Phone companies looking for a cheap way to increase broadband speeds are turning away from fiber optics and towards advanced forms of DSL that don’t bring cost objections from shareholders.

Whether your provider is AT&T or an ISP in Europe or Australia, financial pressure to improve broadband on the cheap is fueling research to wring the last kilobit out of decades-old copper phone wiring.

Alcatel-Lucent suggests VDSL2 Vectoring is one such technology that can enable download speeds up to 100Mbps using noise-cancelling technology to suppress interference.

But the advice doesn’t impress fiber optic fans who suggest any reliance on deteriorating copper phone lines simply postpones an inevitable fiber upgrade that could come at a higher cost down the road.

VDSL2 Vectoring and G.Fast are only as good as the copper wiring that extends to each customer. Up to 45 percent of North American wire pairs are in some state of disrepair.

Vectoring has been described as “pixie dust” by Australia’s former Communications Minister Stephen Conroy. Conroy was overseeing Australia’s switch to fiber service as part of the National Broadband Network. But a change in government has scrapped those plans in favor of a cheaper fiber to the neighborhood broadband upgrade advocated by the new Communications Minister Malcolm Turnbull that resembles AT&T’s U-verse.

“Malcolm can sprinkle pixie dust around and call it vectoring and he can do all that sort of stuff but he cannot guarantee upload speeds,” Conroy told Turnbull.

As with all forms of DSL, speed guarantees are extremely difficult to provide because the technology only performs as well as the copper wiring that connects a neighborhood fiber node to a customer’s home or office. Upload speeds are, in practical terms, significantly slower than download speeds with VDSL2. Turnbull expected download and upload speeds on Australia’s VDSL2 network to be around a ratio of 4:1, which means a customer who has a download speed of 25Mbps per second would receive an upload speed of around 6Mbps.

In the lab, VDSL2 Vectoring delivers promising results, with speeds as high as 100Mbps on the download side. DSL advocates are excited about plans to boost those speeds much higher, as much as 1,000Mbps, using G.Fast technology now under development and expected in 2015. VDSL2 Vectoring and G.Fast both require operators to minimize copper line lengths for best results. Unfortunately, dilapidated copper networks won’t work well regardless of the line length, and with many telephone companies cutting back upkeep budgets for the dwindling number of customers still using landlines, an estimated 15-45 percent of all line pairs are now in some state of disrepair.

Assuming lab-like conditions, G.Fast can deliver 500Mbps over copper lines less than 100 meters long and 200Mbps over lines between 100 and 200 meters in length.

G.Fast also allows for closer symmetrical speeds, so upload rates can come close or match download speeds.

This cabinet houses the connection between a fiber optic cable and copper phone wiring.

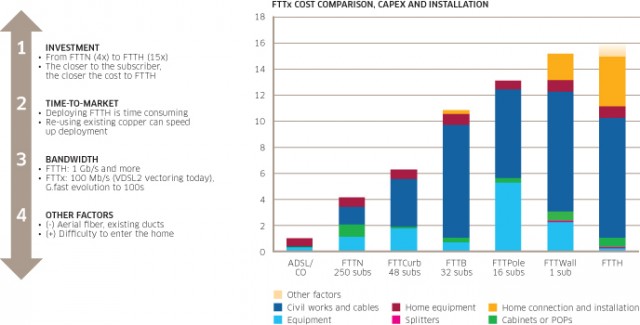

Providers prefer the copper-fiber approach primarily for cost reasons. There are estimates deploying a G.Fast-capable VDSL service to a home would cost around 70 percent less than fiber to the home service. Workers would not need to enter customer homes either, offering less-costly self-install options.

Telekom Austria and Swisscom are among providers committed to launching the technology. Both countries are mountainous and have many rural areas to serve. Fiber rich providers are also looking at the technology for rural customers too costly or too remote to service with fiber.

Critics question the real world performance of both VDSL2 Vectoring and G.Fast on compromised copper landline networks. Decades of repairs, deteriorating insulation, corroded wires, water ingress, and RF interference can all conspire to deliver a fraction of promised speeds.

