Wall Street analysts are predicting the end of free video streaming in the near-term as media and cable companies regain control over online content for themselves.

Wall Street analysts are predicting the end of free video streaming in the near-term as media and cable companies regain control over online content for themselves.

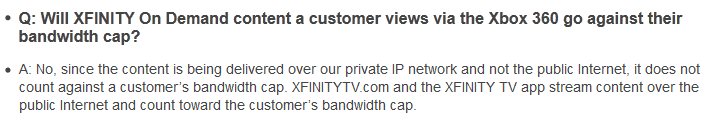

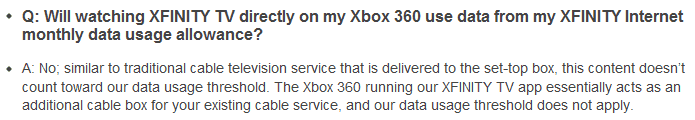

Cable companies are partnering with content producers to move a growing amount of streamed video content behind paywalls in an effort to protect their core business profits.

The trend is evolving so rapidly, analysts like Laura Martin with Needham & Co. predict the end of free streaming is imminent. Either customers will pay upfront or use TV Everywhere “authentication platforms” that require evidence of a pay television subscription before being able to watch.

Craig Moffett, an analyst with Sanford Bernstein, perennially sees cable operators as the most likely winners in the billion-dollar entertainment battle.

“They’re winning the broadband wars,” Moffett says of the cable industry. “Broadband is increasingly the flagship product, not the video distribution business.”

Cable networks and program producers are growing increasingly alarmed at the impact video streaming services like Hulu and Netflix are having on their bottom lines.

Case in point: the fall of Nickelodeon, a popular children’s cable network that used to guarantee high ratings and lucrative ad revenue. Recently the network has fallen off the ratings cliff. Some careful analysis found the reason why: Netflix. Nickelodeon, along with many other cable networks, licensed a number of their series to Netflix for on-demand viewing. In households with young children, parents increasingly choose the on-demand Netflix experience for family viewing over the traditional cable channel.

That’s a major problem for content producers and networks, and Moffett quotes industry insiders who predict licensing deals for Netflix streaming will increasingly not be renewed (perhaps at any price) as networks retrench to protect their core business. What is left will soon be behind paywalls, limited to customers who already subscribe to a pay television service.

That line of thinking is already apparent at Time Warner (Entertainment), Inc., where CEO Jeff Bewkes rarely has a good thing to say about Netflix. His company refuses to license a significant amount of their content for online streaming because it erodes more profitable viewing elsewhere.

Time Warner only licenses older content and certain “serialized dramas” that have proven difficult to syndicate on traditional broadcast television or cable outlets. But the company keeps kid shows to itself and its own distribution platforms, like Cartoon Network.

When it does let shows go online, it wants them behind paywalls.

Bewkes applauded Hulu’s recently announced plans to move its service away from free viewing. Authenticating viewers as pay TV subscribers before they can watch “makes sense” to Bewkes.

“Hulu is moving in the right direction now,” Bewkes said.

Big media companies do not want significant changes to the viewing landscape, where major networks front the costs for the most expensive series, and cable networks commission lower budget programs and repurpose off-network content. Pay television providers bundle the entire lineup into an enormous package consumers pay to receive. That is the way it will stay if they have their say.

“Just because consumers would rather get individual channels a-la-carte, on-demand, and streamed — only what they want to pay for — [if they think] that is inevitably the way the world if going to evolve, not so fast,” Moffett said. “It may be the way consumers want it and it may be the way technologists want it, but the media companies have a say here.”

“There is no way they are going to voluntarily unbundle themselves,” Moffett said.

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg Moffett on Cable Operators 4-30-12.mp4[/flv]

Craig Moffett talks about the current state of the media business on Bloomberg News. He sees trouble ahead for online video streaming, as powerful media and entertainment content distribution companies reposition themselves to better control their content… and the revenue it earns. The big winners: Cable operators, Hollywood, and major cable networks. The losers: Consumers, Netflix, Hulu, and free video streaming. (11 minutes)

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg Martin Sees End of Free Streaming TV Content 5-4-12.mp4[/flv]

Laura Martin with Needham & Co. predicts the imminent demise of free video streaming. Media companies can’t handle the loss of control over their programming, and the erosion of viewers (and ad revenue) it brings. Martin tells Bloomberg News she sees a future of paywalls blocking access to an increasing amount of online video content. (5 minutes)

Subscribe

Subscribe