Just weeks after Time Warner Cable and CBS settled a dispute over retransmission fees, other broadcasters and networks are preparing to make new demands for increased compensation from their cable, satellite, and telco IPTV partners at prices likely to provoke more blackouts.

Just weeks after Time Warner Cable and CBS settled a dispute over retransmission fees, other broadcasters and networks are preparing to make new demands for increased compensation from their cable, satellite, and telco IPTV partners at prices likely to provoke more blackouts.

Despite repeated protestations from Time Warner that over-the-air stations and networks deserve lower fees than cable-only networks, once the two parties went behind closed doors, the cable company quickly agreed to pay considerably more for CBS programming. Sources say CBS made a deal that will run up to five years and includes more than $1.50 in fees per subscriber, up from between 50-85 cents per month, depending on the city served, under the old contract. CBS had asked for about $2 a month. Effectively, the company will earn more than that because Time Warner also agreed to renew both the CBS Sports Network and Smithsonian Channel, which cost extra.

“There is a new template here. Two dollars is the new holy grail,” Wunderlich Securities analyst Matthew Harrigan told Reuters.

Fox was the highest paid network before the CBS deal, collecting close to $1.25 per month per subscriber. ABC receives 50-65 cents and NBC less than that.

Harrigan predicts the other networks will race to raise their own prices, with Time Warner Cable (and others) likely forced to raise rates early next year to cover increased costs.

In the war for compensation, programmers hold most of the leverage.

[flv width=”392″ height=”244″]http://www.phillipdampier.com/video/WSJ Lessons Learned CBS 9-2-13.flv[/flv]

The Wall Street Journal reports the dispute between Time Warner Cable and CBS set new industry precedents on the value of broadcast stations and networks and how their programming is distributed on digital platforms. (2 minutes)

There have already been local station blackouts in 80 cities so far this year, with the likelihood last year’s record of 91 markets will be broken before Thanksgiving. In almost every instance where a popular network is involved, the pay television provider eventually capitulates because of subscriber complaints or cancellations.

Moonves

Time Warner Cable admits its dispute with CBS cost the company business, both from prospective new customers going elsewhere and customer disconnects. Time Warner also spent money advertising its side of the dispute and paid to distribute free antennas to affected subscribers.

CBS’ Les Moonves had predicted Time Warner would eventually meet most of the network’s compensation demands before football season arrived. He was right.

“CBS is the winner. Content owners always win these negotiations, it’s just a matter of how much they won,” said Craig Moffett of Moffett Research. “They have all the leverage. Consumers don’t get mad and trade in their channel when these fights drag on. They go looking for a different satellite or telephone company.”

Almost 200,000 Time Warner Cable television customers left during the second quarter, and company officials admit that trend continued during the third quarter as the dispute dragged on. Time Warner Cable is likely to end the year with fewer than 11.5 million video subscribers, a loss of several hundred thousand this year.

Sources say one major sticking point that kept CBS off Time Warner Cable systems for nearly a month wasn’t about money. Instead, it was about digital distribution rights.

Time Warner Cable wanted CBS on its TV Everywhere app TWCTV and was also concerned about CBS selling content to online video streaming competitors that could accelerate cord-cutting.

Time Warner Cable did win permission to offer Showtime on its digital streaming platform and on apps for portable devices. But Time Warner will not get to carry local CBS-owned stations on streaming platforms, a significant blow. The cable company will also have to pay more for streamed and on-demand content.

In the end, CBS got almost everything it wanted and Time Warner Cable was handed back its largely unfulfilled wish list and a bigger, retroactive bill subscribers will eventually have to pay.

“We wanted to hold down costs and retain our ability to deliver a great video experience to our customers,” Time Warner Cable CEO Glenn Britt said in defense of the agreement. “While we certainly didn’t get everything we wanted, ultimately we ended up in a much better place than when we started.”

Moonves gloated to various trade publications and investors that CBS went unscathed after the month-long dispute.

“Our national ad dollars did not go down,” Moonves told attendees at the recent Bank of America/Merrill Lynch Media Communications & Entertainment Conference. “There were no such things as make-goods and there was no harm done financially to CBS Corporation.”