Many critics also point to the required aggressive deployment of fiber/VDSL cabinets — unsightly and occasionally loud “lawn refrigerators” that sit either in the right of way in front of homes or hang from nearby utility poles. To get the fastest possible speeds, one cabinet may be needed for every four or five homes, depending on lot size. Australia’s VDSL network, without Vectoring or G.Fast requires at least 70,000 cabinets, each powered by the electric grid and temporary backup batteries that keep services running for 1-2 hours in the event of a power failure. The batteries need to be decommissioned periodically and, in some instances, have caused explosions.

The costs of electric consumption, backup batteries, infrastructure, and maintenance of copper lines must be a part of the cost equation before dismissing fiber to the home as too expensive.

Subscribe

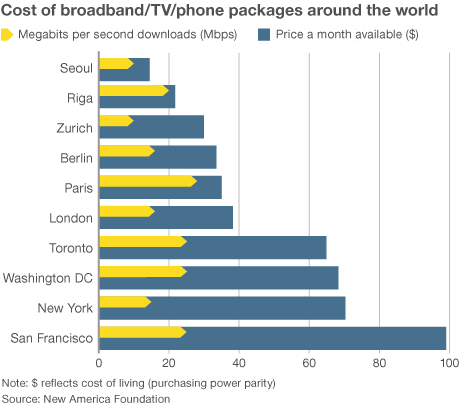

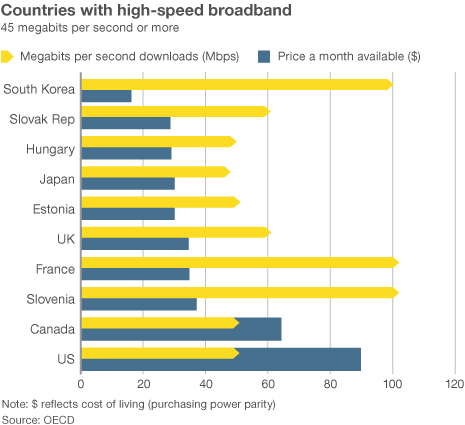

Subscribe Broadband in the United States costs far more than in other countries —

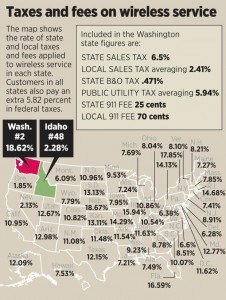

Broadband in the United States costs far more than in other countries —  “Americans pay so much because they don’t have a choice,” said Susan Crawford, a former special assistant to President Barack Obama on science, technology and innovation policy. “We deregulated high-speed Internet access 10 years ago and since then we’ve seen enormous consolidation and monopolies, so left to their own devices, companies that supply Internet access will charge high prices, because they face neither competition nor oversight.”

“Americans pay so much because they don’t have a choice,” said Susan Crawford, a former special assistant to President Barack Obama on science, technology and innovation policy. “We deregulated high-speed Internet access 10 years ago and since then we’ve seen enormous consolidation and monopolies, so left to their own devices, companies that supply Internet access will charge high prices, because they face neither competition nor oversight.”

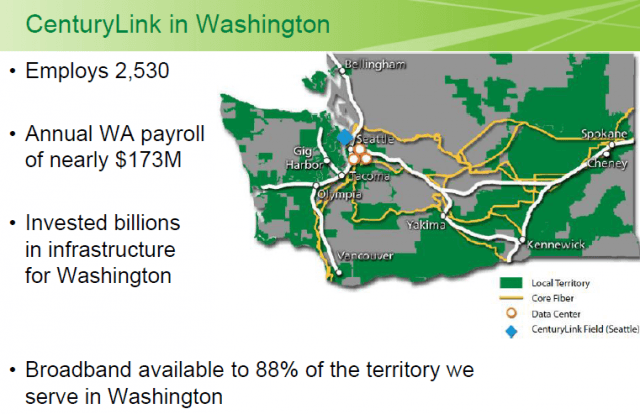

CenturyLink is seeking “greater flexibility” to set its own prices, terms and conditions of service without a review by Washington State regulators, even as its broadband customers complain about bait and switch Internet speeds and poor service.

