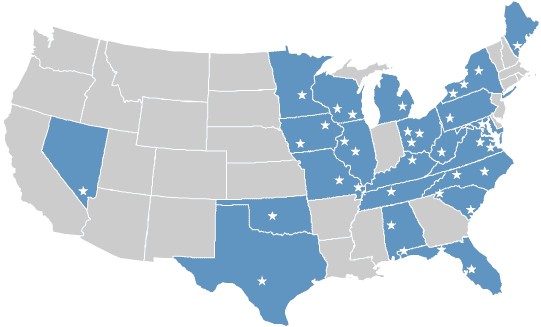

Time Warner Cable’s Roll Over or Get Tough campaign was tailor-made to bolster the company’s defenses as the deadline nears for the nation’s second largest cable operator and Fox to reach an agreement on carrying Fox-owned stations in the new year.

Time Warner Cable’s Roll Over or Get Tough campaign was tailor-made to bolster the company’s defenses as the deadline nears for the nation’s second largest cable operator and Fox to reach an agreement on carrying Fox-owned stations in the new year.

For sports fans, the relentlessly ticking 24-like clock may run out on some important football games airing on Fox on New Year’s Day, requiring viewers to pull out the rabbit ears and settle for whatever over-the-air signal they can get. At the moment, the two companies remain far apart in reaching a settlement over exactly how much Time Warner Cable will have to pay to carry Fox affiliates in some of the nation’s top TV markets.

Fox wants a reported $1 per subscriber per month. Time Warner Cable prefers to pay nothing for Fox broadcast stations — the cable industry typically cuts deals to carry network-owned cable channels for which they will pay. That’s how many Time Warner Cable customers ended up with channels like Sleuth, CNBC World, and other little-watched NBC-Universal cable channels just to smooth the way for retransmission consent for NBC-owned broadcast affiliates. Fox shoved the dismally-rated Fox Business News and several regional sports channels onto many Time Warner Cable systems to win retransmission consent deals with higher-rated Fox networks just a few years ago.

Now Fox insists on cash money for carriage.

News Corporation’s Rupert Murdoch, who runs the company that owns Fox, has been making plenty of noise this year about the “business model” of broadcast television being broken in the United States. Murdoch wants everyone to pay for News Corporation content, be it online from the Wall Street Journal or on your local cable system where the Fox family of cable and broadcast networks occupy at least a half-dozen channels on the lineup.

News Corporation’s Rupert Murdoch, who runs the company that owns Fox, has been making plenty of noise this year about the “business model” of broadcast television being broken in the United States. Murdoch wants everyone to pay for News Corporation content, be it online from the Wall Street Journal or on your local cable system where the Fox family of cable and broadcast networks occupy at least a half-dozen channels on the lineup.

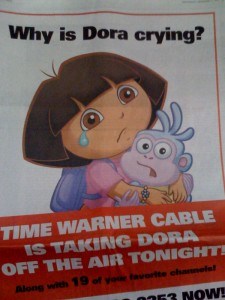

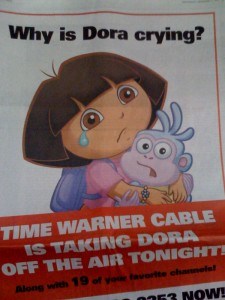

The level of nastiness has approached that of last year’s vicious battle with Viacom over how much Time Warner Cable would pay for channels like Nickelodeon, Comedy Central, and MTV. Last year the low point was achieved when Viacom ran full page newspaper ads with a crying Dora the Explorer lamenting the fact she was about to be ripped off the television screens of millions of cable customers.

Time Warner Cable hopes its preemptive strike will earn it some peace and understanding when upset subscribers call the cable company to complain about the loss of Fox on their cable dial. After all, you did want them to “get tough” with those nasty programmers, right? Time Warner Cable has pointed the finger specifically at Fox in the newest round of attack ads, and Fox returned fire with a new slap against Time Warner Cable.

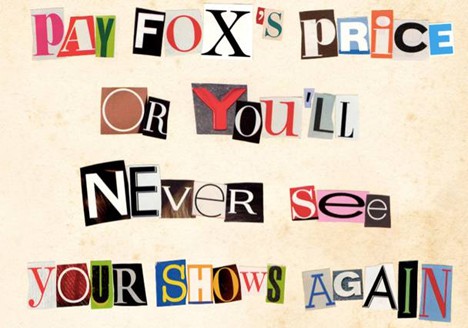

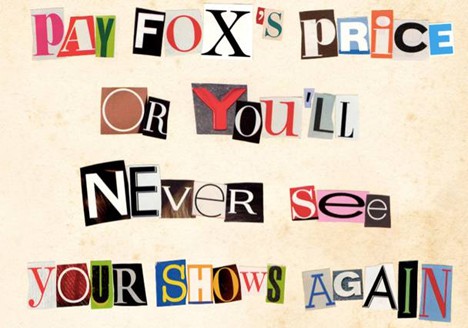

[flv width=”480″ height=”290″]http://www.phillipdampier.com/video/Time Warner Ransom Ad.flv[/flv]

Time Warner Cable characterizes a missed deadline in the dispute as the equivalent of Fox taking your TV hostage.

