Sources close to the Clinton campaign told Politico three names are emerging as potential FCC nominees in a presumed Clinton Administration, and all three are close friends of Bill and Hillary Clinton, all have spent time traveling through the revolving door of D.C. politics and the private sector or lobbying, and one served as a FCC commissioner before under Bill Clinton’s presidency.

All three are classic D.C. Establishment types, so there should be no surprises or rebellion from within the Democratic ranks.

Ness

Susan Ness: A former FCC commissioner, Ness today serves as a top Clinton fundraiser. Prior to her FCC appointment, Ness was a senior lender to communications companies as a group head and vice president of a regional financial institution. She served as Assistant Counsel to the Committee on Banking, Currency and Housing of the U.S. House of Representatives, and she founded and directed the Judicial Appointments Project of the National Women’s Political Caucus. Ness is a member of the National Association of Regulatory Utility Commissioners’ Committee on Communications, the Federal Communications Bar Association, and Leadership Washington (Class of 1988). Before she joined the FCC, she served in many civic leadership roles, including chair of the Montgomery County, Maryland, Charter Review Commission; vice chair of the Montgomery County Task Force on Community Access Television; and president of the Montgomery County Commission for Women.

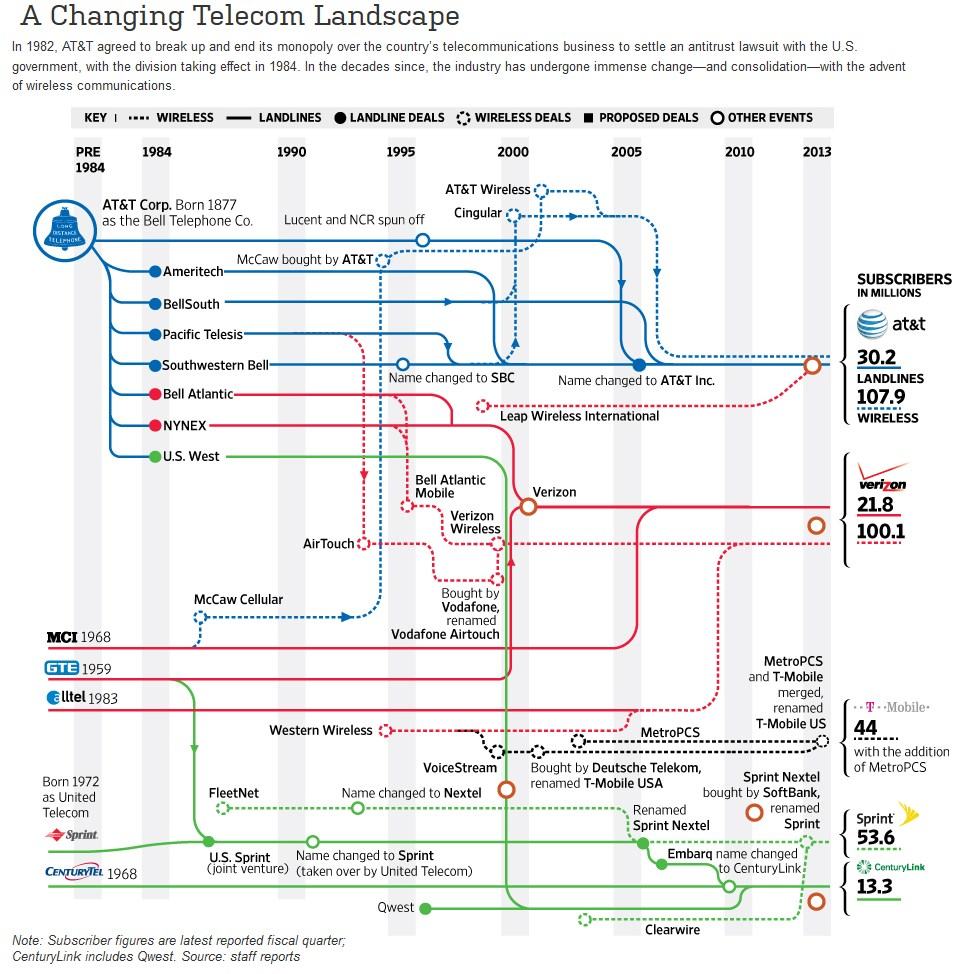

In her favor, Ness didn’t end her service with the FCC and become a paid lobbyist, preferring to spend her years outside of public service in the private sector. However, she was a director for Adelphia, America’s first criminally convicted cable company (the principal owners, the Rigas family, went to prison for a variety of white-collar crimes). Ness was also an apologist for the disastrous telecom deregulation policies of the Clinton Administration, which backfired and created mass corporate consolidation and higher bills for consumers.

