Robocallers pitching extended auto warranties, home alarm systems, lowered interest rates on credit cards, and more are back in business, despite the “Do Not Call Registry” from the Federal Trade Commission designed to stop the junk phone calls.

Robocallers pitching extended auto warranties, home alarm systems, lowered interest rates on credit cards, and more are back in business, despite the “Do Not Call Registry” from the Federal Trade Commission designed to stop the junk phone calls.

Rogue telemarketing has gotten so out of hand, the very federal agency responsible to help stop the torrent of unwanted sales calls had to post a warning about telemarketers misrepresenting themselves as FTC agents on its own website.

The FTC acknowledges it has an uphill battle.

“Our law enforcement actions have already halted billions of robocalls, but with today’s technology, tens of millions can be blasted each day — at a per-minute calling cost of less than 1 cent,” said Federal Trade Commission official Lois Greisman, who oversees the National Do Not Call Registry.

Identifying violators has become increasingly difficult as scammers learn to fake (or ‘spoof’) call origination data that shows up on your Caller ID display.

“Dozens and dozens of spoofed numbers can be used per robocall campaign, and telemarketing scripts are shared as well,” says Greisman, explaining why you may get the same rip-off recording from different incoming numbers.

The most recent trick is to spoof a Caller ID number that appears local, increasing the odds you will pick up the phone. Instead of a family friend on the other end, it is a recorded pitch offering to refinance your mortgage.

A desperate FTC concluded it might be in over its head and launched a contest offering $50,000 and a trip to Washington, D.C. for anyone offering a better solution.

The winner: Nomorobo

Nomorobo is the idea of Steve Foss and it tied first place in the FTC Robocall Challenge.

Nomorobo is the idea of Steve Foss and it tied first place in the FTC Robocall Challenge.

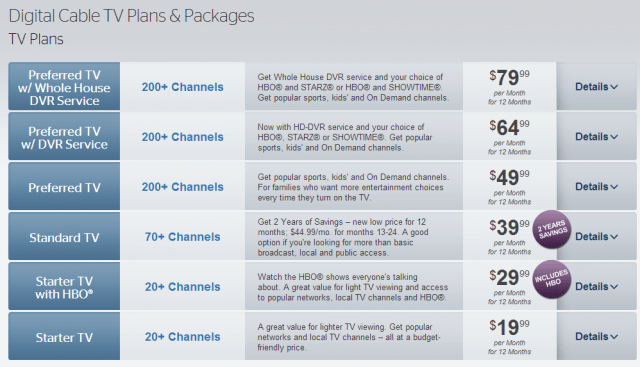

The free service works with most Voice over IP phone lines (think Vonage or a phone line supplied by your cable operator), but has gotten a mixed reception from wireless carriers and landline giants Verizon and AT&T.

It works with a phone feature called “Simultaneous Ring,” which means when a person calls your number, Nomorobo’s “phone” is also ringing just long enough to collect Caller ID information to compare against its master-telemarketer list. If the number is a known phone spammer, Nomorobo intercepts the call and hangs up on the caller after the first ring. Your legitimate calls still arrive with no interference.

Some phone companies known to support Nomorobo, but not necessarily the only ones:

- AT&T U-verse

- Cablevision Optimum

- SureWest

- Time Warner Cable

- Verizon FiOS

- Vonage

Phone companies like AT&T and Verizon have so far refused to support the service for its landline and wireless customers.

After registering, Nomorobo will guide new users through the simple set up process step-by-step.

After registering, Nomorobo will guide new users through the simple set up process step-by-step.

The system does not track your incoming calls nor does it monitor them. If an unwanted telemarketer does get through, a report option on the website will help get the unwanted caller’s number into the database.

Stop the Cap! has tested the service and found it effective in blocking about 75% of the unwanted calls that arrive in our office. Our phone rings just once — long enough for caller ID information to be passed — and when the system identifies a known phone spammer, it disconnects them. But the system is not perfect. Telemarketers can theoretically change their spoofed Caller ID number(s) to get around the call block, and we found Nomorobo’s database only as good as the crowdsourced data allows.

Nomorobo also won’t stop political or non-profit groups from calling, at least for now. Our second biggest problem — calls from collection agencies hounding the last owner of our phone number, also remain unaffected.

[flv]http://www.phillipdampier.com/video/KNXV Phoenix Block robocalls for free with new website 10-15-13.mp4[/flv]

KNXV in Phoenix explains Nomorobo to its viewers. The service works mostly with Voice over IP providers, which leaves a lot of AT&T and Verizon customers unprotected. (2:04)

Subscribe

Subscribe The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

Local ABC, CBS, NBC, FOX, PBS, and CW stations;

Local ABC, CBS, NBC, FOX, PBS, and CW stations; Cox Communications is contemplating jumping into the bidding for

Cox Communications is contemplating jumping into the bidding for  Cox and Cablevision, the nation’s two largest privately held or controlled cable companies, have both been mentioned as targets for takeover in a rush to consolidate the cable industry. Cablevision has been rumored to be on the verge of selling for years, but the Dolan family that founded the cable operator has the final say. Cox previously indicated it had no intention of selling, preferring to explore buying opportunities.

Cox and Cablevision, the nation’s two largest privately held or controlled cable companies, have both been mentioned as targets for takeover in a rush to consolidate the cable industry. Cablevision has been rumored to be on the verge of selling for years, but the Dolan family that founded the cable operator has the final say. Cox previously indicated it had no intention of selling, preferring to explore buying opportunities.