DirecTV under AT&T’s ownership is turning out to be no bargain for customers finding it increasingly tough getting a promotional rate package with the satellite provider.

DirecTV under AT&T’s ownership is turning out to be no bargain for customers finding it increasingly tough getting a promotional rate package with the satellite provider.

Fred Johnson has been a DirecTV customer in rural Iowa for almost six years and has had to call DirecTV every time his on-contract promotion nears an end. Off-contract customers generally do not receive the best promotions and DirecTV’s regular prices can make the average cable company blush.

“It is not unusual for DirecTV customers to get quoted rates of $80 a month for satellite television and then receive a bill for over $100 once the surcharges, rental fees, taxes, and other hidden fees are added to your bill,” Johnson tells Stop the Cap! “There are months when the bill can go up even higher with no explanation, and even the customer service department cannot explain all the mysterious charges.”

At the end of the usual two-year contract, it has become customary for many long time DirecTV customers to call and threaten to cancel if they cannot get a renewed promotional rate, and for years DirecTV had been happy to oblige.

In 2015, AT&T bought the satellite provider and is in the process of integrating it as part of the AT&T family of services, next to U-verse, AT&T Mobility, and traditional landline service. That is the year the discounts seemed to evaporate for customers like Johnson and Evelyn Wiedmer, who subscribes to DirecTV for the family’s recreational vehicle.

Recreational vehicle owners are among the most loyal to satellite television.

“We were just told our bill was going to increase $45 a month starting in February and there is little we can do about it,” Wiedmer tells us. “The call center lady mentioned that the new owner of DirecTV is going in a different direction with promotions and we no longer qualify for any specials, unless we also want to get an AT&T cell phone.”

Wiedmer and her husband are retired and travel the country in their RV and do not have room in the budget to pay AT&T an extra $540 a year for the same package of channels they used to get for about $65 a month.

“They apparently do not want us to be customers anymore because DISH Networks will sell us a comparable package for about $60 a month, which is much less than the $105 DirecTV is charging us starting next month,” Wiedmer writes. “It looks like DirecTV won’t be competing with AT&T U-verse and the cable company anymore at their prices.”

Critics charge that is exactly the point. Adam Levine-Weinberg called the AT&T-DirecTV merger “one more step towards oligopoly,” warning approval of the merger would remove a serious competitor for tens of millions of customers also served by AT&T U-verse.

“That means there [were] tens of millions of people who [had] a choice between AT&T and DirecTV (as well as the local cable company and satellite TV rival DISH Networks,” said Levine-Weinberg. “The merger [reduced] many consumers’ pay-TV options from four to three, giving the remaining companies more pricing power.”

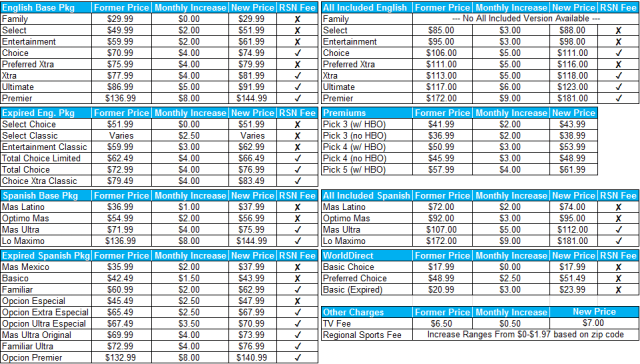

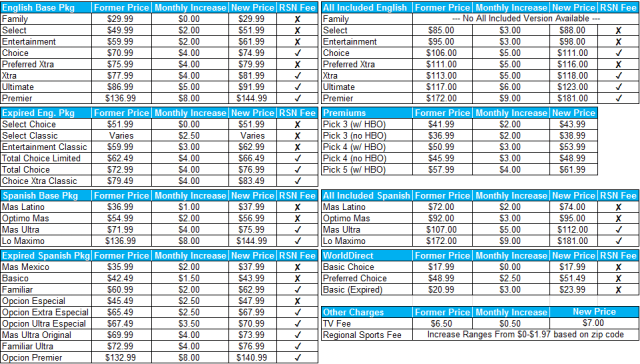

AT&T is flexing that pricing power by pulling back on promotions and discounts. In addition to curtailing retention plans and promotions for existing customers, AT&T also announced rate increases for DirecTV that take effect tomorrow:

