As Cox Communications continues to expand its arbitrary data cap program on its broadband customers, the company has announced a ‘cap relief’ option for customers willing to pay $50 more for the same service they enjoyed last year without a data cap.

As Cox Communications continues to expand its arbitrary data cap program on its broadband customers, the company has announced a ‘cap relief’ option for customers willing to pay $50 more for the same service they enjoyed last year without a data cap.

Company insiders tell DSL Reports Cox will introduce a new $50 option to avoid the data caps and overlimit fees the company began imposing in 2015 starting in its Cleveland, Ohio service area.

On Wednesday, Cox is expected to introduce two add-on options to help avoid the bill shock likely if customers exceed 1TB of usage per month and face the $10 overlimit fee for each 50GB of data consumed:

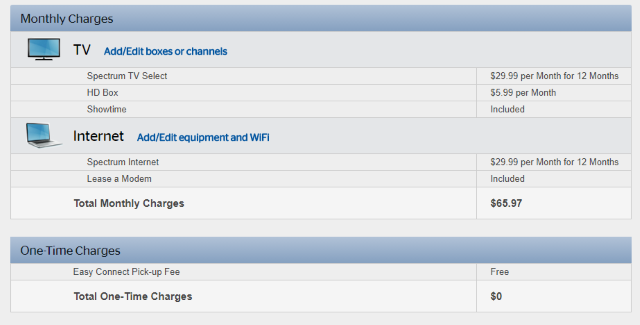

- $30 a month for 500GB of extra data;

- $50 a month to avoid data caps altogether and get back unlimited service.

These fees are in addition to whatever Cox customers currently pay for broadband service.

“An overwhelming majority of data is consumed by a very small percentage of internet users,” a memo to employees documenting the changes reads. “The new choices are great options for the small percentage of heavy users who routinely use 1TB+ per month and prefer a flat monthly rate, rather than purchasing additional data blocks. In Cox markets with usage-based billing, the less than two percent of customers who exceed the amount of data included in their plan still have the option of paying $10 for each additional 50GB of data when they need it.”

Such claims raise the same questions Stop the Cap! has always asked since we began fighting data caps in 2008:

If data caps only impact <2% of customers, why impose them at all?

Is the actual revenue earned from overlimit fees worth the expense of introducing usage measurement tools, billing system changes, and the cost of customer dissatisfaction at the prospect of an unexpectedly high bill?

What technical reasons did Cox choose 1TB as its arbitrary usage allowance other than the fact Comcast and other operators chose this level first?

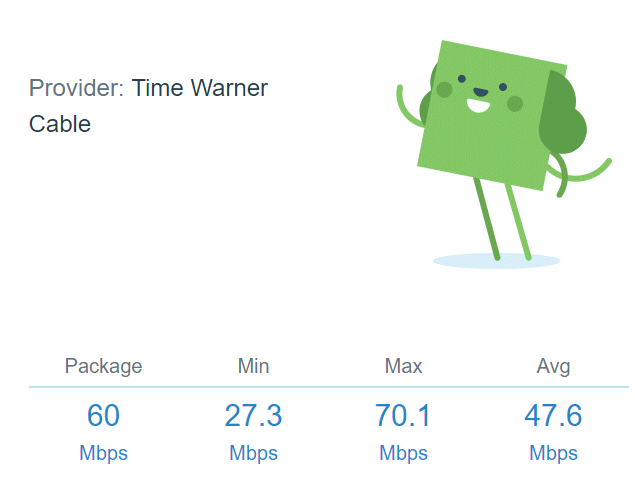

Time Warner Cable executives privately admitted in internal company documents obtained by the New York Attorney General’s office that internet traffic costs represent little more than “a rounding error” in expenses for cable companies. But for most consumers, $30-50 to buy a bigger data allowance is hardly that.

In short, the “solution” Cox has decided on this week comes in response to a problem the company itself created — imposing arbitrary, unwanted data caps and overlimit fees on a product that is already intensely profitable at the prices Cox has charged for years. This internet overcharging scheme is just another way to gouge captive customers that will likely have only one alternative — the phone company and its various flavors of DSL or a U-verse product that cannot compete on speed unless you are lucky enough to live in a fiber-to-the-home service area.

Subscribe

Subscribe