALEC) considers municipal broadband a significant issue. The corporate-funded group offers state legislators the opportunity to meet with telecom company lobbyists. Legislators are also provided already-written sample legislation restricting municipal broadband developed by ALEC’s telecom company members, including AT&T, Comcast, and Time Warner Cable. In states where Republicans hold the majority in the state legislature, such bills often become law.

The FCC represents a serious threat to the telecom company-sponsored broadband legislation. Instead of debating the impact of the law on unpopular phone and cable companies, the four state officeholders claim the dispute is a battle pitting states’ rights against the powers of the federal government.

Haslam, who also serves as the national chairman of the Republican Governors Association, formally asked Congress to intervene against the FCC to protect state sovereignty. In a separate appeal to the FCC, Tennessee officials argued the FCC violated the country’s founding concept of separation of state and federal power, citing the 10th Amendment to the Constitution reserving power not delegated to the United States for the states respectively, or to the people.

Haslam’s critics contend the governor has delegated his own power to protect the interests of large telecommunications corporations operating in his state — companies the critics claimed wrote and lobbied for a state law that established anticompetitive broadband corporate protectionism in Tennessee. Among Haslam’s top campaign contributors are AT&T and Comcast — Tennessee’s two largest telecommunications companies.

Gov. Haley

Slattery, appointed by the Tennessee Supreme Court, argued in his letter to Congress the FCC lacked any authority to circumvent Tennessee state law.

The FCC has consistently claimed it is not overturning any state laws. Instead, it is performing its duties under its mandate.

The FCC cites Section 706 authority to regulate when broadband is not being deployed in a reasonable and timely manner, something that cannot happen if a state law impedes new competitors and entrants.

Alabama’s attorney general joined the fight in a brief to the Sixth Circuit opposing preemption, with a copy sent to the House Subcommittee on Communications and Technology, which is planning to hold a hearing on the matter. Alabama has several municipal and public utility networks operating in the state. AT&T and Comcast also serve large parts of Alabama. AT&T gave $11,000 to Strange’s campaign, Comcast sent $8,500. The Koch Brothers, fierce opponents of community broadband, also donated $10,000 to Strange through Koch Industries.

South Carolina Governor Nikki Haley told legislators she strongly opposes external entities like the FCC overreaching into her state’s business. She did not mention AT&T is her fifth largest contributor, donating more than $16,000 to her last campaign. South Carolina’s largest cable operator is Time Warner Cable. It donated $9,900 to the governor’s campaign fund.

Time Warner Cable customers should not have to pay for service when an outage makes it unavailable, but like most cable and phone companies you will not get a service credit without asking.

Time Warner Cable customers should not have to pay for service when an outage makes it unavailable, but like most cable and phone companies you will not get a service credit without asking.

Subscribe

Subscribe

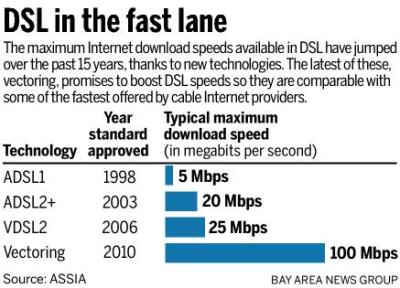

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Any final approval of Charter Communication’s planned acquisition of Time Warner Cable and Bright House Networks will likely not come before next summer, as

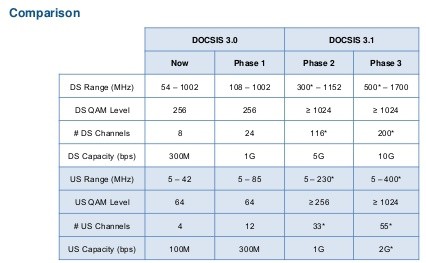

Any final approval of Charter Communication’s planned acquisition of Time Warner Cable and Bright House Networks will likely not come before next summer, as  Time Warner Cable customers who purchased their own cable modems to avoid the company’s $8 monthly rental fee will effectively be forced to indirectly pay those fees once again if Charter Communications wins approval to buy the cable operator.

Time Warner Cable customers who purchased their own cable modems to avoid the company’s $8 monthly rental fee will effectively be forced to indirectly pay those fees once again if Charter Communications wins approval to buy the cable operator. Zoom wants Charter to be required to offer consumers that own their own equipment a tangible monthly discount for broadband service as a condition of any merger approval.

Zoom wants Charter to be required to offer consumers that own their own equipment a tangible monthly discount for broadband service as a condition of any merger approval.

Much of the opposition to municipal broadband comes from Republican politicians on the state and federal level. Most claim municipal providers represent unfair competition to the private sector. The American Legislative Exchange Council (ALEC) considers municipal broadband a significant issue. The corporate-funded group offers state legislators the opportunity to meet with telecom company lobbyists. Legislators are also provided already-written sample legislation restricting municipal broadband developed by ALEC’s telecom company members, including AT&T, Comcast, and Time Warner Cable. In states where Republicans hold the majority in the state legislature, such bills often become law.

Much of the opposition to municipal broadband comes from Republican politicians on the state and federal level. Most claim municipal providers represent unfair competition to the private sector. The American Legislative Exchange Council (ALEC) considers municipal broadband a significant issue. The corporate-funded group offers state legislators the opportunity to meet with telecom company lobbyists. Legislators are also provided already-written sample legislation restricting municipal broadband developed by ALEC’s telecom company members, including AT&T, Comcast, and Time Warner Cable. In states where Republicans hold the majority in the state legislature, such bills often become law.