The monthly pre-tax price of DirecTV’s “Select” and “Entertainment” programming tiers will go up by $2, to $51.99 and $61.99, respectively. The “Choice” and “Xtra” bundles will increase $4 to $74.99 and $81.99, respectively; the “Ultimate” pack will go up $5 a month to $91.99; and the “Premier” bundle will grow by $8 to $144.99. That is well over $150 a month after taxes and fees are added, just to watch television. AT&T is also applying a 50 cent increase to a fee DirecTV charges for… selling television service. The so-called “TV Fee” will now cost $7.00 a month.

(Courtesy: zidanetribal17)

“You used to switch to satellite to save money, but now cable companies offer returning customers lower prices than what DirecTV will offer,” notes Johnson. “It’s almost like they want to drive customers away. It worked. Our neighbors are now collecting money to convince Mediacom to extend their cable down our rural street and after these price increases we finally have enough willing to contribute to switch to cable television and remove the satellite dishes from our rooftops.”

Wiedmer has also canceled her DirecTV service this week, switching to DISH Networks.

“Would you sign another two-year contract agreeing to pay $540 more a year for two years with nothing in return for the extra money?” Wiedmer asks. “AT&T and DirecTV can take a hike.”

Cox Communications is requiring cable customers to add a cable box to their television set(s) or they will start losing channels as the company continues its nationwide effort to digitally encrypt all of its television services.

Cox Communications is requiring cable customers to add a cable box to their television set(s) or they will start losing channels as the company continues its nationwide effort to digitally encrypt all of its television services. Cox customers with a basic Starter package of more than 40 channels at $24.99 a month will get two miniboxes free for two years. Those with the second tier Essential package ($75.99) with more than 90 channels will get two miniboxes free for one year. You read that right. If you pay Cox more, you get free boxes for half the time lower-paying customers do. Each additional box is $2.99 a month. A traditional HD-capable set-top box from Cox rents for $8.50 a month.

Cox customers with a basic Starter package of more than 40 channels at $24.99 a month will get two miniboxes free for two years. Those with the second tier Essential package ($75.99) with more than 90 channels will get two miniboxes free for one year. You read that right. If you pay Cox more, you get free boxes for half the time lower-paying customers do. Each additional box is $2.99 a month. A traditional HD-capable set-top box from Cox rents for $8.50 a month.

Subscribe

Subscribe

Fido Cable (which has no relationship with the Canadian prepaid mobile provider “Fido,” owned by Rogers Communications), says internet and voice plans start at $39.99 a month, but not for TWC or Charter customers.

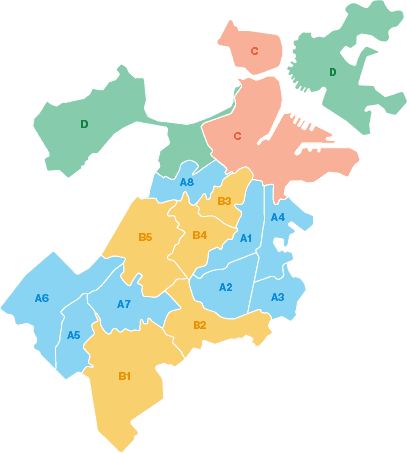

Fido Cable (which has no relationship with the Canadian prepaid mobile provider “Fido,” owned by Rogers Communications), says internet and voice plans start at $39.99 a month, but not for TWC or Charter customers. The long wait for fiber optic broadband in the city of Boston is finally over.

The long wait for fiber optic broadband in the city of Boston is finally over.

Frontier Communications plans to leverage their existing fiber-copper infrastructure to

Frontier Communications plans to leverage their existing fiber-copper infrastructure to

DirecTV under AT&T’s ownership is turning out to be no bargain for customers finding it increasingly tough getting a promotional rate package with the satellite provider.

DirecTV under AT&T’s ownership is turning out to be no bargain for customers finding it increasingly tough getting a promotional rate package with the satellite provider.