[flv width=”640″ height=”380”]http://www.phillipdampier.com/video/Bloomberg Moonves CBS Got Fair Value for Our Content 9-7-13.flv[/flv]

CBS’ Les Moonves has won his dispute with Time Warner Cable, says Les Moonves in this interview with Bloomberg TV. (10 minutes)

Comcast owns both NBC and the cable companies that carry its local affiliates.

Cable rate increases are not likely to stop with the agreement with CBS. Analysts predict NBC, ABC, and FOX will be seeking similar rates when their contracts come up for renewal. Altogether, every cable, telco IPTV, and satellite subscriber could see rates increase up to $6 a month for the four major American networks.

“Any time one of these larger networks sets the new standard in terms of pricing for their programming, the rest follow,” Justin Nielson, an analyst for SNL Kagan, told Hollywood Reporter. “In most cases it’s been CBS and FOX trailblazing what the rates should be and then ABC and NBC following.”

Comcast-NBC’s Steve Burke is already there. Burke told investors affiliates should be paying 20 to 25 percent more for cable networks such as USA, Bravo, SyFy, CNBC and MSNBC .

“We’re not paid as much as we should be given our rating and positioning by cable and satellite companies,” Burke said. “I see no reason why we won’t sort of draft behind the other broadcast networks and get paid in a similar way.”

Burke predicts NBC will earn between $500 million to $1 billion annually from increased retransmission consent fees comparable to what CBS and FOX receive.

Next week, DISH Networks faces the expiration of their contract with ABC/Disney-owned channels, including the Cadillac-priced ESPN. The outcome of renewal negotiations may serve as an indicator for where rates are headed in the world of retransmission economics.

A growing number of elected officials in Washington are paying attention as they and their constituents live through one programmer blackout after another. At least four pieces of legislation have been introduced to deal with the problem in very different ways, according to Bloomberg News:

The Satellite Television Extension and Localism Act

This law, known as STELA, dates to 2004 and gives satellite companies a license to provide local TV stations, just as cable operators do. The current law is set to expire at the end of 2014, with most observers calling its reauthorization a near certainty. The debate is mainly over how “clean” the STELA reauthorization bill will be as it emerges from the legislative process, with the pay TV companies urging lawmakers to address the issue of retransmission disputes. Broadcasters are working for a “clean” bill, written narrowly to address the satellite companies’ immediate needs. “There’s nothing clean about the current retransmission system,” says Brian Frederick, a spokesman for the American Television Alliance, a coalition of pay-TV companies. Two House committees held hearings on the law this week. A final bill and vote are expected next year.

Video CHOICE (Consumers Have Options in Choosing Entertainment)

Representative Anna Eshoo, a Democrat who represents much of Silicon Valley, introduced this bill Sept. 9 aimed at ending blackouts. “Recurring TV blackouts, including the 91 U.S. markets impacted in 2012, have made it abundantly clear that the FCC needs explicit statutory authority to intervene when retransmission disputes break down,” Eshoo said in a press release. (The FCC gets involved now only if one party accuses the other of negotiating in bad faith.) The bill would unbundle broadcast stations from a cable package and prohibit a broadcaster from requiring a pay TV operator to take affiliated cable channels to obtain more popular channels. That issue is at the heart of why Cablevision sued Viacom in February, following a contentious negotiation.

Eshoo’s bill would also require the FCC to study programming costs for sports networks in the top 20 regional sports markets. The rising fees for sports programming—led by ESPN—is considered one of the major influences behind rising cable bills and the power that content creators such as Disney hold in negotiations. Cable companies have praised Eshoo’s bill, while broadcasters are not fans. Don’t expect to see it get far in a Republican-led House.

Television Consumer Freedom Act of 2013

This bill, introduced in May by Senator John McCain (R-Ariz.), would end the long era of the cable television bundle, that phenomenon by which you pay for hundreds of channels and find yourself watching only about two dozen, or fewer. This summer, Connecticut Senator Richard Blumenthal signed on as a Democratic co-sponsor, but there’s been no similar sponsors on the House side. Blumenthal explained his support of the bill in an August interview with the Hollywood Reporter:

“What I hear from cable consumers overwhelmingly is, ‘give us freedom of choice. Don’t make us pay for something we don’t want and won’t watch. Why am I paying for—you name a channel you don’t like or five or ten or them—just so I can watch the one I do want.’ That’s overwhelmingly the sentiment of people who buy this product. So this bill just gives voice and force to that sentiment.”

