“Of course you know this means war.”

Altice USA has found a way to use CBS’ All Access online streaming service against a Connecticut CBS affiliate that blacked out its signal for some Connecticut Cablevision customers.

Meredith-owned CBS affiliate WFSB-TV in Hartford has been off the Optimum television lineup in two dozen Connecticut towns as of 5pm Friday, Jan. 13 after negotiations between Iowa-based Meredith and Altice USA broke down over the price of renewing a retransmission consent contract that Altice claims is 800% more expensive than before.

That means Optimum customers in Litchfield County no longer have access to CBS programming. Or do they? Optimum’s website is redirecting affected customers to WFSB’s network — CBS — and offering a week’s free trial of CBS’ All Access, which allows viewers online access to all CBS programming on demand.

Optimum’s previously negotiated distribution deal with CBS for the All Access platform has been in place since the summer of 2015, which means CBS cannot pull the offer down from Altice’s website. That effectively means CBS is being used to undercut its own affiliate’s most important leverage — taking away popular programming until a provider finally capitulates and signs a renewal contract.

Matt Polka, president of the American Cable Association, which represents small and independent cable companies, loves it.

“Local broadcasters cannibalized by their own network!” Polka tweeted.

Oh…The #Irony — Local #broadcasters cannibalized by their own network! Gotta love the #Internet and the #ISP that provides it! https://t.co/RABX3BHh4R

— Matthew M. Polka (@MATTatACA) January 16, 2017

Altice USA has promised investors it will hold the line on programming costs even if it means finding alternatives for customers. This seems to be an example at work.

Will CBS All Access weaken Meredith’s position on WFSB to force price concessions? The New Haven Register isn’t sure, reporting there are years of “bad blood” between Cablevision and Meredith over carriage contracts:

During the last retransmission agreement negotiations in 2014, Cablevision Systems called on the Federal Communications Commission to investigate whether Meredith Corp. was meeting public interest obligations that are an important component of all television station licenses. Cablevision also sued Meredith in Connecticut’s court system under the Unfair Trade Practices Act.

The latest dispute has attracted the attention of both of Connecticut’s U.S. senators.

“I typically don’t get involved because it’s not for me to dictate the terms of a dispute between a cable company and a network,” Sen. Chris Murphy said in a statement issued Friday night. “But I haven’t been pleased with Altice’s commitment to Connecticut since it bought Cablevision.”

FierceCable reported the area’s congressional delegation isn’t happy with either company:

Connecticut’s two Democratic U.S. Senators, Richard Blumenthal and Christopher Murphy, sent a letter addressed to both Meredith Corp. CEO Stephen Lacy and Altice USA CEO Dexter Goei.

“While we respect the private negotiations being conducted by Optimum and WFSB and make no representations as to the merits of either side’s position, we believe that the current impasse does a disservice to Connecticut families and we urge you to negotiate in good faith to bring an end to this blackout,” the Senators wrote.

Altice, meanwhile, said in its own statement, “We have been negotiating in good faith for weeks and made multiple offers to Meredith even though their initial request was for more than 800% over what we currently pay.”

