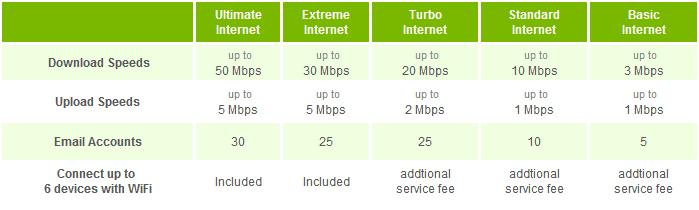

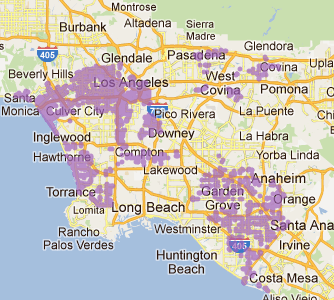

For those who admire the apparent pervasiveness of competition between Time Warner Cable and Cablevision Industries vs. Verizon Communications’ FiOS, the idea the Big Apple has a broadband problem seems a bit ridiculous, particularly if you can’t get your local cable company to pick up their phone and AT&T will only hand you a 1.5Mbps DSL line, if you can get it.

But according to the Village Voice, New York City broadband “sucks,” and it will continue to suck for at least the next eight years.

“Though entrepreneurs in most parts of the city can access a fast broadband connection today, many of those we interviewed said that New York’s telecom infrastructure is well behind where it should be for a city vying to be one of the nation’s two leading technology hubs,” the study notes.

What it comes down to is that New York — despite being the world’s media capital — does not have adequate access or bandwidth to support tech companies’ needs.

For example, some companies might be able to get either FiOS or Time Warner Cable, but not both, which means they can’t have broadband backup.

“It’s like the elephant in the room is that bandwidth here sucks,” one entrepreneur told the researchers. “You should be able to walk into any building and have at least 150 megabit connection available to you. There has to be ways for the city to construct much better bandwidth availability for start-ups.”

Many cited told the researchers that their internet routinely goes down. And startups who want to set up shop in cheaper, industrial districts often can’t, because the cable companies would rather provide service to more lucrative residential areas. Sometimes, telecom concerns are willing to dig up streets and lay cable, but at a hefty price — around $80,000.

That $80,000 bill is handed to a prospective customer and does not come from cable operators’ capital expense fund.

Researchers gave New York a broadband grade of B to B-, which isn’t too bad considering what broadband is like in the mid-south, the midwest, and the rural west. But it doesn’t cut it for helping New York become a bigger tech city.

While Time Warner Cable and Cablevision have wired multi-dwelling units and homes across New York City, cable operators have only recently started to turn their serious attention to corporate business customers. Time Warner Cable agreed, as part of its franchise renewal deal with the city, to invest $1.2 million per year for fiber connections to commercial buildings yet to be wired for cable. Cablevision, which can be found in boroughs like Brooklyn and out on Long Island, agreed to spend a more modest $600,000 a year for the same purpose.

Time Warner Cable has already warned investors its capital spending on wiring commercial office buildings across the country is increasing as the company sees lucrative new revenue opportunities competing with their usual nemesis — the phone company.

Verizon treats FiOS deployment in New York City as a long, long-term project. There are neighborhoods in Manhattan that can’t wait much longer for the fiber optic network as Verizon increasingly lets its old copper wiring go to pot, leaving some New Yorkers without phone service for weeks. The city of New York has given Verizon until 2014 to wire the city, and the company appears likely to need those two additional years at their current pace, and that agreement only covers residential properties, not commercial ones.

Robust broadband is essential for many high technology startups and the multi-million dollar data centers that support them. New York mayor Michael Bloomberg considers it a top priority to reduce the city’s economic dependence on Wall Street, which generates considerable tax revenue for both the city and state. High tech enterprises fit that bill. But the city’s broadband grades do not.

“For a city that’s trying to be a tech powerhouse, we need to have an A,” said Jonathan Bowles, the author of the study, “New Tech City.”

Subscribe

Subscribe