Next Generation Television Marketplace Act

This bill from Representative Steve Scalise, a Louisiana Republican, and former South Carolina Senator Jim DeMint, also a Republican, dates to December 2011 and would deregulate the entire television market, top to bottom. It would repeal compulsory copyright licenses, the legal mechanism by which content owners are required to let pay TV companies carry their programs, if they are paid a fee for the content. The bill, which would also dismantle the system of retransmission fees, is essentially an exercise in carrying free-market ideology to its logical conclusion. The problem? It would require a countless number of individual deal negotiations—any radio or television station that wanted to carry programming (i.e., all of them)—would need to strike deals with every programmer, yielding an inefficient system that would likely prove unworkable. Lawyers would love the bill, but don’t expect it ever to pass Congress.

In fact, none of these bills are expected to pass through both the gridlocked House and Senate this year.

[flv]http://www.phillipdampier.com/video/CNBC Les Moonves Says It Would Be Dumb For Lawmakers To Change Retransmission Rules 9-4-13.flv[/flv]

CNBC also talked with CBS’ Les Moonves about CBS’ views towards compensation and distributing content online. (13 minutes)

C Spire, a wireless phone company serving the southeastern United States today announced ambitious plans to deploy a gigabit fiber to the home network in the state of Mississippi, now considered to be one of the worst states for broadband speed and availability.

C Spire, a wireless phone company serving the southeastern United States today announced ambitious plans to deploy a gigabit fiber to the home network in the state of Mississippi, now considered to be one of the worst states for broadband speed and availability. C Spire claimed its proposed fiber to the home network will expand faster and deeper into Mississippi than Google Fiber’s limited network in Kansas City and nearby suburbs.

C Spire claimed its proposed fiber to the home network will expand faster and deeper into Mississippi than Google Fiber’s limited network in Kansas City and nearby suburbs.

