Telecom Italia (TI) has a big problem. While AT&T charges the average American $66 a month for mobile service, competition in Italy has forced wireless prices down to $18 a month for comparable service.

TI chief executive officer Marco Patuano wants the price cutting to end and traveled to the United States to learn from AT&T how it was able to raise prices and increase customer spending with usage-capped Internet, phone and television service. His self-described “innovation trip” brought him straight to the office of AT&T CEO Randall Stephenson.

TI is trying to end years of losses and sales declines precipitated by falling prices and a growing disinterest in traditional landline service. AT&T accomplished that by boosting investment in mobile services. AT&T charged high prices for unlimited data plans until demand for data grew to the point the company could earn much more metering Internet usage. As a result, AT&T has earned a staggering $100 billion over the past decade from boosted phone bills.

Patuano

Patuano wants to find a way to follow in AT&T’s footsteps as TI’s share price has fallen more than 70 percent over the last six years. Fierce competition from Vodafone and VimpelCom have forced prices down across Italy. With prices so low, investors have shown little interest in providing funding for wholesale upgrades to 4G wireless service. In turn, that has kept Telecom Italia from offering faster data speeds which would allow them to raise prices for service.

In North America, high wireless prices and the relative lack of competition have brought considerably better financial returns for investors. That high rate of return has attracted investment allowing providers like AT&T and Verizon Wireless to spend billions on network upgrades that have, in turn, further increased revenue at both companies. Customers benefit from the faster speeds, but also pay for the privilege with some of the highest wireless prices in the world.

It’s a formula Patuano wants to bring to the Italian market, but he needs more investment to stabilize TI’s finances. TI was the government-owned phone company until it was privatized in 1997. Despite having a massive customer base, nimble wireless competitors have outflanked the phone company and the results have been falling sales, disconnected customers, and its $37 billion in debt reduced to junk status by investor rating services. The company sold its headquarters in Milan and got rid of its Argentine subsidiary, along with suspending shareholder dividends.

“The first target now for a phone carrier is upgrading networks and transform it to a platform for high-value services,” Patuano said. “This is exactly what AT&T did and what we are calling for.”

“The first target now for a phone carrier is upgrading networks and transform it to a platform for high-value services,” Patuano said. “This is exactly what AT&T did and what we are calling for.”

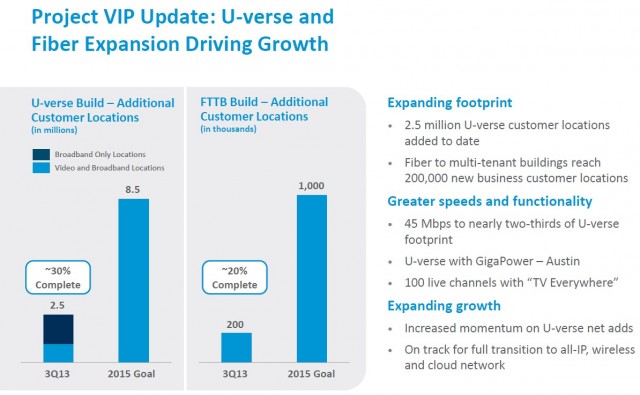

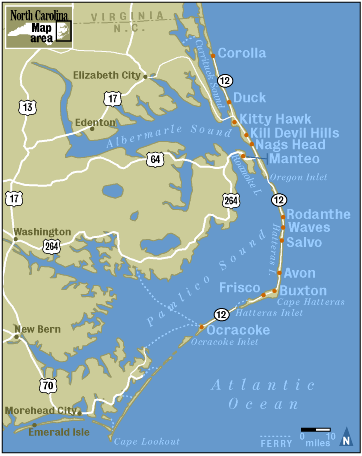

Patuano has seen AT&T defend its turf in the wireline business by scrapping its traditional landline/DSL-only service in larger markets in favor of a hybrid fiber-copper network dubbed U-verse. Patuano is now pondering whether TI could deliver a package of phone, broadband and television service over a broadband platform. The average AT&T U-verse customer spends $170 a month on U-verse, an amount much better than $18 a month. TI could do even better than AT&T because Italy lacks many cable television providers — Italians depend on satellite television for multichannel pay television.

AT&T and TI are no strangers to one another. In 2007, AT&T attempted to buy a stake in the Italian phone company but met with a storm of objections from Italian politicians. AT&T dropped the idea soon after.

Subscribe

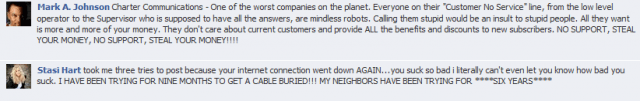

Subscribe Charter Communications’ march to all-digital service is one big Excedrin headache for many of the communities enduring the cable company’s conversion.

Charter Communications’ march to all-digital service is one big Excedrin headache for many of the communities enduring the cable company’s conversion. Only recently, Charter notified customers they also planned to encrypt the basic lineup, rendering the digital televisions useless without the additional cost and inconvenience of installing Charter’s digital set-top boxes. Although Charter will temporarily offer customers free rental of the boxes, after the offer expires, customers will pay Charter $6.99 a month for each box. For some upper end condos, the cost of renting multiple boxes will exceed the cost of the cable TV package.

Only recently, Charter notified customers they also planned to encrypt the basic lineup, rendering the digital televisions useless without the additional cost and inconvenience of installing Charter’s digital set-top boxes. Although Charter will temporarily offer customers free rental of the boxes, after the offer expires, customers will pay Charter $6.99 a month for each box. For some upper end condos, the cost of renting multiple boxes will exceed the cost of the cable TV package.

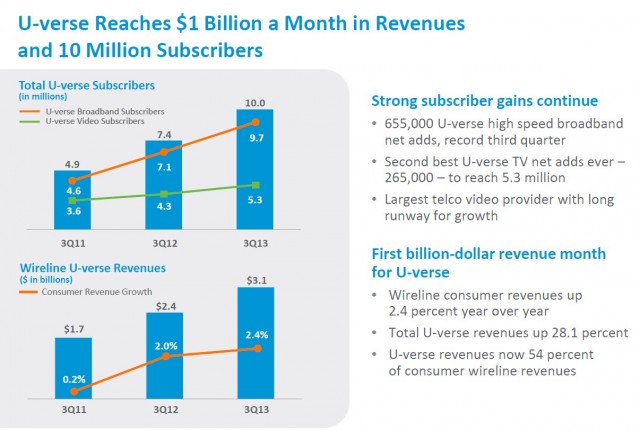

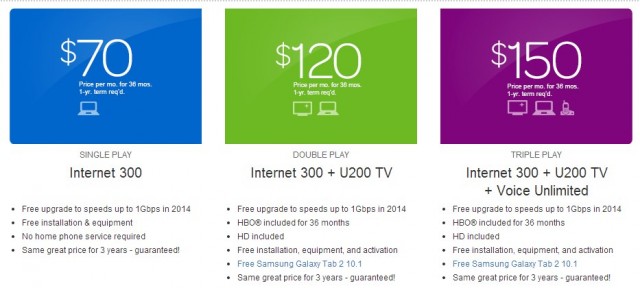

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.