Major cable and phone companies are rolling out new bundled packages and promotions designed to protect their cable television packages from cord cutting.

Major cable and phone companies are rolling out new bundled packages and promotions designed to protect their cable television packages from cord cutting.

Verizon, Comcast and Time Warner Cable have all run promotions that carry a clear message: cancel your cable television and your wallet gets it.

The Wall Street Journal shared the story of Comcast subscriber Cathy Vu, who decided she no longer wanted cable TV and tried to downgrade to a broadband-only account.

Comcast gave her an offer she could not afford to refuse when the representative explained canceling cable television would increase her monthly bill $20. As a result, Vu decided she would save more money keeping her cable television turned on.

Welcome to the new world of double and triple play bundled pricing promotions that bring downgrade penalties customers cannot ignore.

The idea of repricing cable service to protect vulnerable cable television and phone service began in earnest after analysts like Sanford Bernstein’s Craig Moffett began noticing customers were no longer addicted to keeping cable television, no matter the cost. He proposed a solution: price broadband service higher and cut the cost of cable television.

The result: carefully constructed promotional and bundled package offers that entice customers to purchase services they might not even want, to get the best (and sometimes lowest) price. Gone were promotions that offered phone, broadband, and television service for $33 each. In their place, new pricing that charges $60-70 for the first service, and heavily discounted prices for each additional service.

You know the pitch:

“Yes, I am calling to sign up for broadband service,” you say.

“Certainly, I would be glad to help you with that. But did you know that for just $20 more a month, you can also get cable television?”

“Really, it’s only $20 more? Sure.”

“I am thrilled to hear you say that. But I hope you are sitting down because I have more good news. For just $10 more, we can give you a phone line with unlimited local and long distance calling. How much do you pay the phone company now?”

“Too much, that sounds like an amazing deal, so I get everything together for $99 a month?”

“You sure do, for the first 12 months anyway.”

One year later when the promotion ends, you call to begin downgrading service to lower your bill. But cable and phone companies are increasingly ready for you.

First they will offer you a slightly less attractive promotional retention offer to keep your business. If you accept, the company gets to book the extra revenue and probably locked you into an annual service agreement.

If you don’t bite and insist on a downgrade, they have some bad news for you — that broadband service you still want will now cost you $60-70 a month, including the modem fee.

If you bail early on a promotional discount offer, the bite on your wallet can be significant.

The Journal found unbundling just does not pay:

- Comcast: TV + Internet for about $50/month for the first 6 months vs. standalone same speed Internet for about $70/month.

- Verizon FiOS: TV + Internet for about $85/month (two-year contract) vs. standalone Internet for about $80/month.

- Time Warner Cable: TV + Internet for about $50/month for 12 months vs. standalone Internet for about $45/month for 12 months, then up to $60 after that.

At the end of the day, Moffett and the rest of Wall Street get their wish — preservation of the all-important growing average revenue (ARPU) collected from each customer. Downgrades lower ARPU, so they must be discouraged at all costs.

At the end of the day, Moffett and the rest of Wall Street get their wish — preservation of the all-important growing average revenue (ARPU) collected from each customer. Downgrades lower ARPU, so they must be discouraged at all costs.

Cable operators “recognize that their most advantaged product is broadband,” said Moffett. “They don’t want to sacrifice that advantage by giving the opportunity for customers to cherry pick their best product at a low price and take the rest of your services from somebody else. In effect, they are pricing the broadband at a price that discourages you from taking broadband only.”

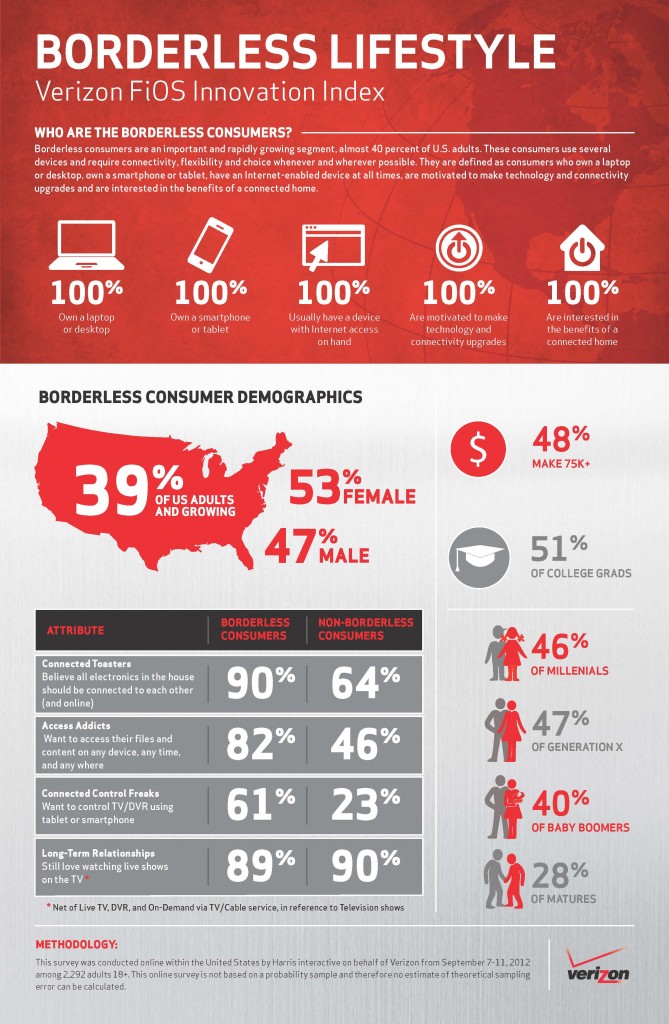

Customers primed for cord cutting (or who have never bought cable TV) are likely to receive targeted mailings from Verizon, Comcast and Time Warner Cable encouraging subscriptions to cable TV and prices that nearly give the service away.

Comcast’s Blast Plus promotion in selected markets delivers 30Mbps broadband with Digital Economy television service, both for $50 a month for six months. Internet-only customers would pay $70 per month for the same speeds without television.

Time Warner Cable in New York City wants to be your cable TV supplier so much, it offers a package of broadband and throws in Broadcast Basic service for just $5 more per month. Combined, Turbo Internet and television will cost $49.99 a month for a year. Standalone Internet on a promotion runs $45 a month for 12 months.

On a strict cost basis, charging more for Internet does not make sense. The Journal reports that about 90% of your monthly broadband bill is pure profit for cable operators, because the cost of delivering the service has continued to plummet to all-time lows. Cable television is no longer the cash cow it used to be for cable operators because programmers increasingly demand a piece of the profit pie. Today, cable operators only get to book about 35% of your monthly cable television payment as profit.

[flv width=”640″ height=”369″]http://www.phillipdampier.com/video/WSJ Cable Cord Cutting Less Attractive 11-13-12.mp4[/flv]

The Wall Street Journal examines the trend towards repricing broadband service so that customers feel compelled to keep their cable television package or face even higher bills. (5 minutes)

Subscribe

Subscribe