Subscribe

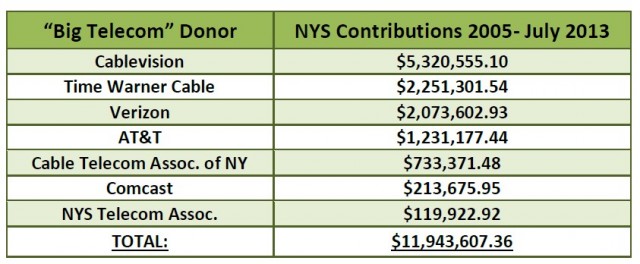

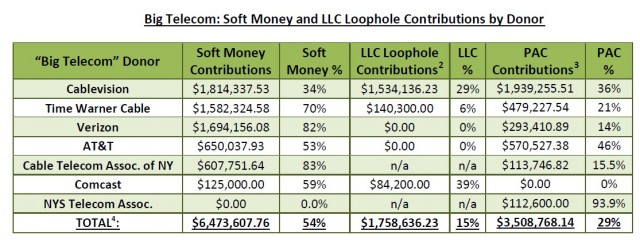

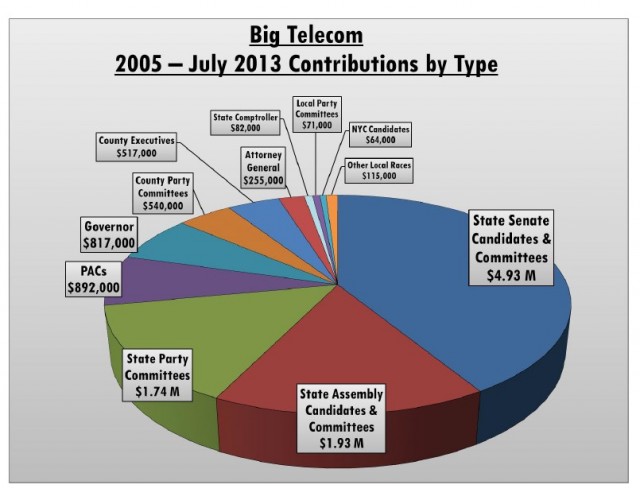

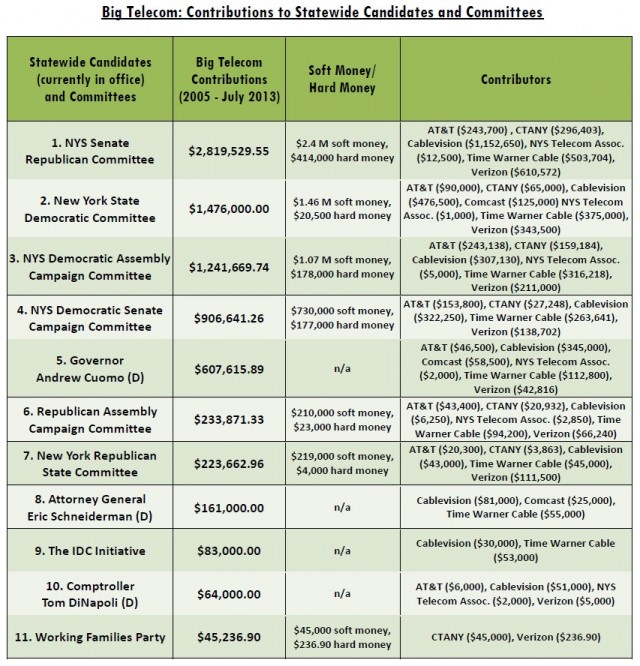

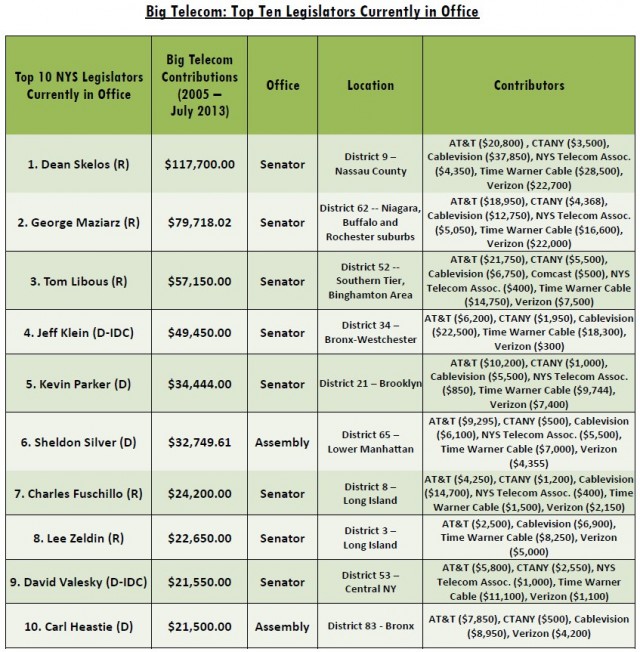

Subscribe Since 2005, five cable and telephone companies and their respective lobbying trade associations have donated nearly $12 million to New York politicians, making Big Telecom companies among the biggest political donors in the state. Now a government reform group wants an investigation by the state’s anti-corruption commission.

Since 2005, five cable and telephone companies and their respective lobbying trade associations have donated nearly $12 million to New York politicians, making Big Telecom companies among the biggest political donors in the state. Now a government reform group wants an investigation by the state’s anti-corruption commission.

Where does all the money go?

Where does all the money go?

A 7635-A / S5630-A: Establishes a moratorium on telephone corporations on the replacement of landline telephone service with a wireless system.

A 7635-A / S5630-A: Establishes a moratorium on telephone corporations on the replacement of landline telephone service with a wireless system.

A6003/S5577 — Directs the Department of Public Service to study and report on the current status of cable television systems providing services over fiber optic cables.

A6003/S5577 — Directs the Department of Public Service to study and report on the current status of cable television systems providing services over fiber optic cables.

Starting Oct. 1, Target shoppers will be able to order movies and television shows to rent or buy online at prices from 99 cents to $36.99.

Starting Oct. 1, Target shoppers will be able to order movies and television shows to rent or buy online at prices from 99 cents to $36.99. Just weeks after Time Warner Cable and CBS settled a dispute over retransmission fees, other broadcasters and networks are preparing to make new demands for increased compensation from their cable, satellite, and telco IPTV partners at prices likely to provoke more blackouts.

Just weeks after Time Warner Cable and CBS settled a dispute over retransmission fees, other broadcasters and networks are preparing to make new demands for increased compensation from their cable, satellite, and telco IPTV partners at prices likely to provoke more blackouts.

Cue the lawyers.

Cue the lawyers.