Subscribe

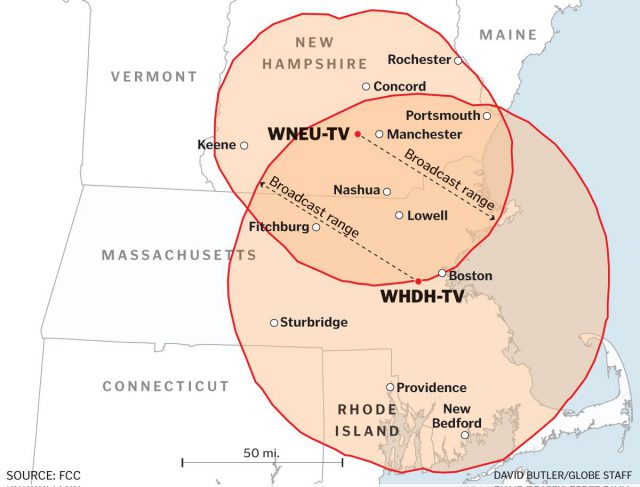

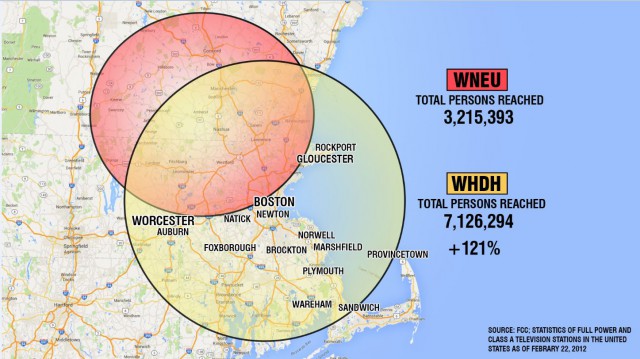

Subscribe Cord-cutting in Boston is getting more difficult if you are an NBC fan. Comcast, which owns NBC/Universal, has terminated its affiliation agreement with full-power Boston station WHDH and is moving NBC programming in Boston to a little-watched television station in New Hampshire currently affiliated with Telemundo.

Cord-cutting in Boston is getting more difficult if you are an NBC fan. Comcast, which owns NBC/Universal, has terminated its affiliation agreement with full-power Boston station WHDH and is moving NBC programming in Boston to a little-watched television station in New Hampshire currently affiliated with Telemundo.

Even Comcast recognizes the political controversy that is likely to erupt as a substantial portion of Boston’s cord-cutting over-the-air audience loses access to NBC unless they sign up for Comcast Cable or another pay television provider. So NBC has also arranged to buy low-power station WBTS-LD 46, which also currently airs Telemundo programming for the benefit of Boston residents within Route 128. WBTS does not come close to providing a good signal throughout Boston either, and Fybush notes over-the-air viewers in Worcester or on the South Shore are going to be out of luck.

Even Comcast recognizes the political controversy that is likely to erupt as a substantial portion of Boston’s cord-cutting over-the-air audience loses access to NBC unless they sign up for Comcast Cable or another pay television provider. So NBC has also arranged to buy low-power station WBTS-LD 46, which also currently airs Telemundo programming for the benefit of Boston residents within Route 128. WBTS does not come close to providing a good signal throughout Boston either, and Fybush notes over-the-air viewers in Worcester or on the South Shore are going to be out of luck. If you cut the cord and are watching all of your HD programming over-the-air, we have some bad news. Your current television set will soon be obsolete.

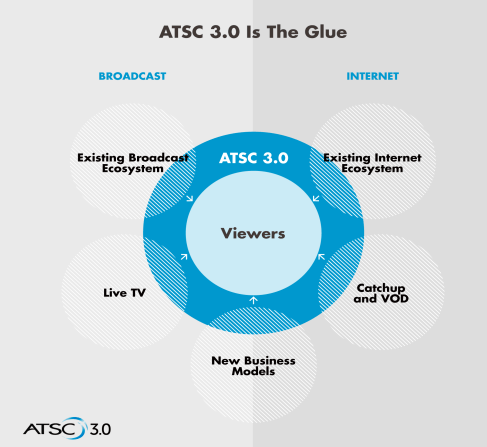

If you cut the cord and are watching all of your HD programming over-the-air, we have some bad news. Your current television set will soon be obsolete. To avoid a firestorm from the public, some station owners are thinking about a stop-gap measure that would launch a “digital bouquet” of participating local stations using lower bit rate Standard Definition on a single legacy ATSC 1.0 transmitter for at least a year or two until consumers upgrade their existing equipment. Then, one by one, existing HD stations would switch to ATSC 3.0 and effectively disappear from the dial of sets made before 2016. The good news is you would still have access to free television. The bad news is the picture will be significantly degraded.

To avoid a firestorm from the public, some station owners are thinking about a stop-gap measure that would launch a “digital bouquet” of participating local stations using lower bit rate Standard Definition on a single legacy ATSC 1.0 transmitter for at least a year or two until consumers upgrade their existing equipment. Then, one by one, existing HD stations would switch to ATSC 3.0 and effectively disappear from the dial of sets made before 2016. The good news is you would still have access to free television. The bad news is the picture will be significantly degraded. Unless something changes, NECN will disappear on Jan. 1, 2017, replaced by a new “NBC Boston” cable channel. The decision will also strand WHDH without a major network affiliation, which is likely to significantly cut the station’s value and ratings.

Unless something changes, NECN will disappear on Jan. 1, 2017, replaced by a new “NBC Boston” cable channel. The decision will also strand WHDH without a major network affiliation, which is likely to significantly cut the station’s value and ratings.

WHDH’s lawyers have now pushed back:

WHDH’s lawyers have now pushed back: LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content.

LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content. Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks.

Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks. In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.

In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.