In a speech in January 1999, Ness promised good times were ahead because of Clinton Administration’s support for deregulation:

It takes good business planning, raising capital, provisioning, and investment before the fruits of competition can be harvested. And sometimes companies succeed and sometimes they fail. That’s the marketplace at work.

That’s why I’ve been somewhat surprised at the impatience with which some pundits have viewed the level of local competition under the ’96 Act.

On the first anniversary, folks were asking “where’s the competition?” I observed then that this was like piling the family into the car for a long trip, and, before you’ve reached the end of the driveway, there is a plaintive voice from the back seat, “Are we there yet?”

No, we’re not there yet — even now, two years further into the journey.

Kornbluh

Unfortunately for Americans, we’re still not there more than 15 years later. The marketplace and regulatory agencies have rigged the game into a comfortable duopoly where competition benefits exist primarily for new customers getting a sign-up promotion. Once expired, high prices predominate. Ness promised competition. We got consolidation and more deregulation instead, and Americans are paying some of the highest broadband and wireless prices in the world as a result. We’re uncertain if she has learned her lesson.

Karen Kornbluh: Her middle initials should be “D.C.” because she’s been there for so long. Kornbluh is the Democratic Party establishment through and through, with a record of public service dating back to the 1980s. From 1991-1994, she was a legislative aide for Sen. John Kerry (D-Mass.) She spent two years at the Treasury Department, then spent three years as a Tech Fellow at the New America Foundation think tank. She served as a policy director for Barack Obama when he was a senator from Illinois and was appointed as ambassador to the OECD in 2009, which means she is at least aware of how poorly the U.S. compares in broadband speeds to the rest of the world. Kornbluh will not rock the boat as a FCC commissioner, but should be a reliable vote for all of a presumed President Clinton’s telecom initiatives.

Phil Verveer serves as a senior counselor to current FCC chairman Thomas Wheeler, which may offer some continuity for Chairman Wheeler’s policies under the Obama Administration in a presumed Clinton Administration. Verveer is a longtime friend of the Clintons. He also served as Deputy Assistant Secretary of State and US Coordinator for International Communications and Information Policy with Ambassadorial rank from 2009 to 2013.

Verveer

Verveer has practiced communications and antitrust law in the government and in private law firms for more than 40 years. From 1969 to 1981, he practiced as a trial attorney in the Antitrust Division of the Department of Justice, as a supervisory attorney in the Bureau of Competition of the Federal Trade Commission, and as the Chief of the Cable Television Bureau, and the Common Carrier Bureau of the Federal Communications Commission. Between 1973 and 1977, he served at the Antitrust Division’s first lead counsel in the investigation and prosecution of United States v. American Tel. & Tel. Co., the case that eventuated in the divestiture of the Bell System. As a bureau Chief at the FCC, Verveer participated in a series of decisions that enabled increased competition in video and telephone services, introduced asymmetric telecommunications regulation, and limited regulation of information services. But he was also a telecom lobbyist or counsel for Willkie, Farr and Gallagher (1999-2005) and Jenner & Block (2006-2009).

With those three names now out in the public view, Big Telecom lobbyists are reportedly “coalescing around those perceived to be frontrunners for a commission spot,” reports Politico.

“Nearly everyone on the list is part of the Clinton campaign’s network of tech advisers, which helped draft the Democratic nominee’s tech policy platform,” Politico adds, which means it is likely what Secretary Clinton has promised in her campaign documents about future telecom policy will likely move forward under the stewardship of her potential appointees who helped write it.

Subscribe

Subscribe In the Netherlands, having access to two broadband competitors isn’t enough to guarantee broadband competition, and Dutch telecom regulators are not about to deregulate Internet service in the country until consumers have more choices for broadband access.

In the Netherlands, having access to two broadband competitors isn’t enough to guarantee broadband competition, and Dutch telecom regulators are not about to deregulate Internet service in the country until consumers have more choices for broadband access.

Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

When Industry Canada announced it was planning to boost competition by setting aside certain spectrum for new competitors entering the wireless marketplace, the Conservative government promised Canadians they would see a new era of robust competition and lower prices as a result.

When Industry Canada announced it was planning to boost competition by setting aside certain spectrum for new competitors entering the wireless marketplace, the Conservative government promised Canadians they would see a new era of robust competition and lower prices as a result.