After more than a year of aggressive promotions for new customers and those threatening to switch to a competitor, Time Warner Cable has pulled back to boost revenue and make greater profits.

After more than a year of aggressive promotions for new customers and those threatening to switch to a competitor, Time Warner Cable has pulled back to boost revenue and make greater profits.

CEO Glenn Britt told Wall Street investors on this morning’s quarterly results conference call that the cable operator is moving in a different direction.

“It’s based on a simple premise: sell people what they want and what they can afford in the first place,” Britt said.

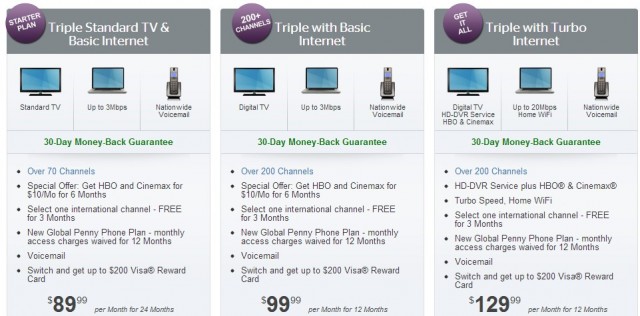

In February, Stop the Cap! noted that Time Warner Cable’s new customer promotions had dramatically changed for the worse. The package prices remained the same — around $80 for a double-play or $89-99 for a triple-play package of cable, broadband, and/or phone service, but customers received a lot less for their money. For example, last year’s promotions bundled Standard/Turbo Service broadband (10-15Mbps) with most offers. Starting this year, only 3Mbps Internet is included. Equipment fees are still extra, but more costly than ever – $8.99 a month for a traditional set-top box, $21.94 a month for a DVR-equipped box and service.

Robert Marcus, Time Warner Cable’s chief operating officer now admits it was all part of the plan, and the company now earns 15-20% more from customers subscribing to the less-aggressive new customer promotions.

“In January we implemented a new pricing and packaging architecture that’s designed to drive greater [new customer revenue] and profit,” Marcus told investors. “We still advertise the same beacon prices, but the product packages are leaner, with lower speeds and fewer channels and features. Once our beacon offers get the phone to ring, our inbound sales reps are trained to help customers select options that are important to them, like faster broadband or a DVR. As a result, customers are up-sold into packages that better meet their needs.”

This year’s promotions largely only bundle 3Mbps broadband instead of the standard 10-15Mbps bundled last year.

Marcus admitted the trade-off is customers shopping around for the best deal who read the fine print are likely to consider an offer from a competitor more closely. Others are disconnecting service when their promotion expires.

Marcus

“By and large, when were talking about triple play disconnects, they are going to our telco competitors,” Marcus said. “When we’re talking about single-play video disconnects, they, by and large, leave us for satellite. We’re increasingly finding that phone customers are dropping landline phone for wireless-only, and there are video customers who are leaving — and broadband customers for that matter, who are leaving the category, and that’s probably more of an affordability issue than anything else.”

Verizon FiOS is Time Warner’s most dangerous competitor because it beats the cable operator on broadband speed and promotional pricing. Time Warner faces some of the highest disconnect numbers in FiOS areas. AT&T U-verse is also having a greater impact because AT&T recently decreased the price of both their triple and double-play promotions and has increased broadband speeds in some areas, Marcus reported.

Marcus said Time Warner is handling the subscriber churn fine, and the cable company now cares more about higher revenue and profits than attracting deal-hunters who shop on price.

“Last year’s aggressive triple play offers drove significant connect volume, which led to the highest quarterly subscriber net adds we’ve had over the last several years,” Marcus said. “But in large part, we were attracting discount seekers who are more likely to [switch after the promotion ended]. In many cases, we caused customers who didn’t need or want phone to take a triple play offer just to get the low triple play rates.”

What new customers Time Warner did attract largely took one or two products from the cable company, usually cable television and broadband. New phone service customers have declined year-over-year as a result of less attractive pricing. Instead, Marcus noted customers are spending on incremental broadband speed upgrades, which cost Time Warner much less than delivering phone service.

Nobody needs 1Gbps, argues Britt.

With the looming threat of Google Fiber in both Kansas City and Austin, Britt seemed generally unconcerned about the impact the gigabit broadband provider would have.

“At the end of the day, what we’re doing is not any different than an overbuilder, and we’ve had overbuilders for the last several decades in this business so that’s what they appear to be doing,” Britt said. “They appear to be very aggressive on price. They’re even giving some tiers away essentially for free, and we’ll see where that goes. Despite the glow and all of that, the products are essentially the same others are offering today in a practical sense.”

Britt said gigabit speeds probably won’t have the impact many customers think they should because most websites are not built to deliver content at those speeds.

Marcus noted that in Kansas City, Google has only passed 4,000 homes so far, about 2,000 of which are Time Warner Cable customers.

“The number of defections we’ve seen is de minimis at this point,” Marcus said.

Both Britt and Marcus responded to a question about consumption billing saying nothing had changed in the company’s thinking about usage caps or charging for what customers consumed.

“We have in place in almost all of our footprint the option for people to pay less money if they wish to really consume less,” Britt said. “People who want to keep getting unlimited and pay for that, can do that. So we really don’t have anything new. It is in place in our whole footprint, I think, except one location.”

“The take rate on that offering has still been fairly modest, but we think it’s a very important principle that there’s a relationship between usage and the price that customers pay,” Marcus added.

Some other highlights:

- Time Warner Cable’s cloud-based set-top box guide is now testing in employee homes with plans to roll the new boxes out to subscribers later this year. Britt said these were the first of a new generation of all-IP boxes, which means if you have a device in your house that knows how to receive IP, you’ll get access directly via WiFi or through a cable technology called MoCA;

- Time Warner Cable will digitally encrypt its entire television lineup in New York City;

- Time Warner Cable’s recent restructuring cost 500 employees their jobs, mostly in finance, marketing and human resources.

Subscribe

Subscribe

Greenlight, the broadband provider owned and operated by the city of Wilson, N.C. today announced that it will begin offering gigabit Internet connectivity services to its customers by this July.

Greenlight, the broadband provider owned and operated by the city of Wilson, N.C. today announced that it will begin offering gigabit Internet connectivity services to its customers by this July.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Since introducing its version of TV Everywhere more than a year ago, one of the most frustrating aspects of Time Warner Cable’s video streaming service has been it only works within your own home over the cable company’s own broadband service. As of tomorrow morning, that will change. If you own an Apple iOS tablet or smartphone, the cable company’s new version of its TWC TV app (free) will bring streamed and on-demand programming from a handful of cable networks regardless of where you happen to be.

Since introducing its version of TV Everywhere more than a year ago, one of the most frustrating aspects of Time Warner Cable’s video streaming service has been it only works within your own home over the cable company’s own broadband service. As of tomorrow morning, that will change. If you own an Apple iOS tablet or smartphone, the cable company’s new version of its TWC TV app (free) will bring streamed and on-demand programming from a handful of cable networks regardless of where you happen to be.