CenturyLink is seeking “greater flexibility” to set its own prices, terms and conditions of service without a review by Washington State regulators, even as its broadband customers complain about bait and switch Internet speeds and poor service.

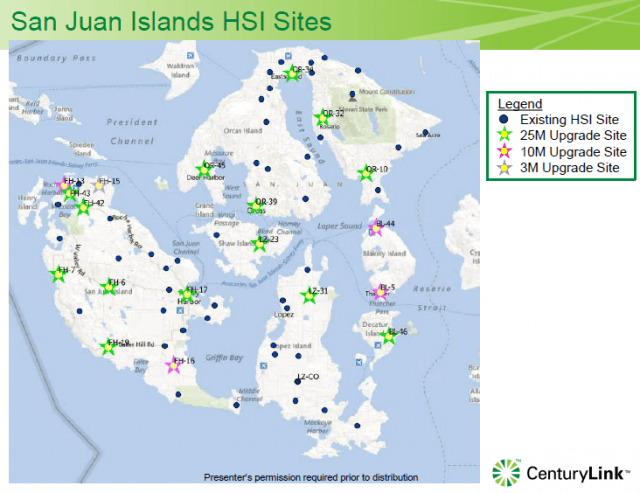

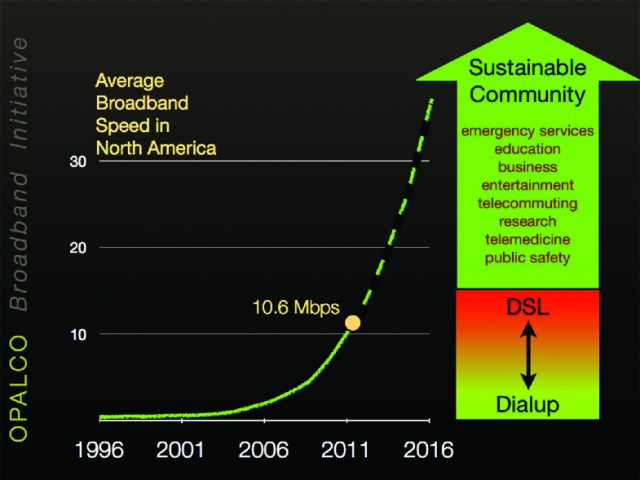

“For our long-term financial interests in this county, we need to have reliable 10-25Mbps service to customers on any part of the islands,” Hughes added. “My goal has always been 90+ percent should be able to get 25Mbps or better connectivity in the county.”

“For our long-term financial interests in this county, we need to have reliable 10-25Mbps service to customers on any part of the islands,” Hughes added. “My goal has always been 90+ percent should be able to get 25Mbps or better connectivity in the county.” OPALCO originally proposed a hybrid fiber-wireless system designed to reach 90% of the county with a $34 million investment, to be built over two years. When completed, all county residents would pay a $15 monthly co-op infrastructure fee and a $75 monthly fee for broadband and telephone service. To gauge interest, OPALCO asked residents for a $90 pre-commitment deposit. By the annual meeting in May, the co-op admitted only 900 residents signed up and it needed 5,800 customers to make the project a success.

OPALCO originally proposed a hybrid fiber-wireless system designed to reach 90% of the county with a $34 million investment, to be built over two years. When completed, all county residents would pay a $15 monthly co-op infrastructure fee and a $75 monthly fee for broadband and telephone service. To gauge interest, OPALCO asked residents for a $90 pre-commitment deposit. By the annual meeting in May, the co-op admitted only 900 residents signed up and it needed 5,800 customers to make the project a success. “Our data communications network brings exponential benefit to our membership,” OPALCO notes. “It includes tools that allow the co-op to: control peak usage and keep power costs down, remotely manage and control the electrical distribution system, manage and resolve power outages more efficiently, integrate and manage community solar projects and improve public safety throughout the county.”

“Our data communications network brings exponential benefit to our membership,” OPALCO notes. “It includes tools that allow the co-op to: control peak usage and keep power costs down, remotely manage and control the electrical distribution system, manage and resolve power outages more efficiently, integrate and manage community solar projects and improve public safety throughout the county.” Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.

Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.