[flv width=”640″ height=”506″]http://www.phillipdampier.com/video/Fox Ad Targets TWC.flv[/flv]

Fox returns fire with another direct shot at Time Warner Cable in their latest ad.

Meanwhile, local newscasts around the country are sporadically updating viewers about the fight. Because football is involved, amazing efforts are underway to force the two to reach an agreement, or at least leave the games on. One Orlando attorney is filing a lawsuit to get an emergency injunction to make sure Orlando’s WOFL-TV stays on Bright House Networks. That cable company is being represented by Time Warner Cable over the Fox matter.

[flv width=”640″ height=”388″]http://www.phillipdampier.com/video/WESH Orlando Bright House Fox Battle Sugar Bowl In Between 12-28-09.flv[/flv]

[flv width=”640″ height=”388″]http://www.phillipdampier.com/video/WFTV Orlando Contract Dispute May Keep Gator Fans From Watching Game 12-28-09.flv[/flv]

Bright House Networks in central Florida is also impacted by the Fox-Time Warner Cable stalled negotiations. WESH-TV and WFTV-TV in Orlando report on the major impact the loss of WOFL-TV – Orlando’s Fox station, would have on area sports fans. (WESH-2 minutes WFTV-3 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/NY1 Time Warner Fox Dispute 12-28-09.flv[/flv]

Time Warner Cable’s Alex Dudley, familiar to Stop the Cap! readers from the cable operator’s effort to launch a major Internet Overcharging scheme on customers last April, is back in a decidedly pro-Time Warner piece on the cable company-owned NY1. Dudley can’t resist taking that last shot at Fox, pointing out impacted customers can always watch a lot of Fox programming for free online, thanks to Hulu. (3 minutes)

With these kinds of battles becoming increasingly contentious, Time Warner Cable CEO Glenn Britt hinted the cable operator may look at offering customers more choice in what channels make up a subscriber’s package. Consumers have howled for years over rate increases that outpace inflation, as cable operators keep expanding the number of channels on offer, and keep raising the rates to pay for them.

“People want more choice, and collectively, we should be responsive to that,” Britt said at a investor conference in New York City. “I haven’t been a big fan of a la carte. The economics don’t work for the programming part of the business and ultimately don’t work for consumers. They do like to buy packages, maybe not as big as the packages we offer now, but they do like packages.”

“The comments are pretty consistently saying, ‘We would like the choice to buy smaller packages,'” Britt said.

The cable industry has traditionally resisted true a-la-carte pricing, which permits customers to choose and pay for only the channels they wish to watch. Basic cable networks depend on both advertising revenue and the subscription payments they charge every customer who can watch their channels. With the millions of cable subscribers pooled together, the cost per subscriber for each channel is usually less than 50 cents per month. Letting subscribers opt-out increases the prices networks have to charge to those still receiving the channel. Many niche networks would likely not survive such a transition. The cable industry also argues it would force every subscriber to rent a set top box or similar device for every television in the home, as every channel would have to be scrambled. Billing costs would also be higher.

Britt’s suggestion that Time Warner Cable could look into adding more “packages” of programming could resemble how C-band satellite dish owners paid for their programming. Before the days of DISH Networks and DirecTV, millions of Americans placed large satellite dishes (typically 10-12 feet in diameter) in their yards to receive satellite-delivered programming. When programmers encrypted their signals, satellite dish owners purchased programming in mini-packages comprising a handful of channels. Some packages were theme-based — news packs with CNN, Headline News, MSNBC, Fox News, and CNBC for $5 a month or company-based, such as a package containing channels formerly owned by Ted Turner or those from Scripps-Howard (HGTV, Food, Style, etc.) for a few dollars a month. Most subscribers paid for a “basic package” of popular basic networks grouped together and then added on more expensive premium channels or sports channels individually. It often didn’t make economic sense to purchase each channel individually because of their relative high cost, but consumers could save quite a lot excluding some of the most expensive channels from their lineup (especially sports programming).

Whether Britt would follow through with the threat of “mini packages” is open for debate. Any savings consumers realize from such offers would reduce Time Warner Cable’s revenue per subscriber, and that’s a sure fire way to upset Wall Street.

Watch more video and learn how Time Warner Cable customers nationwide may be facing the loss of Fox-owned cable channels, even if the local broadcast affiliate stays put. We also have a more in-depth report on why retransmission consent agreements are increasingly important to broadcasters and pay television operators, all below the page break.

… Continue Reading

Subscribe

Subscribe