We know what you are watching.

AT&T’s efforts to expand its U-verse platform to more communities is all about improving AT&T’s growing revenues in the broadband business and further monetizing customers’ broadband usage.

Those are the views of Jeff Weber, AT&T’s president of content and advertising sales. Appearing at last week’s Nomura Global Media Summit Conference, Weber also admitted AT&T is using viewer data collected from U-verse TV set-top boxes to help decide what networks to carry and which can be dropped because of lack of viewership.

Weber appeared at the conference to talk about the implications of Project Velocity IP — AT&T’s investment in expanding its U-verse platform and its proposal to transition rural landline customers to AT&T’s wireless service.

AT&T claims when the project is complete, two-thirds of its landline customers will have access to U-verse, and 99 percent of AT&T’s wireline service areas will be covered by AT&T’s mobile network.

Weber’s job primarily focuses on AT&T’s U-verse TV service — dealing with all the networks on the lineup and selling advertising time.

Although television programming is an important revenue generator for AT&T, broadband revenue is the real focus behind AT&T’s U-verse expansion.

“At the core, it is about improving the fundamental broadband business, extending our footprints to be able to cover more of our customers,” Weber said. “Because our core belief is that the broadband business is [going to be] a very good business for a long time.”

Weber

One way AT&T can further increase revenue is to limit broadband usage and charge overlimit fees for customers who exceed their monthly allowance. AT&T currently limits DSL customers to 150GB of usage per month, 250GB for U-verse broadband. The overlimit fee is $10 for each additional 50GB of usage. At present, both the usage limits and overlimit fees are not broadly enforced in many areas.

“I think very clearly incremental broadband usage is going to drive incremental revenue,” explained Weber. “Part of that assumption is that as traffic continues to grow, you need to be able to monetize that traffic in some way, shape or form. At the end of the day, it’s a pretty efficient market and a really efficient way for customers to pay. In almost every other way the more you use, the more you pay. And I don’t think that’s a radical notion and I suspect that’s a kind of thing we’ll see.”

AT&T already earns $170 a month in average revenue per U-verse customer, mostly from package sales of telephone, broadband, and television service.

Television programming content continues to be a major and growing expense for AT&T, eating into profits. Weber complained programming costs are “too high” and limit AT&T from asking subscribers to pay more when rate increases are contemplated.

Instead, AT&T is increasingly playing hardball with programmers, refusing to pay growing programming costs for certain networks and dropping others that do not have many viewers.

How does AT&T know what channels its customers are watching? The company tracks viewing habits with U-verse TV set-top boxes, which automatically report back to AT&T what channels and programs customers are watching.

“Everybody is facing [profit] margin pressure as content costs go up but the question is how will customers react to higher prices as content costs go up,” Weber said. “Everybody is having to make tough decisions and we’ve been able to use that data and make very smart decisions for our customers.”

As an example, Weber noted AT&T uses real viewer numbers during contract negotiations, suggesting that lower-rated networks deserve a lower rate. If a programmer refuses, AT&T can successfully drop a little-watched network without significant customer backlash.

Weber said the numbers are even more valuable when negotiating carriage fees for expensive regional sports networks. Weber said in one city, AT&T decided to not carry a regional network because it found the majority of customers never watched many of the sports teams featured.

Comcast’s Sportsnet for Houston is not available to some U-verse subscribers because AT&T determined the audience for the sports teams on the network was too small.

“We looked at how many of our customers watched zero of those games, one, two, all the way through 150 games for baseball and 80 games for the basketball team that we’re talking about,” Weber said, noting that if a particular viewer watched 30 or more games, AT&T considered that customer a passionate viewer likely to cancel service if the channel was dropped from the lineup.

“It was very clear the viewership intensity in that particular market was low and we didn’t need to pay the rates that were being asked and we’re not,” Weber said, calling the tracking a “perfect insight” into programming costs vs. viewership value.

AT&T also made it clear if programmers went around the company to sell channels direct to consumers over the Internet, AT&T would bring significant pressure for a wholesale rate cut, which some programmers might see as a deterrent to offering online viewing alternatives.

“If they’re going to [stream their programming online], then that’s a very different conversation and a very different value for our customer,” Weber said. “That’s a choice the content providers can make. We’re totally OK with that, but exclusivity versus non-exclusivity has materially different value for our customers, and I think we would want that reflected,” he added.

Monitoring customer viewing habits also helps AT&T earn more revenue by selling targeted commercial messages to specific viewing audiences.

“If an advertiser wanted to buy The Ellen DeGeneres Show, we know based on our data who that audience is,” Weber said. “We can go find that same audience outside of Ellen and maybe extend reach or drive [the ad] price a bit [higher]. We can also go find that same audience online or on your mobile phone.”

Sure enough, Robert Mercer, a DirecTV spokesman, explained the satellite provider pulls a credit report on every potential customer to determine their financial viability. DirecTV doesn’t want deadbeat customers, not after spending close to $900 to install satellite television in the average home.

Sure enough, Robert Mercer, a DirecTV spokesman, explained the satellite provider pulls a credit report on every potential customer to determine their financial viability. DirecTV doesn’t want deadbeat customers, not after spending close to $900 to install satellite television in the average home.

Subscribe

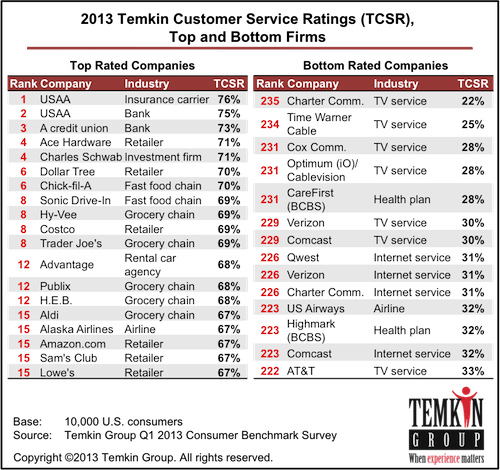

Subscribe Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a

Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a