For more than 20 years, Boston residents have watched NBC for free on WHDH-TV Channel 7. But if Comcast gets its way, at least four million Beantown viewers may have to subscribe to pay cable television service to keep watching.

For more than 20 years, Boston residents have watched NBC for free on WHDH-TV Channel 7. But if Comcast gets its way, at least four million Beantown viewers may have to subscribe to pay cable television service to keep watching.

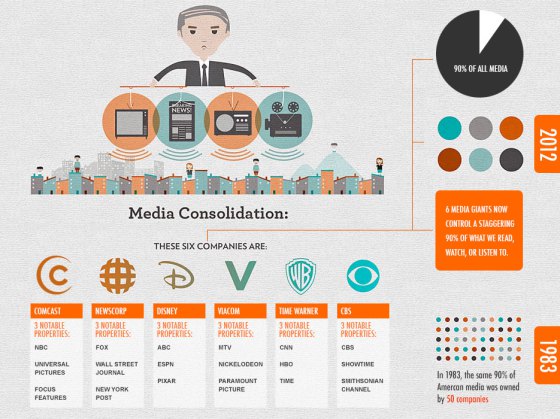

This morning, WHDH filed suit against the cable giant in federal court in Boston alleging Comcast broke federal and state laws and an agreement it signed with antitrust regulators when it announced it would not renew WHDH’s affiliation contract with NBC. Comcast acquired NBC in 2011, after agreeing to conditions preventing the cable company from engaging in anti-competitive behavior.

Media observers say Comcast has made no secret of its desire to buy WHDH or another Boston over the air station, to build its network of affiliates directly owned and operated by the cable company. Station owner Ed Ansin isn’t selling, at least not at Comcast’s current asking price. But eyebrows were raised when Comcast announced it would end its affiliation agreement with WHDH – a well-known, high-powered television station – and move NBC programming to New England Cable News (NECN), a low-rated Comcast-owned cable channel.

Unless something changes, NECN will disappear on Jan. 1, 2017, replaced by a new “NBC Boston” cable channel. The decision will also strand WHDH without a major network affiliation, which is likely to significantly cut the station’s value and ratings.

Unless something changes, NECN will disappear on Jan. 1, 2017, replaced by a new “NBC Boston” cable channel. The decision will also strand WHDH without a major network affiliation, which is likely to significantly cut the station’s value and ratings.

“Comcast has a reputation for pushing the envelope wherever they can but they’ve just done an awful lot of things wrong here,” said Ansin.

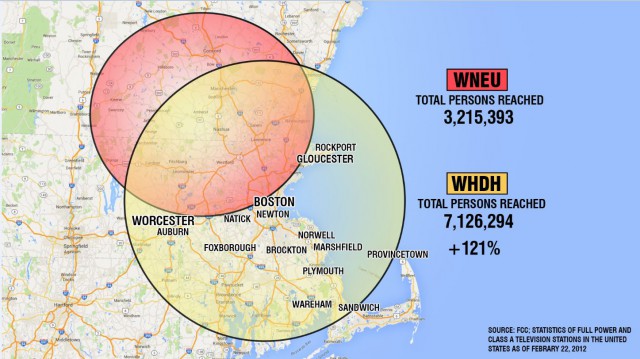

In an effort to limit the damaging optics of Comcast forcing free network television programming to pay cable, Comcast announced it would also relay its NBC Boston cable channel over a UHF channel in another state now showing Telemundo programming. Those without cable will have to adjust their antennas carefully to receive WNEU-TV Channel 60, in Merrimack, N.H, the new home of NBC for Boston-area cord-cutters and cord-nevers.

WNEU’s coverage area only reaches 50% of the Boston television market.

That may be good news for New Hampshire residents in Concord or Nashua that may have had trouble watching NBC shows over WHDH, but very bad news for about four million people inside Greater Boston who live where WNEU’s signal doesn’t reach, including those in primarily minority communities like Roxbury, Dorchester, Mattapan, and Brockton. Those residents, along with other areas in southern Boston, will likely have to call Comcast and buy cable TV to keep watching NBC starting this January.

WHDH’s lawyers have now pushed back:

WHDH’s lawyers have now pushed back:

When Comcast, the largest cable company in the world, acquired NBC in 2011, there was widespread concern about the impact this unprecedented accumulation of power in the television industry would have on viewers and other market participants. Particularly in markets like Boston, where Comcast is the dominant cable provider, citizen groups, industry participants and government agencies expressed concern that Comcast would seek to leverage its cable holdings and in the process degrade its broadcasting presence and diminish the important public service role that broadcast television stations historically have played. To address those concerns, Comcast promised its NBC affiliates (including WHDH) that it would negotiate affiliate extensions in good faith such that over the air access would be maintained, and cable interests would not influence those negotiations. As part of the FCC’s approval of Comcast’s acquisition of NBC, the FCC adopted these same conditions in order to protect the public interest.

WHDH believes that Comcast has violated these conditions. It also believes that Comcast’s actions violate Massachusetts law prohibiting unfair and deceptive business practices. Finally, WHDH believes that Comcast’s actions violate federal and state antitrust laws because they have enabled Comcast to increase its monopoly power in the Boston television market, and the resulting decrease in competition will harm consumers, advertisers and other broadcasters.

In its suit WHDH is seeking an injunction and an order requiring Comcast to comply with its obligations under its agreement with WHDH and the FCC order. WHDH will also seek damages.

WHDH also accuses Comcast of stringing it along on the renewal of its affiliate agreement, claiming they were told discussions about an extension would begin “when the time was right.” WHDH says Comcast was plotting to launch its own cable network alternative all along, and didn’t negotiate in good faith. In July 2013, NECN ad sales representatives began telling advertisers it would soon become the local NBC affiliate. After WHDH protested to Comcast, the cable company claimed NECN’s statements were untrue.

“No major national broadcaster has ever terminated its relationship with a successful independent affiliate in a major market to build its own local affiliate from scratch,” WHDH lawyers wrote.

[flv]http://www.phillipdampier.com/video/WHDH Boston Major announcement involving NBC and WHDH-TV 1-7-16.mp4[/flv]

WHDH in Boston informed viewers back in January that Comcast was not going to renew its affiliation agreement with NBC. Today, WHDH’s lawyers took Comcast to court. (3:27)

Subscribe

Subscribe

Residents in Los Angeles and San Diego join those in New York and Kansas City that can now receive local over the air programming on their home computer, tablet, game console, or Roku box. Time Warner Cable requires viewers to subscribe to both its television and broadband services to watch, and only from your home’s Wi-Fi network.

Residents in Los Angeles and San Diego join those in New York and Kansas City that can now receive local over the air programming on their home computer, tablet, game console, or Roku box. Time Warner Cable requires viewers to subscribe to both its television and broadband services to watch, and only from your home’s Wi-Fi network.